Table of Contents

IRS Form W-4P – Withholding Certificate for Periodic Pension or Annuity Payments – Retirement income from pensions and annuities can be a reliable stream, but ensuring the right amount of federal income tax withholding is key to avoiding surprises at tax time. Enter IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments—your tool to customize tax withholding from these regular distributions. If you’re a retiree wondering, “How do I set up pension withholding for 2025?” or “What’s the default tax rate on annuity payments?”, this SEO-optimized guide has you covered.

Drawing from the latest IRS resources for tax year 2025, we’ll explain eligibility, step-by-step completion, special rules, and tips to optimize your withholding. Proper use of Form W-4P helps you align payments with your tax liability, potentially reducing or eliminating the need for estimated taxes via Form 1040-ES. Download the 2025 version from IRS.gov and get started today.

What Is IRS Form W-4P?

Form W-4P allows recipients of periodic pension or annuity payments to elect federal income tax withholding at a specific rate or amount. “Periodic” means payments made in installments (e.g., monthly or quarterly) over more than one year, such as from employer-sponsored plans, IRAs, profit-sharing plans, or commercial annuities. Withholding applies only to the taxable portion of these payments.

Unlike lump-sum or nonperiodic distributions (which use Form W-4R), W-4P focuses on ongoing income, mirroring the structure of Form W-4 for wages but tailored for retirees. If you don’t submit a Form W-4P, payers default to withholding as if you’re single with no adjustments—often leading to over- or under-withholding. Submit a new form anytime to update, effective for payments starting more than 30 days after submission (or sooner if the payer agrees).

For 2025, the form incorporates updated standard deductions and tax brackets, ensuring accurate withholding amid inflation adjustments.

Who Needs to File Form W-4P?

You should complete Form W-4P if:

- You’re a U.S. citizen or resident alien receiving periodic pension or annuity payments.

- You want to adjust withholding beyond the default (e.g., to account for other income, deductions, or credits).

- You have multiple income sources, like a spouse’s pension or job earnings, requiring coordinated adjustments.

Exceptions:

- Nonresident aliens or foreign estates: Use alternatives in Publication 515 or 519.

- Military retirement pay or certain deferred compensation: Use Form W-4 instead.

- Eligible rollover distributions: Mandatory 20% withholding; use Form W-4R for more.

Even if you elect no withholding (allowed for U.S. addresses), you may still owe estimated taxes if your total liability exceeds $1,000 after credits. Payers must notify you of your withholding rights unless the entire payment is nontaxable.

Pro Tip: Use the IRS Tax Withholding Estimator at irs.gov/W4App to check if your current setup matches your 2025 tax picture—especially useful for partial-year payments or life changes.

How to Complete IRS Form W-4P for 2025: Step-by-Step Guide

The redesigned 2025 Form W-4P has five steps, plus an optional Deductions Worksheet. Aim for withholding that covers at least 90% of your 2025 tax or 100% of your 2024 tax to avoid penalties. Here’s how to fill it out:

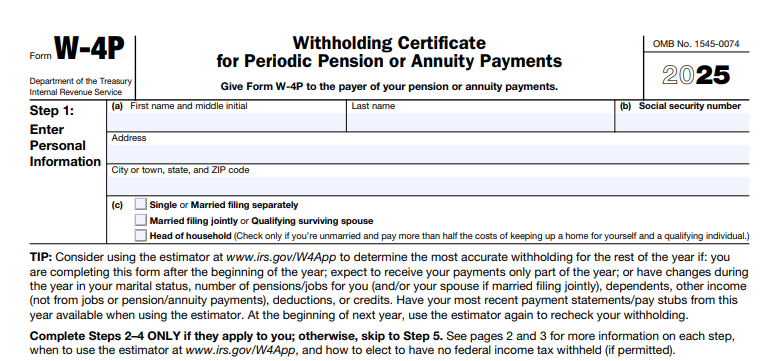

Step 1: Enter Your Personal Information

- Provide your full name, address, and Social Security number (SSN).

- Select your filing status: Single or Married filing separately; Married filing jointly or Qualifying surviving spouse; or Head of household.

- Why it matters: Filing status determines your standard deduction ($15,000 single, $30,000 joint, $22,500 head of household for 2025).

Step 2: Account for Multiple Incomes

- If you (or your spouse) have job income or other pensions/annuities, estimate totals here to avoid under-withholding.

- Option (a): Use the IRS estimator (recommended).

- Option (b): Add estimated job pay (plus other income from Form W-4 Step 4(a)) and lower-paying pensions; enter the sum.

- Example: Single retiree with $50,000 from this pension, $25,000 from a job, and $1,000 interest—enter $26,000 in Step 2(b)(i) and (iii). Skip Steps 3–4(b) if you have jobs; handle on your Form W-4.

Complete this only on your highest-paying pension’s form if no jobs.

Step 3: Claim Dependents and Other Credits

- For incomes under $200,000 ($400,000 joint): $2,000 per qualifying child under 17; $500 per other dependent.

- Add credits like child tax, education, or foreign tax credits.

- Example: Two kids under 17 and one college student = $4,500 ($2,000 x 2 + $500).

Step 4: Other Adjustments (Optional)

- (a) Other income (e.g., dividends, taxable Social Security): Enter annual estimate.

- (b) Extra deductions: Use the Deductions Worksheet for itemized amounts over standard, plus age 65+ bonuses ($1,600–$3,200) or adjustments like IRA contributions.

- (c) Extra withholding per payment: Specify a flat amount.

- To elect no withholding: Write “No Withholding” below Step 4(c). (Not for foreign addresses.)

Deductions Worksheet Quick Guide:

- Estimate itemized deductions (e.g., medical >7.5% AGI, state taxes up to $10,000).

- Subtract standard deduction.

- Add age/blindness extras.

- Include other adjustments (e.g., student loan interest).

- Total goes in Step 4(b).

Step 5: Sign and Date

- Your signature validates the form. Submit to your payer (e.g., plan administrator).

File a separate W-4P for each payer. Invalid forms (no SSN/signature) default to single/no adjustments.

Key Updates for Form W-4P in 2025

The 2025 form reflects inflation adjustments:

- Standard deductions: $15,000 (single), $30,000 (joint), $22,500 (head of household).

- Dependent credits: Unchanged at $2,000/$500, but income limits $200,000/$400,000.

- No major redesign: Builds on 2022 updates; prior elections don’t auto-carry—resubmit if needed.

- Withholding methods: Payers use Publication 15-T tables; default single if no form.

Check irs.gov/FormW4P for post-publication changes from legislation like the One, Big, Beautiful Bill Act.

Special Situations for Pension Withholding

| Situation | Guidance |

|---|---|

| Multiple Pensions | Adjust only on the highest-paying W-4P; blank others. Coordinate with spouse’s forms. |

| Self-Employment | Estimator handles SE tax; consider quarterly estimated payments. |

| Nonperiodic Payments | Switch to Form W-4R (10% default). |

| Outside U.S. | Generally required withholding; no “no withholding” election. |

| Terrorist Victims | Nontaxable disability? Elect no withholding per Pub. 3920. |

If withholding is too low, pay estimated taxes quarterly (due April 15, June 16, Sept. 15, 2025; Jan. 15, 2026). Use Pub. 505 for details.

IRS Form W-4P Download and Printable

Download and Print: IRS Form W-4P

5 Tips for Optimizing Your W-4P Withholding in 2025

- Run the Estimator Annually: Input 2024 data and project 2025 changes for precision.

- Coordinate All Incomes: Include Social Security, investments—avoid underpayment penalties via Form 2210.

- Elect No Withholding Wisely: Only if you’ll cover via other withholding or estimates; revocable anytime.

- Update for Life Events: Marriage, new grandkids, or health deductions? Refile promptly.

- Consult Pros: For complex scenarios (e.g., international pensions), see a tax advisor.

Frequently Asked Questions (FAQs) About IRS Form W-4P

What’s the default withholding if I don’t file Form W-4P?

Treated as single with no adjustments—typically 10–22% based on payment size, per Pub. 15-T.

Can I elect no federal tax withholding on my pension?

Yes, for U.S. residents, but ensure estimated taxes cover your liability to avoid penalties.

How often should I update my W-4P?

Annually or after changes; effective for future payments.

Does Form W-4P affect state taxes?

No—use state equivalents (e.g., California’s DE 4P).

Where do I get the 2025 Form W-4P?

Free download at irs.gov/pub/irs-pdf/fw4p.pdf; available since late 2024.

Mastering IRS Form W-4P keeps your retirement cash flow steady and IRS-compliant. For personalized help, visit irs.gov or a tax professional. Share your experiences in the comments!

This article provides general info based on 2025 IRS guidelines—not tax advice. Verify with official sources.