Table of Contents

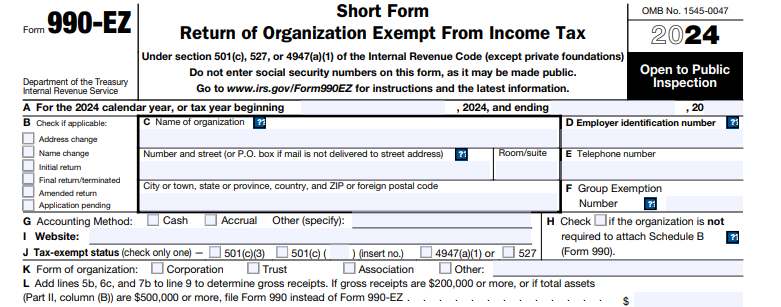

IRS Form 990-EZ – Short Form Return of Organization Exempt from Income Tax – IRS Form 990-EZ is the shortened annual information return that many small to mid-sized tax-exempt organizations file with the Internal Revenue Service (IRS). This form ensures compliance with federal tax-exempt status requirements while providing less detailed reporting than the full Form 990. Understanding Form 990-EZ helps nonprofits maintain transparency, avoid penalties, and preserve their exempt status.

What Is IRS Form 990-EZ?

The IRS requires Form 990-EZ, titled Short Form Return of Organization Exempt from Income Tax, from certain tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations under Internal Revenue Code section 6033. It reports financial activities, governance, and compliance to the IRS and the public.

Unlike the full Form 990, Form 990-EZ is streamlined for smaller organizations, typically spanning four pages plus required schedules. The IRS makes filed returns publicly available (with some redactions), promoting accountability for nonprofits.

Who Must File Form 990-EZ?

Most organizations exempt under section 501(a), including 501(c)(3) charities, as well as section 527 political organizations and certain trusts, must file an annual return unless exempt.

Eligibility for Form 990-EZ specifically applies to organizations that:

- Have gross receipts less than $200,000, and

- Have total assets less than $500,000 at the end of the tax year.

Organizations exceeding these thresholds must file the full Form 990. Smaller organizations with gross receipts normally $50,000 or less can file Form 990-N (e-Postcard) instead.

Exceptions include:

- Private foundations (must file Form 990-PF).

- Sponsoring organizations of donor-advised funds.

- Certain controlling organizations or those operating hospital facilities (must file full Form 990 regardless of size).

- Group returns (must use full Form 990).

Organizations eligible for Form 990-N or Form 990-EZ can voluntarily file a more detailed form if preferred.

Key Differences: Form 990 vs. Form 990-EZ

| Aspect | Form 990-EZ | Form 990 |

|---|---|---|

| Length | 4 core pages + schedules | 12 core pages + more schedules |

| Eligibility | Gross receipts < $200,000 Total assets < $500,000 |

Gross receipts ≥ $200,000 or assets ≥ $500,000 |

| Detail Level | Basic revenue/expense summary | Detailed statements, reconciliations, and governance info |

| Required Schedules | Fewer (e.g., A, B, C, O common) | More extensive schedules |

| Best For | Small to mid-sized nonprofits | Larger or more complex organizations |

Form 990-EZ reduces administrative burden while still requiring key financial and operational disclosures.

Filing Deadline for Form 990-EZ in 2025

The due date is the 15th day of the 5th month after the end of your organization’s tax year.

- For calendar year organizations (January 1 – December 31, 2025): May 15, 2026.

- For fiscal year filers: Calculate 4 months + 15 days after year-end.

If the due date falls on a weekend or holiday, it shifts to the next business day.

You can request an automatic 6-month extension by filing Form 8868 before the original deadline (no reason needed).

Failure to file for three consecutive years results in automatic revocation of tax-exempt status.

IRS Form 990-EZ Download and Printable

Download and Print: IRS Form 990-EZ

How to File Form 990-EZ

Since the Taxpayer First Act (2019), electronic filing is mandatory for Form 990-EZ for tax years ending July 31, 2021, and later. Paper filing is no longer accepted except in rare hardship cases.

Steps to e-file:

- Gather financial records, board information, and activity descriptions.

- Use IRS-approved e-file software or an authorized provider.

- Complete the form, including required schedules (e.g., Schedule A for 501(c)(3) public charity status, Schedule B for contributors).

- Have an authorized officer sign electronically.

- Transmit to the IRS and receive acceptance confirmation.

Many nonprofits use third-party platforms for ease, error checks, and schedule support.

Required Schedules and Common Attachments

Common schedules for Form 990-EZ filers include:

- Schedule A: Public charity status and support (required for most 501(c)(3)s).

- Schedule B: Contributors (if contributions exceed thresholds).

- Schedule C: Political/lobbying activities.

- Schedule O: Supplemental narrative explanations.

Ensure all parts (I–V, and VI for 501(c)(3)s) are complete.

Penalties and Best Practices

Late filing can incur penalties starting at $20 per day, escalating for larger organizations. Incomplete returns may be rejected.

Tips:

- Review prior returns for consistency.

- Avoid including Social Security numbers (redacted if needed).

- Use Schedule O for clear explanations.

For the latest 2025 forms and instructions, visit the official IRS pages: About Form 990-EZ and Instructions for Form 990-EZ.

Timely and accurate filing of Form 990-EZ helps your organization stay compliant and focused on its mission. Consult a tax professional for complex situations.