Table of Contents

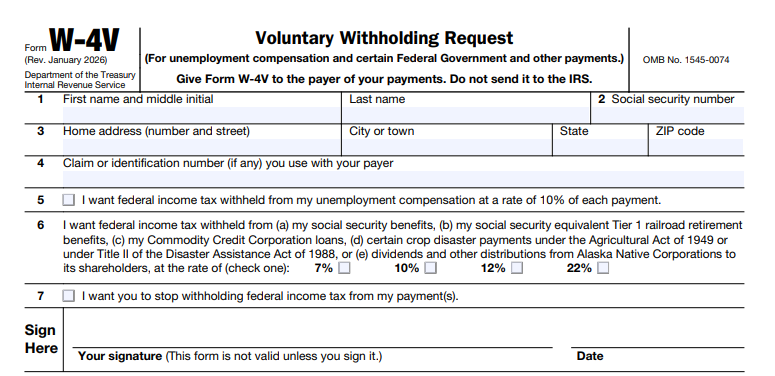

IRS Form W-4V – Voluntary Withholding Request – IRS Form W-4V, officially titled Voluntary Withholding Request, allows individuals to request federal income tax withholding from certain government payments on a voluntary basis. The latest version, revised January 2026, helps recipients avoid large tax bills at year-end by having taxes withheld upfront.

This form is particularly useful for retirees receiving Social Security benefits, individuals on unemployment, or those getting specific federal payments who prefer steady withholding over quarterly estimated tax payments.

What Is IRS Form W-4V?

Form W-4V is a simple one-page IRS document that lets you voluntarily request federal income tax withholding from specific non-wage government payments. Unlike mandatory withholding on salaries (handled by Form W-4) or pensions (Form W-4P), withholding with Form W-4V is entirely optional.

The form is not sent to the IRS—you submit it directly to the payer of your benefits (e.g., Social Security Administration or state unemployment office).

Who Should Use Form W-4V?

Use this form if you receive any of the following payments and want federal taxes withheld:

- Unemployment compensation (including Railroad Unemployment Insurance Act payments)

- Social Security benefits

- Social Security equivalent Tier 1 railroad retirement benefits

- Commodity Credit Corporation loans

- Certain crop disaster payments under the Agricultural Act of 1949 or Title II of the Disaster Assistance Act of 1988

- Dividends and other distributions from Alaska Native Corporations to shareholders

If you’re unsure whether your payment qualifies, contact your payer directly.

Available Withholding Rates on Form W-4V

Withholding options are limited to flat percentages—no custom amounts:

- Unemployment compensation — Fixed at 10% per payment (no other rate allowed)

- Other listed payments (Social Security, etc.) — Choose from 7%, 10%, 12%, or 22%

These rates align with common backup withholding levels and help cover potential tax liability without over- or under-withholding significantly.

IRS Form W-4V Download and Printable

Download and Print: IRS Form W-4V

How to Fill Out Form W-4V (Step-by-Step)

The January 2026 revision of Form W-4V is straightforward with only seven lines:

- Enter your full name

- Enter your Social Security number

- Enter your home address (including city, state, ZIP; for international addresses, include country and postal code)

- Enter your claim or identification number (if applicable—e.g., Social Security claim number; contact payer if unsure)

Then select one withholding option:

- Line 5 → Check for 10% withholding from unemployment compensation

- Line 6 → Check and select 7%, 10%, 12%, or 22% for other payments (Social Security, etc.)

- Line 7 → Check to stop all withholding

Sign and date the form. It is invalid without your signature.

Note for Social Security recipients: You can also change withholding online at ssa.gov/manage-benefits/request-withhold-taxes or by calling 1-800-772-1213 instead of mailing the form.

How to Submit Form W-4V

Submit the completed form directly to your payment payer—not the IRS. Payers may also provide their own equivalent form.

Withholding typically begins after the payer processes your request (ask them for exact timing) and remains in effect until you submit a new form to change or stop it.

How to Change or Stop Withholding

To adjust your rate or stop withholding entirely:

- Complete a new Form W-4V

- Fill lines 1–4

- Check the desired box on line 5, 6, or 7

- Sign and submit to your payer

Why Request Voluntary Withholding?

Many people prefer automatic withholding to avoid underpayment penalties or a large tax bill when filing. This is especially helpful if these payments are your primary income source. However, if you have other income, consider making estimated tax payments using Form 1040-ES for better control.

Frequently Asked Questions About Form W-4V

Is Form W-4V the same as Form W-4?

No. Form W-4 is for employees’ wages, while W-4V is strictly for voluntary withholding from specific government payments.

Can I request a custom withholding amount?

No—only the flat percentages listed are allowed.

What if I don’t want any taxes withheld?

Simply do nothing, or submit Form W-4V with line 7 checked to stop existing withholding.

Is there a 2026 update to Form W-4V?

Yes—the current revision is January 2026. Always download the latest version from IRS.gov.

Where can I download Form W-4V?

Visit irs.gov/FormW4V for the latest PDF.

For personalized advice, consult a tax professional or use the IRS Tax Withholding Estimator to review your overall situation. This guide is based on the official IRS Form W-4V (Rev. January 2026) and related publications.