Table of Contents

IRS Form W-7-COA – Certificate of Accuracy for IRS Individual Taxpayer Identification Number – In the world of U.S. tax compliance, securing an Individual Taxpayer Identification Number (ITIN) is essential for non-U.S. citizens who need to file federal tax returns but aren’t eligible for a Social Security Number (SSN). Enter IRS Form W-7-COA, the Certificate of Accuracy for IRS Individual Taxpayer Identification Number—a critical document that streamlines this process. If you’re a foreign national, expat, or tax professional assisting with ITIN applications, understanding Form W-7-COA can prevent delays and ensure smooth IRS processing.

This SEO-optimized guide breaks down everything you need to know about IRS Form W-7-COA, from its purpose and eligibility to step-by-step filing instructions. Updated for 2025, we’ll draw on official IRS resources to help you navigate ITIN requirements efficiently. Whether you’re searching for “what is IRS Form W-7-COA” or “how to complete ITIN Certificate of Accuracy,” you’ve come to the right place.

What Is an ITIN and Why Do You Need One?

Before diving into Form W-7-COA, let’s clarify the basics. An ITIN is a nine-digit tax processing number issued by the IRS to individuals who must file U.S. federal tax returns but can’t get an SSN. This includes nonresident aliens, their spouses, and dependents involved in U.S. tax matters like wage reporting, claiming refunds, or treaty benefits.

Common scenarios requiring an ITIN:

- Filing a U.S. tax return as a nonresident alien.

- Being claimed as a dependent or spouse on someone else’s return.

- Opening a U.S. bank account or reporting foreign income.

ITINs expire after three years of inactivity, so renewals are often necessary. To apply or renew, you submit Form W-7 (Application for IRS Individual Taxpayer Identification Number), typically with a federal tax return (like Form 1040).

What Is IRS Form W-7-COA?

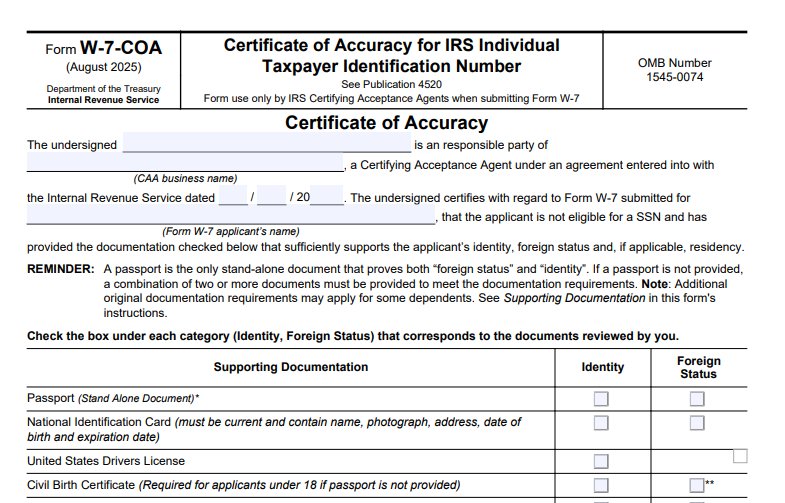

IRS Form W-7-COA (Certificate of Accuracy for IRS Individual Taxpayer Identification Number) is a supporting document attached to Form W-7. It’s exclusively used by authorized Certifying Acceptance Agents (CAAs)—IRS-approved professionals or organizations—to certify the authenticity of an applicant’s identity and foreign status documents.

The form acts as a “seal of approval,” verifying that the CAA has reviewed original or certified copies of required documents. This eliminates the need for applicants to mail originals to the IRS, reducing risk and processing time. The latest version, revised August 2025, emphasizes secure document handling amid rising fraud concerns.

Key fact: Form W-7-COA is not for direct IRS submissions by individuals. Only CAAs can complete it.

Who Needs to File IRS Form W-7-COA?

Form W-7-COA is required when a CAA submits a Form W-7 on behalf of:

- Primary applicants: Nonresident aliens applying for an ITIN.

- Secondary applicants: Spouses or dependents listed on a U.S. tax return.

- Renewal applicants: Those with expiring ITINs (middle digits 70-88, 90-92, or 94-99).

If you’re not using a CAA, skip Form W-7-COA and send originals directly to the IRS. CAAs are ideal for international applicants, as they handle verification via in-person or video interviews.

| Who Files | When Required | Benefits |

|---|---|---|

| Certifying Acceptance Agents (CAAs) | With every Form W-7 submission | Verifies docs; avoids mailing originals |

| Individuals | Never—only CAAs use it | N/A |

| Tax Professionals (non-CAAs) | Not applicable | Use direct IRS method instead |

Purpose of IRS Form W-7-COA: Ensuring Accuracy and Compliance

The primary purpose of IRS Form W-7-COA is to certify that the applicant’s supporting documents are genuine, complete, and accurately establish:

- Identity: Proves who the applicant is.

- Foreign status: Confirms non-U.S. citizenship or residency.

- Residency (if applicable): For certain exceptions.

By signing, the CAA attests under penalty of perjury that they’ve followed IRS guidelines in Publication 4520 (Acceptance Agents Guide for ITINs). This certification combats fraud, as the IRS scrutinizes ITIN apps due to past misuse.

Without it, CAA-submitted applications may be rejected, delaying ITIN issuance by weeks.

Required Documents for ITIN Applications with Form W-7-COA

CAAs must review originals or certified copies. A passport is the only standalone document proving both identity and foreign status. Otherwise, combine two or more from this IRS-approved list:

- Identity: National ID card, U.S. driver’s license, U.S. military ID, birth certificate, or visa.

- Foreign Status: Visa, foreign passport, or foreign driver’s license.

- For Dependents: Passport or civil birth certificate (CAA can authenticate these); originals/certified copies for others.

CAAs retain copies and attach them to the submission. For foreign military IDs, send originals directly to the IRS.

IRS Form W-7-COA Download and printable

Download and Print: IRS Form W-7-COA

Step-by-Step Guide: How to Complete IRS Form W-7-COA

Only CAAs fill this out—applicants provide info for Form W-7. Use the August 2025 revision (Catalog No. 56020G). Here’s how:

- Applicant Details: Enter the full name, mailing address, and foreign address from Form W-7. Include any prior ITIN if renewing.

- Business/Agent Info: As the CAA, input your business name, EIN, office code, PTIN (Preparer Tax ID Number), and acceptance date.

- Document Checklist: Check boxes for reviewed documents (e.g., passport for identity/foreign status). Note: If no passport, ensure combos cover requirements.

- Certification Statement: Confirm docs are authentic and complete. Sign and date as the authorized representative (must be designated in your IRS agreement).

- Attachments: Include signed Form W-7, tax return (if required), and document copies. Retain originals for your records.

Pro tip: Double-check for errors—processing takes 7-11 weeks.

How to Submit IRS Form W-7-COA

- No e-filing: Mail the package to the IRS ITIN Operation in Austin, TX (P.O. Box 149342, Austin, TX 78714-9342).

- Attach to Form W-7 and tax return.

- Track via certified mail; expect your ITIN notice in 7-11 weeks.

For renewals, include the expired ITIN on Form W-7.

Common Mistakes to Avoid When Using Form W-7-COA

- Incomplete Docs: Failing to check all required boxes or attach copies.

- Unauthorized Signers: Only designated CAA reps can sign.

- Missing Tax Return: Most apps need one (exceptions: third-party withholding, wage reporting).

- Outdated Form: Use Rev. 8-2025 only.

These errors can lead to denials or delays—always reference IRS Publication 4520.

Finding a Certifying Acceptance Agent (CAA) for Your ITIN Application

Search the IRS directory at IRS.gov for CAAs by location or specialty (e.g., international tax). They charge fees but save time and hassle. Video verification is now standard for remote applicants.

FAQ: IRS Form W-7-COA and ITIN Basics

Is there a fee for Form W-7-COA?

No, but CAAs may charge for services.

Can I renew my ITIN with Form W-7-COA?

Yes, attach it to a renewal Form W-7.

What if my ITIN expires in 2025?

Apply for renewal by December 31 to avoid refund delays.

Where can I download Form W-7-COA?

Get the PDF at IRS.gov/pub/irs-pdf/fw7coa.pdf.

Final Thoughts: Streamline Your ITIN Process with Form W-7-COA

IRS Form W-7-COA is a game-changer for secure, efficient ITIN applications in 2025. By partnering with a CAA, you ensure compliance while protecting sensitive documents. Ready to apply? Download Form W-7 and W-7-COA from the IRS website, or consult a tax pro for personalized help.

For the latest updates, visit IRS.gov/ITIN. Have questions about “IRS Form W-7-COA instructions” or ITIN renewals? Drop a comment below—we’re here to help!

This article is for informational purposes only and not tax advice. Consult a qualified professional for your situation.