Table of Contents

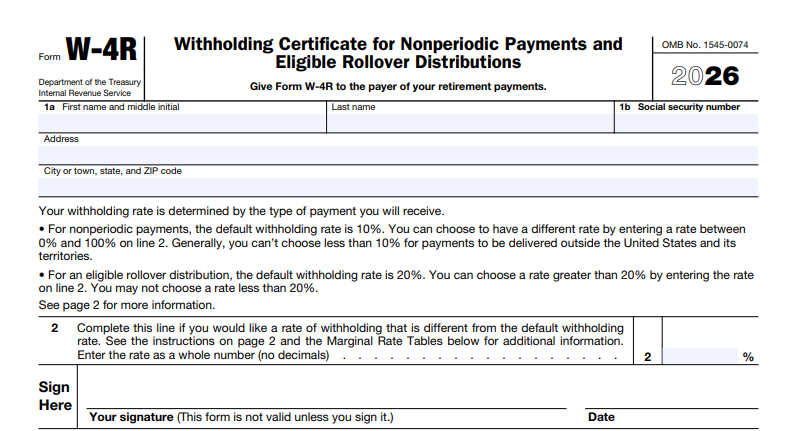

IRS Form W-4R – Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions – IRS Form W-4R is a critical tax document for individuals receiving certain retirement distributions. This withholding certificate helps ensure the correct amount of federal income tax is deducted from nonperiodic payments and eligible rollover distributions from retirement plans, IRAs, or annuities.

As of December 2025, the latest version is the 2026 Form W-4R, released by the IRS for use starting in 2026. The form’s core rules remain consistent with prior years, with updates primarily to tax bracket thresholds for inflation.

What Is IRS Form W-4R and Its Purpose?

Form W-4R, officially titled “Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions,” allows you to specify how much federal income tax your payer (such as a retirement plan administrator or IRA custodian) should withhold from specific types of distributions.

The primary purpose is to help avoid underpayment penalties or large tax bills at filing time by aligning withholding with your expected tax liability. You submit the form directly to your payer—not the IRS—and it applies to future payments from the same plan unless you update it.

Key note: Do not use Form W-4R for periodic payments (regular installments over more than one year, like monthly pension checks). Use Form W-4P instead.

When Should You Use Form W-4R?

Use Form W-4R for:

- Nonperiodic payments — Lump-sum distributions, withdrawals on demand from IRAs, or other one-time/non-regular payments from employer retirement plans (e.g., 401(k)), annuities, or IRAs.

- Eligible rollover distributions — Distributions from qualified plans (like 401(k)s or 403(b)s) that could be rolled over into another plan or IRA, but are paid directly to you.

Examples include:

- A lump-sum payout from a retirement plan upon separation from service.

- A direct IRA withdrawal (not on a scheduled basis).

- Certain rollovers not directly transferred to another account.

Default Withholding Rates on Form W-4R

If you do not submit a Form W-4R (or provide invalid information), default rules apply:

- Nonperiodic payments → 10% federal income tax withholding on the taxable portion.

- Eligible rollover distributions → Mandatory 20% withholding on the taxable portion (you cannot opt out or reduce below 20%).

These defaults may not match your actual tax liability—leading to over- or under-withholding. Submitting Form W-4R lets you customize the rate.

How to Complete Form W-4R: Step-by-Step Guide

The 2026 Form W-4R is a simple two-page document. Here’s how to fill it out:

- Personal Information (Line 1):

- Enter your name, address, and Social Security number (SSN).

- For estates, use the employer identification number (EIN).

- Withholding Election (Line 2):

- This is the key line. Enter a whole percentage rate (e.g., 15%) for withholding.

- For nonperiodic payments: You can request any rate from 0% to 100% (enter “-0-” for no withholding, if eligible). Note: 0% is not allowed for payments delivered outside the U.S.

- For eligible rollover distributions: You must withhold at least 20%; you can only request higher (e.g., 25%).

- Leave blank for default rates (10% or 20%).

- Sign and Date:

- The form is invalid without your signature and date.

- Give the completed form to your payer.

Tip for Accurate Withholding: Use the IRS Tax Withholding Estimator at irs.gov/W4App or refer to Publication 505 for guidance. Consider your total expected income, deductions, and credits when choosing a rate.

IRS Form W-4R Download and Printable

Download and Print: IRS Form W-4R

Using the 2026 Marginal Rate Tables

The form includes suggested marginal rate tables to help select an appropriate withholding percentage. These tables show 2026 federal income tax brackets based on your filing status and total expected income (including the distribution).

Add the distribution amount to your other income, then choose the rate that covers the tax on the additional income.

2026 Marginal Rate Tables Summary

| Filing Status | Income Over | Marginal Rate |

|---|---|---|

| Single or Married Filing Separately | $0 | 0% |

| $16,100 | 10% | |

| $28,500 | 12% | |

| $66,500 | 22% | |

| $121,800 | 24% | |

| $217,875 | 32% | |

| $272,325 | 35% | |

| $656,700 | 37% | |

| Married Filing Jointly or Qualifying Surviving Spouse | $0 | 0% |

| $32,200 | 10% | |

| $57,000 | 12% | |

| $133,000 | 22% | |

| $243,600 | 24% | |

| $435,750 | 32% | |

| $544,650 | 35% | |

| $800,900 | 37% | |

| Head of Household | $0 | 0% |

| $24,150 | 10% | |

| $41,850 | 12% | |

| $91,600 | 22% | |

| $129,850 | 24% | |

| $225,900 | 32% | |

| $280,350 | 35% | |

| $664,750 | 37% |

Examples provided on the form illustrate calculations for straddling brackets (e.g., a $20,000 distribution pushing income from 12% to 22% bracket might suggest 19% withholding).

Special Situations and Exceptions

- Nonresident aliens — Do not use Form W-4R; follow rules in Publication 515.

- Certain distributions exempt from 20% rule — Includes required minimum distributions (RMDs), hardship withdrawals, and others like emergency or disaster recoveries.

- Disability payments from terrorist attacks — May qualify for 0% if nontaxable.

- State tax withholding — Form W-4R is federal only; check with your payer for state rules.

Where to Download Form W-4R

Download the latest 2026 Form W-4R directly from the IRS website: irs.gov/pub/irs-pdf/fw4r.pdf. Prior versions are available for reference.

For more details, see Publication 505 (Tax Withholding and Estimated Tax).

Frequently Asked Questions About Form W-4R

Q: Can I change my withholding later?

A: Yes—submit a new Form W-4R to your payer anytime.

Q: What if I want no withholding?

A: Possible for nonperiodic payments (enter “-0-“), but not for eligible rollover distributions.

Q: Is Form W-4R required?

A: No, but defaults apply if not submitted.

Properly completing Form W-4R helps manage your tax obligations on retirement distributions effectively. Always consult a tax professional for personalized advice, especially with complex situations. For the most current information, visit irs.gov.