Table of Contents

IRS Form SS-8 – Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding – In today’s gig economy and evolving workforce, correctly classifying workers as employees or independent contractors is crucial for businesses and individuals alike. Misclassification can lead to significant tax penalties, back taxes, and legal issues. That’s where IRS Form SS-8 comes into play. This form, officially titled “Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding,” allows firms and workers to request an official IRS ruling on a worker’s classification. Whether you’re a small business owner hiring freelancers or a worker unsure about your status, understanding Form SS-8 can help ensure compliance with federal tax laws.

In this comprehensive guide, we’ll break down what IRS Form SS-8 is, who should use it, how to file it, and the key factors the IRS considers. We’ll also cover recent updates as of 2025 to keep you informed with the latest IRS guidelines.

What Is IRS Form SS-8?

IRS Form SS-8 is a request form submitted to the Internal Revenue Service (IRS) to determine whether a worker should be classified as an employee or an independent contractor under common law rules. This classification affects federal employment taxes, such as Social Security, Medicare, and unemployment taxes, as well as income tax withholding requirements.

The form is not for hypothetical scenarios, proposed transactions, or situations involving pending litigation. Instead, it’s designed for actual work relationships where there’s uncertainty about the status. The IRS uses the information provided to issue a determination letter, which can be binding if the facts and circumstances remain unchanged.

Filing Form SS-8 is free, and it helps prevent costly mistakes. For businesses, treating a worker as an independent contractor when they should be an employee can result in owing unpaid taxes plus interest and penalties. For workers, it ensures proper tax treatment and potential eligibility for benefits like unemployment insurance.

Employee vs. Independent Contractor: The Key Factors

The core of worker classification lies in the degree of control and independence. The IRS evaluates this through three main categories: behavioral control, financial control, and the type of relationship. No single factor is decisive; the IRS weighs all elements holistically based on the entire relationship.

Behavioral Control

This examines whether the business has the right to direct and control how the work is performed. Factors include:

- Instructions on when, where, and how to work (e.g., specific tools or sequences).

- Training provided by the business, which suggests employee status.

Example: If a company dictates daily schedules and methods, the worker is likely an employee. In contrast, an independent contractor typically chooses their own approach.

Financial Control

This looks at the economic aspects of the job:

- How the worker is paid (e.g., hourly wage vs. flat fee per project).

- Reimbursement of expenses and who provides tools/supplies.

- Opportunity for profit or loss, and whether the worker can work for others.

Example: A worker using their own equipment and bearing unreimbursed expenses leans toward independent contractor status.

Type of Relationship

This considers the ongoing nature of the work:

- Written contracts describing the relationship.

- Employee benefits like insurance, pension, or vacation pay.

- Permanency of the relationship and if the work is key to the business.

Example: Long-term engagements with benefits indicate employee status, while short-term projects without perks suggest an independent contractor.

If these factors leave you uncertain, filing Form SS-8 is the next step. The IRS reviews the specifics of your situation to make a determination.

Who Should File Form SS-8?

Both workers and firms (businesses) can file Form SS-8. It’s particularly useful for:

- Businesses hiring workers in roles like gig workers, consultants, or freelancers where classification is ambiguous.

- Workers who believe they’ve been misclassified (e.g., treated as contractors but functioning as employees).

- Situations involving multiple workers in similar roles, where a class determination might apply.

However, it’s not suitable for state or local government workers under Section 218 agreements (handled by the Social Security Administration) or business-to-business transactions. If you’re a worker filing for multiple firms, submit separate forms for each.

Note: Don’t file if confidentiality is a concern, as the IRS may share information with the other party involved.

How to Complete and Submit Form SS-8

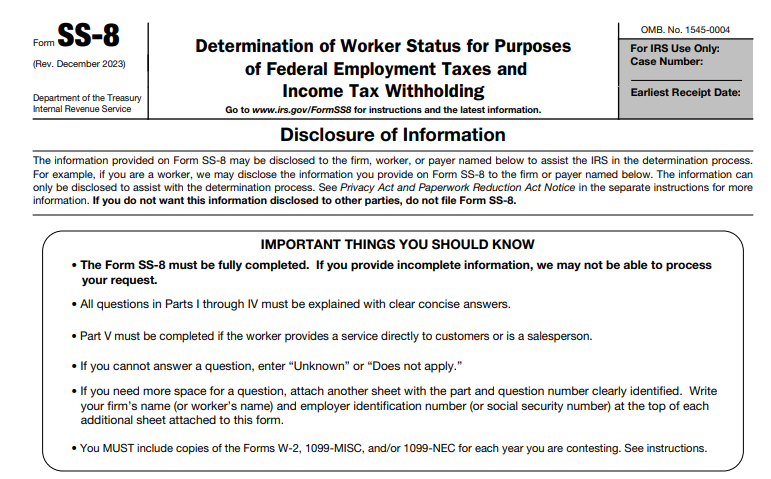

Completing Form SS-8 requires detailed information about the work relationship. The form is divided into parts:

- Part I: General information, including years of service, tax forms issued (e.g., W-2, 1099-NEC), and any litigation.

- Part II: Behavioral control questions.

- Part III: Financial control details.

- Part IV: Relationship factors and any changes over time.

- Part V: For service providers or salespersons (e.g., those interacting directly with customers).

Provide clear, concise answers and attach supporting documents like copies of Forms 1099 or W-2, paystubs, contracts, or bank statements. Use “Unknown” or “Does not apply” where appropriate, and add extra sheets if needed.

Sign the form (handwritten or electronic; no stamps) and submit via mail to Internal Revenue Service, Form SS-8 Determinations, P.O. Box 630, Stop 631, Holtsville, NY 11742-0630, or fax to 855-242-4481. There’s no filing fee, and don’t attach it to your tax return.

IRS Form SS-8 Download and Printable

Download and Print: IRS Form SS-8

The IRS Determination Process

Once submitted, the IRS acknowledges receipt and may request additional information, including from the other party via a blank Form SS-8. The review process, which can take at least six months, involves analyzing facts against common law rules.

The IRS issues either a formal determination letter (binding) or an information letter (advisory). There’s no appeal process like in audits, but you can request reconsideration with new facts. Determinations don’t affect Section 530 relief for businesses with a reasonable basis for their classification.

Consequences of Worker Misclassification

Misclassifying an employee as an independent contractor can lead to:

- Back payment of employment taxes, plus penalties and interest.

- Loss of deductions for businesses.

- For workers: Ineligibility for benefits and potential need to file amended returns.

Correct classification ensures proper withholding, tax payments, and compliance, avoiding audits or disputes.

Recent Updates to IRS Form SS-8 in 2025

As of December 2025, the latest revision of Form SS-8 is from December 2023, with instructions updated in January 2024. No major structural changes have been reported in 2025, but the IRS continues to emphasize accurate classification amid gig economy growth. The “About Form SS-8” page was last updated in February 2025, reinforcing its use for federal tax purposes only.

Third-party resources, like those from payroll providers, have been updated in April 2025 to reflect ongoing guidance without new form revisions. Always check the official IRS website for the most current version before filing.

Frequently Asked Questions (FAQs) About IRS Form SS-8

How long does it take to get a determination?

Typically at least six months, so don’t delay filing taxes while waiting.

Can I file Form SS-8 electronically?

No, only mail or fax submissions are accepted.

What if I’m misclassified as an independent contractor?

If determined an employee, you may need to file amended returns and could be eligible for refunds (within statutes of limitations).

Does a determination apply retroactively?

Yes, for open tax years, but it won’t override prior reasonable classifications under Section 530.

Where can I download the latest Form SS-8?

From the IRS website at irs.gov/forms.

Final Thoughts on Worker Classification and Form SS-8

Navigating worker status can be complex, but IRS Form SS-8 provides a clear path to resolution. By understanding the factors and process, you can avoid pitfalls and ensure tax compliance. If in doubt, consult a tax professional or file the form directly. Stay updated with IRS resources to adapt to any future changes in employment tax rules. Proper classification not only saves money but also protects your business or career in the long run.