Table of Contents

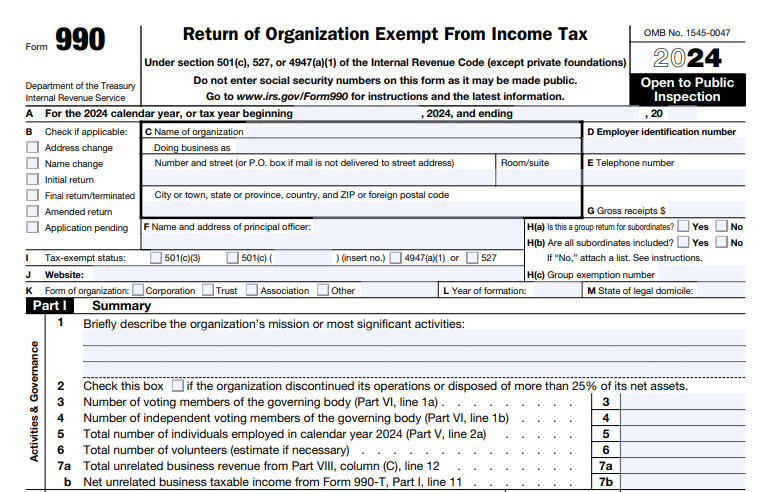

IRS Form 990 – Return of Organization Exempt From Income Tax – Tax-exempt organizations, from charities to political groups, play a crucial role in society by advancing public good without federal income tax liability. However, maintaining that status requires transparency through annual reporting. Enter IRS Form 990, the “Return of Organization Exempt From Income Tax,” which details finances, governance, and activities for public scrutiny and IRS compliance. For tax year 2024 (filed in 2025), accurate filing is more important than ever amid heightened IRS audits and e-filing mandates.

This SEO-optimized guide covers Form 990 filing requirements for 2025, including who must file, deadlines, step-by-step instructions, and penalties. Whether you’re a nonprofit leader or board member, use this resource to ensure compliance. Always consult IRS.gov for the latest updates.

What Is IRS Form 990?

IRS Form 990 is the annual information return required under Internal Revenue Code Section 6033 for most tax-exempt organizations under Section 501(a), Section 527 political organizations, and certain nonexempt charitable trusts. It reports:

- Financial data: Revenue, expenses, assets, and liabilities.

- Program accomplishments: Mission impact and service descriptions.

- Governance: Board structure, policies, and compensation.

- Compliance: Related-party transactions, lobbying, and foreign activities.

Unlike a tax return, Form 990 doesn’t calculate taxes but validates exempt status and promotes accountability. It’s publicly available (except Schedule B contributor details), fostering donor trust and enabling grant eligibility. For 2024 filings, the form emphasizes GAAP-aligned reporting and Schedule O narratives for clarity.

Smaller organizations may file Form 990-EZ (gross receipts < $200,000 and assets < $500,000) or Form 990-N (e-Postcard for receipts ≤ $50,000), while private foundations use Form 990-PF.

Who Must File Form 990 in 2025?

Most tax-exempt entities must file annually, but the form varies by size and type. Exceptions include churches, integrated auxiliaries, certain religious orders, state colleges, and governmental units.

Form 990 Filing Thresholds Table (Tax Year 2024)

| Gross Receipts | Total Assets | Form Required |

|---|---|---|

| Normally ≤ $50,000 | N/A | Form 990-N (e-Postcard; no extension available) |

| < $200,000 | < $500,000 | Form 990-EZ or Form 990 |

| ≥ $200,000 | ≥ $500,000 | Form 990 (full) |

| Any (private foundations) | Any | Form 990-PF |

| Unrelated business income ≥ $1,000 | N/A | Form 990-T (in addition) |

- Required Filers: 501(c) organizations (e.g., charities, trade associations), 527 political groups, 4947(a)(1) trusts. Even without a determination letter, qualifying entities file.

- Group Returns: Central organizations can file for subordinates (up to 25/year; aggregate data).

- Foreign Organizations: File if U.S.-sourced gross receipts ≥ $50,000.

- Disregarded Entities: Report on parent’s Form 990 (use parent’s EIN except for employment taxes).

Failure to file for three consecutive years triggers automatic revocation of exempt status.

When Is Form 990 Due in 2025?

The deadline for Form 990 is the 15th day of the 5th month after your fiscal year ends. For calendar-year organizations (ending December 31, 2024), that’s May 15, 2025. Fiscal-year filers adjust accordingly—e.g., June 30, 2024, end means November 15, 2024 (adjusted for weekends/holidays).

Key 2025 Filing Deadlines Table (Tax Year 2024)

| Fiscal Year End | Original Due Date | Extended Due Date (Form 8868) |

|---|---|---|

| December 31, 2024 | May 15, 2025 | November 17, 2025 |

| March 31, 2025 | August 15, 2025 | February 17, 2026 |

| June 30, 2025 | November 17, 2025 | May 15, 2026 |

| September 30, 2025 | February 17, 2026 | August 15, 2026 |

Notes: Holidays/weekends shift to the next business day. Form 990-N has no extension but no late penalty.

IRS Form 990 Download and Printable

Download and Print: IRS Form 990

Extensions and Amendments

- Automatic 6-Month Extension: File Form 8868 by the original due date—no reason needed. This extends filing but not payment of any unrelated business income tax (Form 990-T).

- Amended Returns: Check “Amended return” in the heading and refile the full form with corrections. Attach an explanation on Schedule O. Late amendments can reinstate revoked status via streamlined procedures.

How to Complete IRS Form 990: Step-by-Step Guide

The 2024 Form 990 (for 2025 filings) includes Parts I–XII, plus schedules triggered by Part IV checkboxes. All filers complete Schedule O for narratives. Use accrual or cash method consistently; report in U.S. dollars, rounded to whole numbers. Attach financial statements if audited.

Essential Sections and Line Highlights

- Heading (Items A–M): EIN, name/address (check change boxes), fiscal period, officer contact, gross receipts/assets, exempt status (e.g., 501(c)(3)), website, formation year/state.

- Part I: Summary: Mission statement; key metrics (revenue $ from contributions/program services; expenses; net assets; employees/volunteers).

- Part III: Program Service Accomplishments: Top 3 programs by expense (description, grants, revenue; NAICS codes); total from Part IX, line 25, column (B).

- Part IV: Checklist of Required Schedules: Yes/No for 38 items (e.g., Schedule A for public charity; B for contributors >$5,000/2%; J for exec comp >$150,000).

- Part V: Statements Regarding Other IRS Filings: Number of 1099s/W-2s filed; foreign accounts (FBAR); excess benefits/loans; contributions.

- Part VI: Governance: Board size/independence; policies (conflicts, whistleblower); compensation process; public disclosure.

- Part VII: Compensation: Officers/directors/key employees (>$150,000); top contractors (>$100,000); reportable (W-2 box 1/5 or 1099-NEC box 1) vs. other comp.

- Part VIII: Statement of Revenue: Contributions (lines 1a–1h); program revenue (2a–2e); investments (3–5); other (6–12). Columns: total/program/unrelated/tax-exempt.

- Part IX: Statement of Functional Expenses: By type (grants/compensation/fees) and function (program/management/fundraising). Total from line 25.

- Part X: Balance Sheet: Assets/liabilities/net assets (beginning/end of year; unrestricted/temporarily/permanently restricted).

- Part XI: Reconciliation of Net Assets: Net income per books; adjustments (e.g., unrealized gains).

- Part XII: Financial Statements and Reporting: Accounting method; audited FS; tax return preparer.

Pro Tip: Sequence: Schedules first (e.g., R for related orgs), then Parts VII–XII, V–VI, III, I. Use software for calculations; retain records 3+ years.

E-Filing Requirements for Form 990

Mandatory e-filing applies to all Form 990 series returns for tax years beginning July 1, 2019, or later (Taxpayer First Act). Use IRS-approved providers (e.g., Tax990, ExpressTaxExempt). Paper filings are rejected unless waived (rare). Benefits: Faster processing (2–4 weeks), error checks, and electronic signatures. File via MeF system; attach PDFs for audits/statements.

Recent Changes to Form 990 for 2025 Filings

The 2024 form (filed in 2025) is largely unchanged, but note:

- Inflation-Adjusted Penalties: Late filing minimum now $20/day (up to $12,000 or 5% of receipts); $120/day for large orgs (>$1.2M receipts, up to $60,000).

- Schedule A Updates: For short years starting 2024, adjust public support test years (e.g., 2020–2024 instead of 2019–2023).

- E-Filing Enforcement: Stricter rejection of incomplete returns (Letters 2694C–2696C).

- No Major Overhauls: Core structure stable; monitor for post-2024 legislation (e.g., via IRS.gov/Form990).

Penalties for Late or Incomplete Form 990 Filing

Non-compliance erodes trust and costs dearly:

- Late Filing (Section 6651): $20/day (small orgs) or $120/day (large), max $12,000/$60,000 or 5% of gross receipts.

- Incomplete/Inaccurate: Same as late; IRS may return via Letter 2694C (10 days to correct).

- Responsible Person: $10/day, up to $5,000 per return.

- Revocation: Automatic after 3 years non-filing—reinstate via Form 1023/1024 or streamlined late filing.

- Other: Willful failure ($5,000+); public inspection violations ($20/day, max $10,000).

Request abatement for reasonable cause (e.g., disaster) with documentation. State penalties may add fees.

Best Practices for Form 990 Compliance in 2025

- Start Early: Gather FS, board minutes, and comp data by Q4 2024.

- Use Tools: E-file with Tax990 or TurboTax Nonprofit for auto-calcs and audits.

- Board Review: Approve draft; document policy compliance.

- Public Disclosure: Post on GuideStar/Website; respond to requests within 30 days.

- Seek Expertise: CPA for complex schedules (e.g., J for exec pay, F for international).

- Track Thresholds: Monitor receipts/assets quarterly to confirm form type.

Compliance isn’t just regulatory—it’s a trust-builder for stakeholders.

Conclusion: File Your Form 990 On Time in 2025

IRS Form 990 is the transparency lifeline for tax-exempt organizations, ensuring accountability while safeguarding your status. With the May 15, 2025, deadline for calendar-year filers, prioritize e-filing via Form 8868 if needed to avoid penalties up to $60,000.

Download the 2024 form/instructions at IRS.gov/Form990. For help, contact the Exempt Organizations hotline at 877-829-5500. Compliant filing lets your mission shine—without IRS shadows.

Last updated: December 2025. Verify with official IRS sources for tailored advice.