Table of Contents

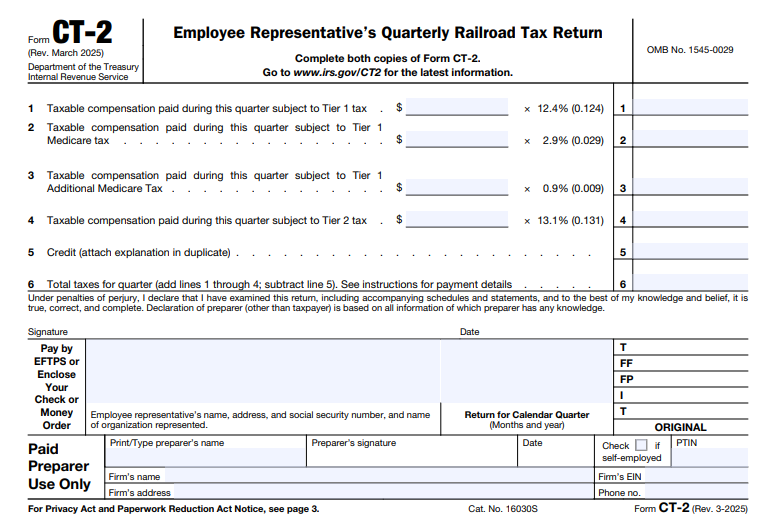

IRS Form CT-2 – Employee Representative’s Quarterly Railroad Tax Return – Railroad labor representatives—union officers, negotiators, and advocates—play a vital role in shaping the industry’s workforce, but their compensation comes with unique tax obligations under the Railroad Retirement Tax Act (RRTA). IRS Form CT-2, the Employee Representative’s Quarterly Railroad Tax Return, ensures these individuals report and pay Tier 1 and Tier 2 taxes on their earnings, mirroring FICA but tailored for rail-specific benefits. For 2025, with the Tier 1 wage base rising to $176,100 and rates unchanged at 12.4% for Tier 1 and 13.1% for Tier 2 (employee share), timely quarterly filing is essential to avoid penalties up to 25% of unpaid taxes. This SEO-optimized guide, based on the March 2025 revision of Form CT-2 and its instructions, covers eligibility, deadlines, and step-by-step filing to keep representatives compliant and credits flowing to the Railroad Retirement Board (RRB).

What Is IRS Form CT-2?

IRS Form CT-2 is a quarterly tax return used exclusively by employee representatives—defined under the Railroad Retirement Act as officers or officials of railway labor organizations—to report and pay RRTA taxes on compensation received for services. It covers Tier 1 taxes (Social Security-equivalent at 12.4% on up to $176,100) and Tier 2 taxes (13.1% on up to $130,800), excluding certain disability payments or reimbursements. Unlike employer Form CT-1 (annual), CT-2 is quarterly, aligning with payroll cycles, and includes a duplicate copy for RRB reconciliation.

Key features:

- Tier 1 Reporting: Mimics FICA—12.4% on first $176,100; Medicare portion (2.9%) unlimited.

- Tier 2 Focus: 13.1% on $130,800 max; no employee withholding—self-paid.

- Exclusions: Sickness/disability under workers’ comp or RRA; travel reimbursements.

The March 2025 revision (Rev. 3-2025, OMB No. 1545-0029) updates wage bases and clarifies exclusions for post-6-month disability payments. Download the form and instructions from IRS.gov/FormCT2.

Who Needs to File IRS Form CT-2 in 2025?

Only employee representatives file Form CT-2—individuals compensated by railway labor organizations for services under the RRTA. Employers use CT-1; general businesses use 941.

| Filing Requirement | Details for 2025 |

|---|---|

| Employee Representatives | Report all RRTA-taxable compensation ≥$600/quarter; self-employed union officials qualify. |

| Compensation Types | Salaries, bonuses, back pay; exclude reimbursements or non-service payments. |

| Threshold | No min—file quarterly even if $0; deposit if >$2,500/quarter. |

| Exemptions | Disability after 6 months from last work; workers’ comp; medical plans. |

| Joint Filers | Spouse if separate representative; otherwise, individual. |

Use SSN; apply via IRS if needed. RRB uses CT-2 data for benefits—accuracy ensures credits.

Filing Deadlines and Extensions for Form CT-2 in 2025

File quarterly by the last day of the month following the quarter. Deposits: Monthly (15th) or semiweekly if lookback >$50,000.

| Quarter | Period | Due Date | Deposit Schedule |

|---|---|---|---|

| Q1 | Jan-Mar | April 30, 2025 | Monthly: Apr 15; Semiweekly: 3 days post-payroll |

| Q2 | Apr-Jun | July 31, 2025 | Monthly: Jul 15 |

| Q3 | Jul-Sep | October 31, 2025 | Monthly: Oct 15 |

| Q4 | Oct-Dec | January 31, 2026 | Monthly: Jan 15 |

- Extensions: Form 8809 (up to 30 days automatic); filing only—pay/deposit timely to avoid interest (0.5%/month).

- Where to File: Mail to IRS center (Kansas City, MO 64999); e-file not available—paper only.

- Deposits: EFTPS required; $100K next-day if accumulated.

Include duplicate for RRB; late = 5%/month penalty.

Step-by-Step Guide to Completing IRS Form CT-2

Gather pay stubs, compensation records. Use March 2025 PDF; duplicate copy for RRB.

- Header: Employee rep name, address, SSN; organization name.

- Line 1: Tier 1 Compensation – Total subject to SS ($176,100 max) ×12.4% = tax.

- Line 2: Tier 1 Medicare – All compensation ×2.9%.

- Line 3: Tier 2 Compensation – Up to $130,800 ×13.1%.

- Line 4: Additional Medicare – Over $200K ×0.9%.

- Line 5: Credits – Adjustments/explanations (attach).

- Line 6: Total Taxes – Sum 1-4 minus 5; pay if >$1.

- Part II: Deposits – Total prior; balance due/refund.

- Sign & Attach: Under perjury; duplicate to RRB (Chicago, IL 60604).

Example: Q1 $50K comp: Tier 1 $6,200 (12.4%), Medicare $1,450 (2.9%), Tier 2 $6,555 (13.1%) = $14,205 total.

2025 RRTA Tax Rates on Form CT-2

Rates unchanged; bases indexed.

| Tier | Rate (Employee Rep) | Wage Base |

|---|---|---|

| Tier 1 SS | 12.4% | $176,100 |

| Tier 1 Medicare | 2.9% | Unlimited |

| Tier 2 | 13.1% | $130,800 |

| Additional Medicare | 0.9% (> $200K) | Unlimited |

Excludes sickness after 6 months; travel reimbursements.

IRS Form CT-2 Download and Printable

Download and Print: IRS Form CT-2

Common Mistakes When Filing Form CT-2 and How to Avoid Them

Niche form means errors abound:

- Base Exceeds: Tier 1 over $176,100—cap per rep.

- Exclusions Missed: Including disability—review RRA rules.

- Deposit Lapses: Semiweekly if lookback >$50K—use EFTPS.

- No Duplicate: Forgetting RRB copy—mail separately.

- Late Filing: Quarterly slips—calendar April 30, etc.

Reconcile with RRB; software aids calculations.

Penalties for Late or Incorrect Form CT-2 Filings in 2025

Similar to FICA; tiered under §6651/6656.

| Violation | Penalty |

|---|---|

| Late Filing | 5%/month (max 25%) of unpaid |

| Late Payment | 0.5%/month + interest |

| Late Deposit | 2-10% (days late) |

| Negligence | 20% underpayment |

Waivers for cause; first-time abatement. RRB audits benefits impact.

Frequently Asked Questions About IRS Form CT-2

Who’s an “employee representative” for 2025?

Union officers/officials compensated under RRRA; not general employees.

What’s the Tier 1 base for 2025?

$176,100—12.4% total.

Can I e-file Form CT-2?

No—paper only; mail with duplicate to RRB.

What if compensation is $0?

File anyway for $0 return.

How does Tier 2 differ?

13.1% on $130,800 max; self-paid, no withholding.

Visit IRS.gov/FormCT2 for more.

Final Thoughts: Ensure RRTA Compliance with IRS Form CT-2 in 2025

IRS Form CT-2 keeps employee representatives on track with quarterly RRTA reporting, funding rail retirement benefits while avoiding 25% penalties on the $176,100 Tier 1 base. The March 2025 revision’s clarity on exclusions makes filing straightforward—submit by April 30 for Q1, deposit via EFTPS, and duplicate to RRB for seamless credits. Download from IRS.gov today and consult a specialist for accuracy.

Advocacy drives change—compliant CT-2 drives your benefits.

Informational only—not tax advice. Verify with IRS or a professional.