Table of Contents

IRS Form W-2VI – U.S. Virgin Islands Wage and Tax Statement – As a business owner or HR professional in the U.S. Virgin Islands (USVI), navigating tax reporting can be complex, especially with territorial-specific forms like IRS Form W-2VI. This U.S. Virgin Islands Wage and Tax Statement is essential for accurately reporting employee wages, tips, and withheld taxes to both federal and local authorities. In this SEO-optimized guide, we’ll break down everything you need to know about Form W-2VI for the 2025 tax year—including its purpose, filing requirements, deadlines, and common pitfalls—to help you stay compliant and avoid penalties.

Whether you’re searching for “IRS Form W-2VI instructions 2025,” “how to file W-2VI,” or “differences between W-2 and W-2VI,” this article has you covered with trusted insights from the IRS and Virgin Islands Bureau of Internal Revenue (VIBIR).

What Is IRS Form W-2VI?

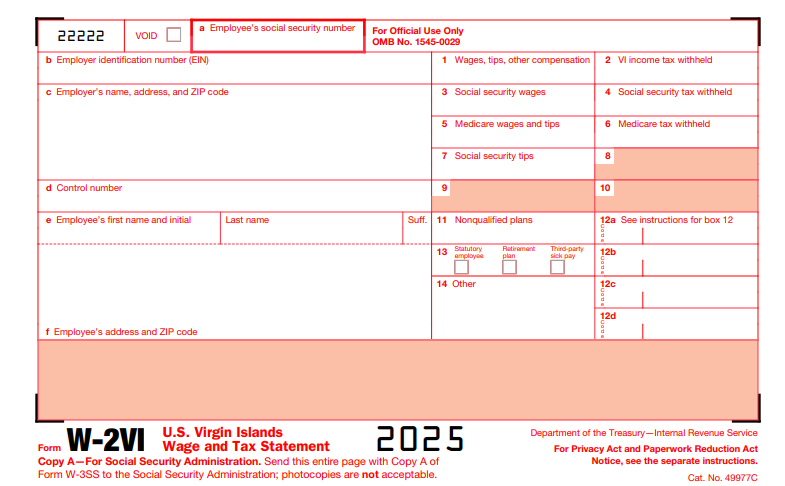

IRS Form W-2VI is the territorial version of the standard Form W-2, designed specifically for reporting wages earned in the U.S. Virgin Islands. It captures wages, tips, and other compensation paid to employees for services performed in the USVI, along with USVI income tax withheld.

Unlike the regular W-2, Form W-2VI is not used for wages subject to U.S. federal income tax withholding. Instead, it’s tailored for USVI-specific tax reporting, ensuring that territorial taxes are properly documented. Employers use it to provide employees with a summary of their earnings and withholdings, while also submitting data to the Social Security Administration (SSA) and VIBIR.

Key components include:

- Employee details: Social Security Number (SSN), name, and address.

- Wage and tax data: Boxes for total wages (Box 1), USVI income tax withheld (Box 2), Social Security and Medicare amounts (Boxes 3–7).

- Other codes: Box 12 for deferred compensation or benefits, and Box 14 for miscellaneous items like union dues.

For the 2025 tax year, the form includes updates like the Social Security wage base limit of $176,100 and corresponding tax maximums (e.g., $10,918.20 for Social Security tax withheld).

Who Must File Form W-2VI?

Any USVI employer engaged in a trade or business must file Form W-2VI if they paid an employee:

- $600 or more in remuneration (including noncash payments) during 2025, or

- Any amount where income, Social Security, or Medicare taxes were withheld.

This applies even if the employee is related to the employer. Household employers may have different thresholds, but most businesses with USVI-based employees will need to comply. If an employee performs services both in the USVI and on the U.S. mainland, separate forms are required: W-2VI for USVI wages and standard W-2 for U.S. wages.

Failure to file can result in penalties starting at $60 per form, escalating for intentional disregard.

Key Differences Between Form W-2 and Form W-2VI

While Form W-2VI mirrors the standard W-2 in structure, it has notable distinctions to accommodate USVI tax rules:

| Feature | Form W-2 (Standard) | Form W-2VI (USVI) |

|---|---|---|

| Purpose | Reports U.S. wages subject to federal income tax withholding. | Reports USVI wages not subject to U.S. federal withholding; focuses on territorial taxes. |

| Box 2 (Tax Withheld) | Federal income tax withheld. | USVI income tax withheld. |

| Boxes 8 & 10 | Allocated tips and dependent care benefits. | Not applicable. |

| Boxes 15–20 | State/local income tax info. | Not applicable (territorial ID in Box 15 if needed). |

| Filing Location | SSA only (Copy A). | SSA (Copy A with W-3SS) and VIBIR (Copy 1). |

| EITC Notice | Required. | Not applicable. |

These differences prevent mixing U.S. and USVI data, which could lead to processing errors or audits. Always use W-2VI exclusively for USVI-sourced income.

IRS Form W-2VI Download and Printable

Download and Print: IRS Form W-2VI

How to Complete and File Form W-2VI: Step-by-Step Instructions

Completing Form W-2VI follows the General Instructions for Forms W-2 and W-3 (2025), with territorial adjustments. Download the fillable PDF from IRS.gov.

Step 1: Gather Employee Data

- Collect SSNs, wages paid (including bonuses, tips, and taxable benefits like group-term life insurance over $50,000).

- Calculate withholdings: USVI income tax (Box 2), Social Security (6.2% up to $176,100), and Medicare (1.45%, plus 0.9% Additional Medicare Tax on wages over $200,000).

Step 2: Fill Out the Boxes

- Box a–f: Employee and employer identifiers (no SSN truncation on Copy A).

- Box 1: Total taxable wages (exclude pre-tax deductions like 401(k) contributions).

- Boxes 3–7: Social Security and Medicare details—ensure Box 5 ≥ Boxes 3 + 7.

- Box 12: Use codes like D (elective deferrals) or EE (Roth contributions).

- Box 13: Check boxes for retirement plans or statutory employees.

- Void errors by marking “VOID” and issuing a new form.

If an employee has multiple W-2VIs (e.g., >4 Box 12 codes), repeat identifying info on extras.

Step 3: Distribute and File

- Furnish Copies B, C, and 2 to employees.

- File Copy A with Form W-3SS to the SSA.

- Send Copy 1 to VIBIR at: 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802.

E-filing is mandatory if filing 10+ returns (including W-2VIs and 1099s). Use SSA’s Business Services Online (BSO) for free submission—register early, as it takes up to 2 weeks. Paper filers must use red-ink scannable forms.

For corrections, use Form W-2c and W-3c.

Deadlines for Filing Form W-2VI in 2025

Timely filing is crucial to avoid penalties. For wages paid in 2025:

- Furnish to Employees: By January 31, 2026 (adjusted to Monday, February 2, 2026, as January 31 falls on a Saturday).

- File with SSA (Copy A + W-3SS): February 2, 2026 (paper or electronic).

- File with VIBIR (Copy 1): Aligns with SSA deadline; confirm via BIR.VI.gov.

Extensions:

- SSA: One 30-day extension via Form 8809 (for extraordinary circumstances only).

- Employee furnishing: Up to 15–30 days via Form 15397.

If employment ends before year-end, provide forms within 30 days of the last paycheck, but no later than February 2, 2026. Late filing penalties start at $60 per form and can reach $630 if over 30 days late.

Common Mistakes to Avoid When Filing Form W-2VI

Steer clear of these pitfalls to ensure smooth processing:

- Mixing Wage Types: Never report U.S.-withheld wages on W-2VI—use separate forms.

- Incorrect Box Usage: Leaving Boxes 8 or 10 blank is fine (not applicable), but don’t enter data there.

- SSN Errors: Always verify SSNs; “Applied For” is temporary—correct later with W-2c.

- E-Filing Oversights: Forgetting the 10-form threshold can trigger audits.

- Missing VIBIR Copy: Dual filing (SSA + VIBIR) is required for full compliance.

Retain Copy C for at least 3 years.

Resources and Support for Form W-2VI

- Official IRS Page: Download forms and instructions at IRS.gov W-2VI.

- General Instructions: Read the full 2025 guide at IRS Instructions for W-2 and W-3.

- VIBIR Guidance: Visit BIR.VI.gov for local reminders and forms requests.

- SSA E-Filing Help: Call 800-772-6270 or use BSO at SSA.gov.

- Professional Assistance: Consult a tax advisor for complex cases, like nonqualified deferred compensation.

Final Thoughts: Stay Compliant with Form W-2VI

Mastering IRS Form W-2VI ensures accurate wage reporting for your USVI employees, supporting seamless tax filings and Social Security credits. With deadlines approaching in early 2026, start gathering data now to avoid last-minute stress. For personalized advice, reach out to the IRS or VIBIR—compliance today means peace of mind tomorrow.

Last updated: December 2025. Always verify with official sources for the latest changes.