Table of Contents

IRS Form W-12 – IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal – Are you a tax professional gearing up for the 2026 tax season? Securing or renewing your Preparer Tax Identification Number (PTIN) via IRS Form W-12 is a non-negotiable step to legally prepare federal tax returns for compensation. Revised in October 2025, this form ensures compliance with IRS regulations while streamlining the process for over 800,000 paid preparers. In this ultimate guide to Form W-12, we’ll cover its purpose, eligibility, step-by-step instructions, and 2026 updates—so you can avoid penalties and focus on what you do best: helping clients navigate tax complexities.

Whether you’re a first-time applicant or renewing your PTIN before the December 31, 2025 deadline, understanding IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal is key to maintaining your professional status. Let’s break it down.

What Is IRS Form W-12?

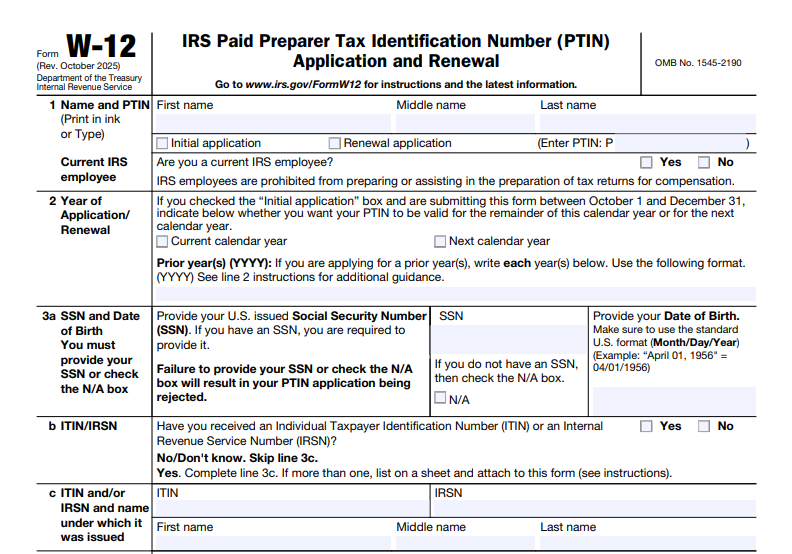

IRS Form W-12, officially the IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal, is a one-page application used to obtain or renew a PTIN—a unique 9-digit identifier starting with “P” (formatted as PXXXXXXXXX). Introduced in 2010 under IRS regulations, it’s required for anyone who prepares, or assists in preparing, all or substantially all of a federal tax return or claim for refund for pay. The form captures personal details, tax compliance status, and professional credentials to verify eligibility.

With Catalog Number 55469F and OMB No. 1545-2190, the estimated completion time is just 15 minutes online—far quicker than the 6-week paper processing. For 2026, the non-refundable fee is $18.75, down from $19.75 in prior years due to recent IRS adjustments. Download the latest PDF from IRS.gov or apply directly via the PTIN portal.

Who Needs to Complete IRS Form W-12?

You must apply for or renew a PTIN if:

- You’re a paid tax preparer (independent, firm employee, or freelancer) handling federal returns.

- You’re an enrolled agent (EA), CPA, attorney, or other credentialed professional preparing returns.

- You assist in substantial preparation for compensation, even if not signing the return.

Enrolled agents must renew annually regardless of preparation activity to keep status active. Volunteers (e.g., VITA/TCE) or unpaid preparers don’t need one. PTINs expire December 31 each year, so renew by December 31, 2025, for 2026 validity. First-timers or those with expired credentials should apply early—online processing is instant.

Purpose and Benefits of IRS Form W-12

The primary purpose of Form W-12 is to regulate tax preparers, ensuring ethical practices and tax compliance while providing the IRS with a database for oversight. It mandates PTIN use on all prepared returns (e.g., in the paid preparer section of Form 1040), reducing fraud and improving return accuracy.

Benefits include:

- Legal Compliance: Avoid fines up to $570 per violation for not using a valid PTIN.

- Professional Credibility: Links to credentials like CPA or EA for client trust.

- Efficiency: Online renewal integrates with the Annual Filing Season Program (AFSP) for limited representation rights.

- Cost Savings: 2026’s reduced $18.75 fee (from $30.75 in 2023) eases annual burdens.

In 2026, with ID.me integration for secure logins, PTIN renewal enhances data protection amid rising cyber threats to tax pros.

Step-by-Step Guide: How to Fill Out IRS Form W-12

Prefer paper? Download Form W-12 and Instructions from IRS.gov. But for speed, use the online PTIN system at www.irs.gov/ptin—most complete it in 15 minutes. Here’s how:

- Prepare Documents: Gather SSN/ITIN, photo ID (e.g., driver’s license), prior PTIN (if renewing), and professional credentials.

- Access the Form: Online—log in via ID.me (new for 2025+ with SSN). Paper—print and use black ink.

- Enter Personal Info (Lines 1-4): Name, address, DOB, SSN/ITIN. Check “IRS Employee” if applicable (new field).

- Application Type (Line 2): Select initial, renewal, or prior year (list YYYY).

- Tax Compliance (Lines 6-9): Affirm filing status, current on taxes (individual/business), and no felony convictions. Explain discrepancies.

- Credentials (Lines 5a-5b): List CPA, EA, etc., with numbers, states, expiration dates. Don’t include expired ones.

- Security Attestation (Line 10): Confirm you have a data security plan.

- Sign and Date (Line 11): Under perjury penalties. Pay $18.75 (check/money order for paper).

- Submit: Online for instant PTIN; mail paper to IRS Tax Pro PTIN Processing Center, PO Box 380638, San Antonio, TX 78238.

Pro Tip: For foreign applicants without SSN, attach Form 8946. Allow 6 weeks for paper; track status online.

IRS Form W-12 Download and Printable

Download and Print: IRS Form W-12

Key Sections of IRS Form W-12 Explained

Form W-12 is concise but thorough. Key updates for Rev. October 2025 include:

Personal and Identification (Lines 1-4)

- Full name, U.S./foreign address, DOB, and SSN/ITIN. Foreigners: Use Form 8945/8946 for SSN alternatives.

Application Details (Lines 2-5)

- Initial/renewal selection; prior years if needed. Repurposed Lines 5a/5b for employer info and credentials (e.g., CPA number, expiration).

Compliance and Background (Lines 6-10)

- Filing status (last return details); tax currency affirmation; felony disclosure; security plan checkbox.

Signature and Payment

- Perjury declaration; fee remittance (non-refundable).

Privacy Notice: Data protected under IRC 6109; used solely for PTIN issuance.

Submission Process for Form W-12

- Online (Recommended): Via PTIN portal—pay by card/eCheck. Receive PTIN immediately; email confirmation.

- Paper: Mail with payment (no staples). Processing: 4-6 weeks; originals returned if submitted.

- Post-Submission: Check status in your PTIN account. Renewed PTINs auto-update for 2026.

For prior-year renewals (e.g., 2025), submit by Dec. 31, 2026, with attestation of preparation activity.

Privacy, Security, and Important Notes

Submissions are safeguarded under the Privacy Act (5 U.S.C. 552a). Share only with IRS for processing; routine uses include credential verification. 2026 Notes:

- ID.me mandatory for SSN users—upload photo ID for verification.

- No fee for 2020 or prior renewals.

- Incomplete apps delay issuance; felonies may bar approval.

Frequently Asked Questions (FAQs) About IRS Form W-12

What’s the 2026 PTIN renewal fee?

$18.75, non-refundable—reduced effective September 30, 2025.

How long does online PTIN renewal take?

About 15 minutes, with instant issuance.

Do I need Form W-12 if I apply online?

No—the portal handles it digitally; use W-12 only for paper.

What if I forgot my PTIN login?

Use “Forgot User ID/Password” or contact PTIN Hotline at 800-908-9982.

Can I renew for multiple years on one Form W-12?

No—annual only, but list prior years separately.

Conclusion: Renew Your PTIN with Form W-12 and Stay Compliant for 2026

IRS Form W-12 is your ticket to seamless PTIN application and renewal, ensuring you’re ready for the 2026 filing season without compliance hiccups. With a quick online process and a lowered fee, there’s no excuse to delay—renew today to protect your practice and clients. Head to www.irs.gov/ptin now.

For enrolled agents, pair with EA renewal via Pay.gov. Questions? Call the IRS PTIN Hotline.

This article is for informational purposes only and not official IRS advice. Always consult IRS.gov or a tax professional for guidance.