Table of Contents

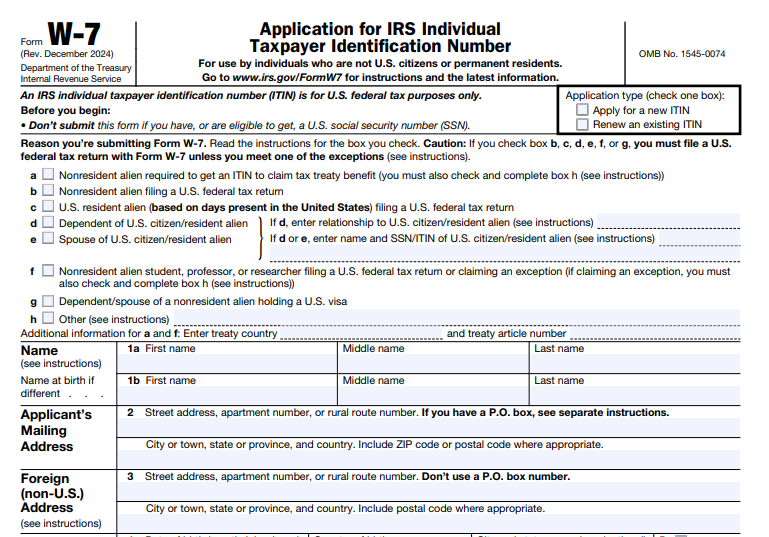

IRS Form W-7 – Application for IRS Individual Taxpayer Identification Number – IRS Form W-7, Application for IRS Individual Taxpayer Identification Number, allows individuals ineligible for a Social Security Number (SSN) to obtain an ITIN for U.S. federal tax purposes. An ITIN is a nine-digit number beginning with 9, issued by the IRS to process tax returns, claim refunds, or meet other tax reporting requirements.

This guide covers the latest information based on the December 2024 revision of Form W-7 and its instructions, applicable for 2025 tax filings. Whether applying for a new ITIN or renewing an expiring one, understanding the process helps avoid delays.

What Is an ITIN and Why Do You Need Form W-7?

The IRS issues an Individual Taxpayer Identification Number (ITIN) to ensure tax compliance for those who need a U.S. taxpayer identification number but cannot obtain an SSN. This includes:

- Nonresident aliens filing U.S. tax returns

- Resident aliens (based on substantial presence)

- Spouses or dependents of U.S. citizens/residents

- Nonresident alien students, professors, or researchers

An ITIN serves federal tax purposes only—it does not authorize work in the U.S., change immigration status, or qualify for Social Security benefits or certain credits like the Earned Income Tax Credit.

Form W-7 applies for a new ITIN or renews an expired one. ITINs expire if unused on a federal tax return for three consecutive years, or for specific middle-digit ranges (the IRS notifies affected holders).

Who Needs to Apply for an ITIN Using Form W-7?

You need an ITIN if you:

- File a U.S. federal tax return (e.g., Form 1040 or 1040-NR) but lack an SSN.

- Claim tax treaty benefits as a nonresident alien.

- Act as a spouse or dependent on a U.S. taxpayer’s return for allowable benefits (e.g., joint filing, premium tax credit, credit for other dependents).

- Receive taxable income subject to withholding or reporting (e.g., scholarships, gambling winnings, or passive income).

U.S. citizens, permanent residents (green card holders), or anyone eligible for an SSN should not apply for an ITIN.

Spouses and dependents qualify only if claimed for specific tax benefits or filing their own return.

Required Supporting Documents for Form W-7

Form W-7 requires proof of identity and foreign status. Submit original documents or certified copies (from the issuing agency—not notarized, except for overseas U.S. military families).

A valid passport stands alone as proof of both identity and foreign status. Otherwise, submit at least two documents (one with a photo, except for minors).

Acceptable Documents

- Passport (preferred standalone).

- National ID card (with photo, name, address, birth date, expiration).

- U.S. or foreign driver’s license.

- Birth certificate (required for dependents under 18 without passport; original only).

- Visa issued by the U.S. Department of State.

- U.S. Citizenship and Immigration Services (USCIS) photo ID.

- Foreign military ID.

- School records (for dependents under 24 if students; must be recent, within 12 months).

- Medical records (for dependents under 6; recent and detailed).

Dependents often need additional proof of U.S. residency (e.g., U.S. school/medical records or utility bills), unless they have a passport with U.S. entry date or meet exceptions.

The IRS returns originals within 60 days.

How to Complete and Submit Form W-7

Step 1: Fill Out Form W-7

Download the latest Form W-7 (Rev. December 2024) from IRS.gov.

Key lines include:

- Reason for applying (boxes a–h, e.g., dependent, nonresident filing return, tax treaty).

- Personal details (name, foreign address, country of citizenship, birth date).

- Previous ITIN (for renewals).

- Supporting document details.

Each family member needs a separate Form W-7.

Step 2: Attach a Federal Tax Return (Usually Required)

Attach a completed U.S. tax return (e.g., Form 1040) unless you qualify for an exception, such as:

- Third-party withholding on passive income.

- Tax treaty benefits on scholarships or wages.

- Mortgage interest reporting.

- Real property dispositions.

See the Exceptions Tables in the instructions for details and required supplemental documents.

Step 3: Choose Submission Method

- By Mail — Send to: Internal Revenue Service, ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342.

- In Person:

- IRS Taxpayer Assistance Centers (TAC; free, appointment recommended).

- Volunteer Income Tax Assistance (VITA) sites with ITIN services (free).

- Certifying Acceptance Agents (CAA; fee-based, can certify most documents; available internationally).

Agents help with completion and may certify documents to avoid mailing originals.

IRS Form W-7 Download and Printable

Download and Print: IRS Form W-7

ITIN Processing Time and Status

Processing takes about 7 weeks, but 9–11 weeks during peak tax season (January 15–April 30) or for overseas applicants. The IRS sends a notice with your ITIN or requests more information.

Track status by calling 800-829-1040 (U.S.) or 267-941-1000 (international).

Common Mistakes to Avoid When Filing Form W-7

- Submitting incomplete forms or insufficient documents.

- Forgetting to attach a tax return when required.

- Using expired or photocopied (non-certified) documents.

- Applying too early or late relative to tax filing deadlines.

- Not renewing expired ITINs before filing.

Frequently Asked Questions About Form W-7 and ITINs

Can I apply for an ITIN without filing a tax return?

Yes, if you meet one of the exceptions (e.g., tax treaty benefits or third-party reporting).

How do I renew an ITIN?

Use Form W-7, mark the renewal box, and follow the same process (tax return usually required).

Is an ITIN the same as an SSN?

No—an ITIN is for tax purposes only and provides no work authorization or benefits.

What if I later get an SSN?

Stop using the ITIN and notify the IRS to link records.

For the most current details, visit IRS.gov and review Publication 1915 or the Form W-7 instructions.

This guide is based on official IRS sources as of late 2025. Always check IRS.gov for any updates before applying.