Table of Contents

IRS Form W-8BEN – Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) – If you’re a non-U.S. resident earning income from American sources, navigating U.S. tax withholding can feel overwhelming. IRS Form W-8BEN, officially known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), is a key document that helps foreign individuals certify their status and potentially reduce or eliminate U.S. tax withholding on certain income. In this comprehensive guide, we’ll break down what Form W-8BEN is, who needs it, how to fill it out step by step, and more—using the latest information as of 2025. Whether you’re dealing with dividends, royalties, or other U.S.-sourced payments, understanding this form can save you time and money.

What Is IRS Form W-8BEN?

Form W-8BEN is an IRS document used by nonresident alien individuals to declare their foreign status for U.S. tax purposes. It certifies that you are not a U.S. person, are the beneficial owner of the income in question, and may qualify for reduced withholding rates under a U.S. income tax treaty. This form applies to chapters 3 and 4 of the Internal Revenue Code, which cover withholding on U.S. source fixed or determinable annual or periodical (FDAP) income, such as interest, dividends, rents, and royalties. It’s not for filing a U.S. tax return but rather for providing to a withholding agent, like a bank or payer, before income is paid or credited to you.

The form helps prevent the default 30% U.S. withholding tax on eligible income by allowing you to claim treaty benefits, if applicable. For instance, if your home country has a tax treaty with the U.S., you might reduce withholding to 0%–15% on dividends or royalties. As of 2025, the current revision of Form W-8BEN is from October 2021, with no major updates noted, though always check the IRS website for the latest version.

Key purposes include:

- Certifying foreign status to avoid backup withholding.

- Claiming exemptions from reporting on certain transactions, like broker proceeds or foreign source interest.

- Supporting withholding under section 1446(f) for transfers of partnership interests.

Who Needs to Fill Out Form W-8BEN?

You should complete Form W-8BEN if you’re a nonresident alien individual and the beneficial owner of U.S.-sourced income subject to withholding. This includes account holders at foreign financial institutions (FFIs) or those receiving payments from U.S. payers. Common scenarios include:

- Foreign investors receiving U.S. dividends or interest.

- Freelancers or creators earning royalties from U.S. platforms.

- Non-U.S. residents with U.S. bank accounts or investment portfolios.

- Individuals involved in life insurance contracts or death benefits under section 6050Y.

Do not use this form if you’re a U.S. citizen or resident (use Form W-9 instead), a foreign entity (use W-8BEN-E), or if the income is effectively connected with a U.S. trade or business (use W-8ECI). For joint accounts, each foreign owner must submit their own W-8BEN.

If a withholding agent requests it and you fail to provide the form, you could face 30% withholding or account closure.

IRS Form W-8BEN Download and Printable

Download and Print: IRS Form W-8BEN

Step-by-Step Guide: How to Fill Out IRS Form W-8BEN

Filling out Form W-8BEN is straightforward but requires accuracy to avoid penalties. The form has three parts: Identification of Beneficial Owner, Claim of Tax Treaty Benefits, and Certification. Always use the latest version from IRS.gov and provide it to your withholding agent—do not send it to the IRS.

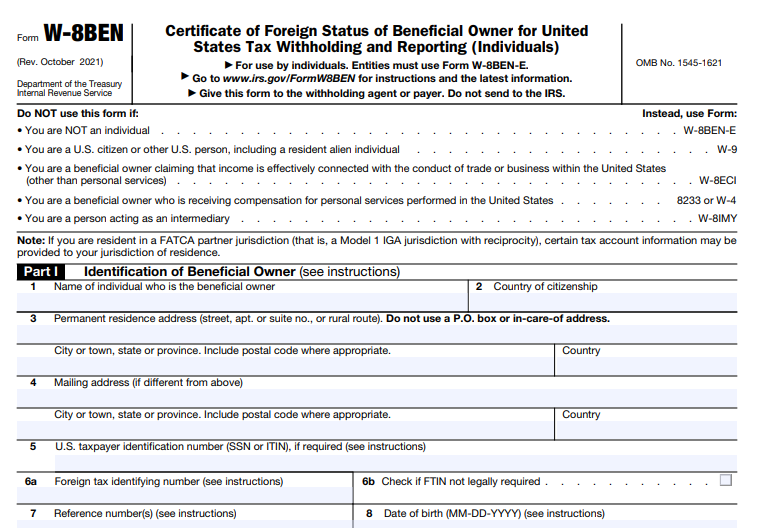

Part I: Identification of Beneficial Owner

This section collects your personal details.

- Line 1: Name – Enter your full legal name as it appears on your tax documents. If you’re the owner of a disregarded entity (like a sole proprietorship), use your name here.

- Line 2: Country of Citizenship – List your country of citizenship. If you’re a dual citizen, enter the country where you’re a tax resident.

- Line 3: Permanent Residence Address – Provide your tax residence address in your home country. Avoid using P.O. boxes or care-of addresses unless that’s your only option.

- Line 4: Mailing Address – Only fill this if different from Line 3.

- Line 5: U.S. Taxpayer Identification Number (TIN) – Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) if you have one. If not, you may need to apply for an ITIN using Form W-7, especially for treaty claims.

- Line 6a: Foreign Tax Identifying Number (FTIN) – Provide your FTIN from your home country if required (e.g., for financial accounts at U.S. institutions).

- Line 6b: FTIN Not Legally Required – Check this if your country doesn’t issue FTINs.

- Line 7: Reference Number – Optional; include account numbers or other identifiers.

- Line 8: Date of Birth – Required for financial accounts; use MM-DD-YYYY format.

For visual reference, here’s an example of Part I filled out:

Part II: Claim of Tax Treaty Benefits

Complete this only if claiming reduced withholding under a U.S. tax treaty.

- Line 9: Country of Residence – Enter the country where you’re a tax resident under the treaty. Check IRS.gov for treaty lists.

- Line 10: Special Rates and Conditions – Specify the treaty article, withholding rate (e.g., 15% for dividends), and type of income. Include additional details like “not attributable to a permanent establishment” for business profits. For scholarships or remittances, provide specifics.

If your country doesn’t have a treaty, skip this part.

Part III: Certification

Sign and date the form, confirming the information is true. Electronic signatures are allowed if they include a timestamp or authorization statement. If signing as an agent, check the box and attach power of attorney.

Here’s a sample of a completed form for guidance:

Common Mistakes to Avoid When Filling Out Form W-8BEN

- Using the wrong form (e.g., W-8BEN-E for entities).

- Providing a U.S. address on Line 3, which could invalidate your foreign status.

- Forgetting to claim treaty benefits or misstating the rate/article.

- Not updating the form after a change in circumstances, like moving countries.

- Omitting required TINs or FTINs, leading to withholding.

Double-check against the official instructions to ensure compliance.

When and Where to Submit Form W-8BEN

Submit the form to the withholding agent or payer (e.g., your bank or investment platform) before receiving income. For multiple payers, provide a separate form to each. It’s valid from the signature date through the end of the third calendar year after, or indefinitely under certain chapter 4 rules, unless circumstances change. Notify the agent within 30 days of any changes and submit a new form if needed.

Frequently Asked Questions About IRS Form W-8BEN

What happens if I don’t submit Form W-8BEN?

You may face 30% withholding on U.S.-sourced income, even if eligible for reductions.

Do I need an ITIN for Form W-8BEN?

Not always, but it’s required for certain treaty claims or partnership income. Apply via Form W-7 if needed.

How long is Form W-8BEN valid?

Generally three years from the signature date, but monitor for changes in status.

Can I claim treaty benefits on scholarships?

Yes, for noncompensatory scholarships if your treaty allows, even if you have a temporary U.S. address.

For more FAQs, consult the IRS instructions or a tax professional.

Conclusion

Mastering IRS Form W-8BEN is essential for foreign individuals to minimize U.S. tax withholding and ensure compliance. By following this 2025 guide, you can confidently complete and submit the form. Remember, tax rules can vary by country and situation—consult a qualified tax advisor for personalized advice. Stay updated via IRS.gov, as regulations may evolve.