Table of Contents

IRS Form W-4 – Employee’s Withholding Certificate – As tax season approaches, ensuring your paycheck withholdings align with your actual tax liability is crucial to avoid a surprise bill or overpaying Uncle Sam. Enter IRS Form W-4, the Employee’s Withholding Certificate, a simple yet powerful tool that tells your employer how much federal income tax to deduct from each paycheck. For the 2025 tax year, the form incorporates updates from the One, Big, Beautiful Bill Act (OBBBA), including an increased standard deduction and enhanced Child Tax Credit, making it easier to adjust for these changes. With the IRS Tax Withholding Estimator updated to reflect these shifts, now’s the perfect time to review or complete your W-4—especially if life events like a new job, marriage, or baby have changed your situation.

This guide, based on the official 2025 Form W-4 instructions (Rev. December 2024) and IRS Publication 505, walks you through the form’s purpose, who needs it, step-by-step completion, deadlines, and common pitfalls. Whether you’re a first-time filer or tweaking for OBBBA benefits, get ready to optimize your withholdings and maximize your take-home pay. Download the 2025 PDF from IRS.gov today and let’s get started.

What Is IRS Form W-4?

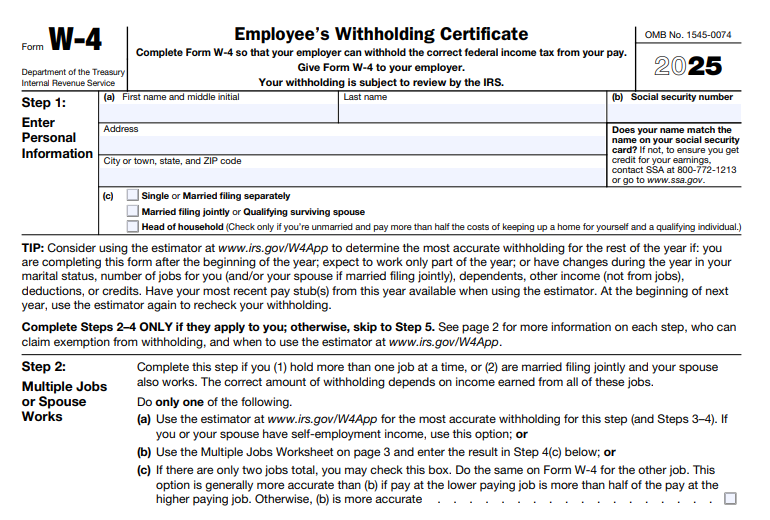

The Form W-4 is a one-page certificate employees use to specify their federal income tax withholding preferences, replacing the outdated “allowances” system with a streamlined approach based on filing status, dependents, and adjustments. Introduced in its current redesign in 2020, it helps employers compute withholdings using Publication 15-T tables, ensuring your deductions match your projected 2025 tax return.

Key features for 2025:

- No Allowances: Focuses on credits (e.g., up to $2,200 per qualifying child under the enhanced Child Tax Credit) and deductions.

- OBBBA Integration: Accounts for the new $31,500 standard deduction for married filing jointly (up from $29,200 in 2024) and other boosts like a $6,000 senior deduction.

- Digital Tools: Pairs with the IRS Tax Withholding Estimator for precise calculations.

You don’t submit the W-4 to the IRS—your employer keeps it on file for four years. Without one, they default to “Single” status with no adjustments, potentially overwithholding.

Key Fact: Proper W-4 completion can prevent underpayment penalties (up to 0.5% per month on owed taxes) and refunds that sit interest-free with the IRS.

Who Must Complete Form W-4?

Every U.S. employee should complete a Form W-4 upon hiring or when circumstances change, as it’s the primary way to customize withholdings. It’s required for:

- New Hires: Submit on or before your first payday.

- Life Changes: Marriage, divorce, birth/adoption, new job, or income shifts (e.g., side gig).

- Annual Reviews: The IRS recommends checking yearly, especially with 2025’s OBBBA updates boosting credits and deductions.

Special Cases:

- Nonresident Aliens: Use Notice 1392 for supplemental instructions—cannot claim exempt unless qualifying.

- Exempt Claim: If you owed no 2024 tax and expect none in 2025 (total tax on line 24 of Form 1040 < sum of lines 27–29), write “Exempt” in Step 4(c)—renew annually.

- Lock-In Letters: If the IRS issues one due to prior underwithholding, follow its specified status and adjustments.

Employers must implement changes within 30 days of receipt.

Step-by-Step Guide: How to Complete IRS Form W-4 for 2025

The 2025 Form W-4 is a four-page PDF with worksheets—complete Steps 1 and 5 always; 2–4 if applicable. Use the IRS Estimator (irs.gov/W4app) for accuracy, especially for multiple jobs or self-employment. Print in black ink or e-sign.

1. Prepare Your Info

- SSN, address, filing status (Single/MFS, MFJ/QSS, HoH).

- Expected 2025 income from all jobs, other sources (e.g., investments).

- Qualifying children (<17: $2,200 credit each) and other dependents ($500 each).

- Itemized deductions estimate (Schedule A) vs. standard ($15,750 single, $31,500 MFJ).

2. Step 1: Personal and Filing Status

- Enter name, SSN, address.

- Select: (a) Single/MFS; (b) MFJ/QSS; or (c) HoH (unmarried, >50% support for qualifying child/dependent).

3. Step 2: Multiple Jobs or Spouse Works

- Skip if one job total.

- Check (c) for two jobs total (uses higher withholding rate).

- For more: Use Multiple Jobs Worksheet (page 3) or Estimator; enter adjustment in Step 4(a).

4. Step 3: Claim Dependents

- Multiply qualifying children under 17 by $2,200; other dependents by $500.

- Add and enter total—reduces withholding.

5. Step 4: Other Adjustments (Optional)

- (a) Other Income: Non-job amounts (e.g., interest, pensions)—increases withholding.

- (b) Deductions: If > standard, use Deductions Worksheet (page 3): Estimate itemized + adjustments (e.g., OBBBA senior $6,000), subtract standard, enter excess.

- (c) Extra Withholding: Flat $ per pay if needed (e.g., for self-employment taxes).

6. Step 5: Sign and Date

- Sign under perjury penalty; employer completes employer section. Submit to employer—effective next payroll.

Pro Tip: For self-employed, use Estimator to account for SE tax; update mid-year for bonuses.

When and How to Submit Form W-4 for 2025

No fixed deadline—submit upon hire or within 10 days of changes. Employers apply updates in the first payroll 30 days after receipt.

- Annual Check: Review by year-end; OBBBA changes may warrant a new form.

- Delivery: Paper, email, or HR portal—retain a copy.

- Exempt Renewal: If claiming, update annually to avoid default withholding.

Common Mistakes to Avoid When Completing Form W-4

W-4 errors cause 75% of underwithholding issues, per IRS data—leading to penalties or small refunds. Here’s a table of frequent slip-ups:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Skipping Multiple Jobs (Step 2) | Assuming single-job rules apply. | Use worksheet/Estimator; check (c) for two jobs. | Underwithholding; 0.5% monthly penalty. |

| Wrong Dependent Credits (Step 3) | Miscounting qualifiers or ages. | Verify SSN/residency; $2,200/child <17, $500 others. | Overwithholding; smaller refunds. |

| Ignoring Other Income (Step 4(a)) | Forgetting investments/freelance. | Estimate non-wage income; add to withholding. | Tax bill + interest. |

| Miscalculating Deductions (Step 4(b)) | Using 2024 standard vs. 2025 OBBBA amounts. | Worksheet with $15,750 single/$31,500 MFJ. | Inaccurate take-home pay. |

| No Signature (Step 5) | Oversight. | Always sign; invalid otherwise. | Employer defaults to Single/no adjustments. |

| Outdated Form Use | Sticking with pre-2020 version. | Download 2025 PDF; no allowances. | IRS notices; refiling hassle. |

Correct anytime with a new W-4—no penalty for updates.

IRS Form W-4 Download and Printable

Download and Print: IRS Form W-4

2025 Updates and Special Considerations for Form W-4

The 2025 instructions (Rev. Dec. 2024) reflect OBBBA’s impacts:

- Standard Deduction: $15,750 single/MFS, $31,500 MFJ/QSS, $23,625 HoH (up ~$800–$2,300 from 2024).

- Child Tax Credit: Up to $2,200/child (refundable portion $1,700); phases out at higher incomes.

- New Deductions: $6,000 for seniors (65+), tip/overtime exclusions—factor into Step 4(b).

- Estimator Updates: Reflects OBBBA but not all new deductions—use worksheet for those.

Nonresidents: No exempt claims; use special tables.

Final Thoughts: Optimize Your Withholdings with Form W-4 in 2025

The IRS Form W-4 is your first line of defense against tax surprises, tailored for 2025’s OBBBA enhancements to keep more money in your pocket year-round. Complete it accurately using the Estimator, update with life changes, and consult Pub. 505 for details. Employers: Remind staff annually to foster compliance.

For complex scenarios, see a tax pro. This guide is informational; not advice—verify at IRS.gov.

Not tax advice. Always use official IRS resources.

FAQs About IRS Form W-4

What is the 2025 standard deduction for Form W-4?

$15,750 single/MFS, $31,500 MFJ/QSS, $23,625 HoH.

When should I complete a new W-4?

Upon hiring or changes like marriage/child; annually for accuracy.

Can I claim exempt on 2025 Form W-4?

Yes, if no 2024 liability and none expected in 2025—write “Exempt” in Step 4(c).

How does the Child Tax Credit affect W-4?

Multiply qualifying children by $2,200 in Step 3 to reduce withholding.