Table of Contents

IRS Form W-8ECI – Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States – In today’s global economy, foreign individuals and businesses often engage in U.S.-based activities, leading to potential tax implications. One crucial document for managing these is IRS Form W-8ECI, officially known as the Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States. This form helps foreign persons avoid unnecessary withholding taxes on certain U.S. source income. Whether you’re a non-resident alien, foreign corporation, or partnership with U.S. trade ties, understanding W-8ECI is essential for compliance and optimizing your tax position.

This comprehensive guide covers everything you need to know about IRS Form W-8ECI, including its purpose, who needs it, step-by-step instructions for completion, validity rules, and key considerations for 2025. We’ll draw from official IRS resources to ensure accuracy and relevance.

What Is IRS Form W-8ECI and Its Purpose?

IRS Form W-8ECI is a certification form used by foreign persons to declare that specific U.S. source income is “effectively connected” with a trade or business conducted in the United States. This connection exempts the income from the standard 30% withholding tax under Internal Revenue Code sections 1441 or 1442, which typically applies to non-resident aliens and foreign entities on fixed, determinable, annual, or periodical (FDAP) income.

Effectively connected income (ECI) includes earnings from U.S. business operations, such as sales, services, or investments tied to a U.S. trade or business. By submitting this form, you’re asserting that the income should be reported on a U.S. tax return (like Form 1040-NR for individuals or Form 1120-F for corporations) rather than withheld at source. Note that this form does not apply to personal services income performed by foreign individuals—use Form 8233 or W-4 instead.

The form also plays a role in specific scenarios, such as withholding on partnership distributions under section 1446(a), transfers of publicly traded partnership (PTP) interests under section 1446(f), and sales of life insurance contracts under section 6050Y(b), where the income is deemed effectively connected.

As of 2025, there are no major updates to the form beyond its October 2021 revision, which incorporated changes like PTP withholding rules effective from 2023. Always check the IRS website for the latest version to ensure compliance.

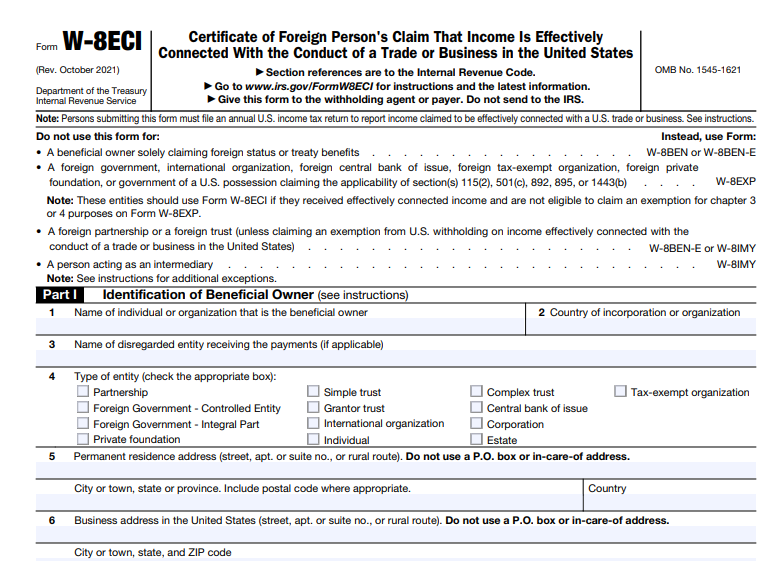

IRS Form W-8ECI Download and Printable

Download and Print: IRS Form W-8ECI

Who Needs to File Form W-8ECI?

Not every foreign person dealing with U.S. income requires Form W-8ECI. It’s specifically for those who meet these criteria:

- Beneficial Owners of ECI: If you’re a foreign individual, corporation, partnership, trust, or estate and the beneficial owner of U.S. source income that’s effectively connected with a U.S. trade or business.

- Foreign Partnerships and Trusts: These entities may submit the form on behalf of partners or beneficiaries if the income is ECI.

- Foreign Securities Dealers: To claim an exception from withholding on PTP interest transfers, certifying that any gain is ECI without regard to section 864(c)(8).

- Sellers of Life Insurance Contracts: Foreign sellers where the sale generates ECI.

Do not use W-8ECI if:

- The income is not effectively connected (use Form W-8BEN or W-8BEN-E instead).

- You’re an intermediary, flow-through entity, or withholding foreign partnership (use Form W-8IMY).

- Claiming treaty benefits for exempt organizations or governments (use Form W-8EXP).

- Disposing of U.S. real property (use Form 8288-B).

If your income includes both ECI and non-ECI components, submit separate forms for each.

How to Complete IRS Form W-8ECI: Step-by-Step Instructions

Form W-8ECI is a one-page document divided into two parts: Identification of Beneficial Owner (Part I) and Certification (Part II). Here’s a detailed breakdown:

Part I: Identification of Beneficial Owner

- Line 1: Enter your full name as the beneficial owner. For disregarded entities, use the foreign owner’s name.

- Line 2: Provide the country of incorporation (for entities) or tax residence (for individuals).

- Line 3: If applicable, enter the name of a disregarded entity receiving payments (optional for reference).

- Line 4: Check the box for your entity type (e.g., Individual, Corporation, Partnership, Foreign Government – Integral Part, etc.). Foreign governments should note classifications under Temp. Reg. §1.892-2T.

- Line 5: Permanent residence address in your tax residence country (no P.O. boxes unless it’s your registered address; include city, state/province, postal code, and country).

- Line 6: U.S. business address (street, city, state, ZIP; no P.O. boxes).

- Line 7: U.S. Taxpayer Identification Number (TIN)—required for validity. Use SSN/ITIN for individuals (apply via Form SS-5 or W-7) or EIN for entities (Form SS-4).

- Line 8a: Foreign Tax Identifying Number (FTIN) if required for financial accounts reporting on Form 1042-S.

- Line 8b: Check if your jurisdiction doesn’t legally require an FTIN.

- Line 9: Optional reference numbers (e.g., account numbers).

- Line 10: Date of birth (MM-DD-YYYY) for individuals if an account holder.

- Line 11: List each item of ECI (attach a statement if needed, including elections under sections 871(d) or 882(d)).

- Line 12: Check if you’re a foreign securities dealer claiming a PTP withholding exception.

Part II: Certification

Sign and date the form under penalties of perjury, confirming accuracy, beneficial ownership, ECI status, includibility in gross income, non-U.S. person status, and authorization. Authorized representatives must indicate capacity and attach Form 2848 if needed. Electronic signatures are allowed with proper authentication.

Submit the completed form to your withholding agent or payer before receiving income—do not send it to the IRS. Generally, one form per withholding agent is required.

Validity Period and Renewal of Form W-8ECI

A signed Form W-8ECI remains valid from the signature date until the end of the third succeeding calendar year (e.g., signed in 2025, valid through 2028). However, it becomes invalid immediately if your circumstances change (e.g., income is no longer ECI). In such cases, notify the withholding agent within 30 days and provide an updated form or alternative (like W-8BEN-E).

Common Mistakes, Penalties, and Tips for Compliance

Avoid these pitfalls:

- Failing to provide a U.S. TIN—renders the form invalid.

- Using the wrong form for non-ECI or personal services income.

- Not updating for changes in status.

Penalties include liability for false statements, plus 30% withholding or backup withholding (up to 24%) if the form isn’t provided. Always file an annual U.S. tax return to report ECI.

For 2025, consult a tax professional if dealing with complex scenarios like PTPs or disregarded entities. Download the latest form and instructions from the IRS website to stay current.

By properly using IRS Form W-8ECI, foreign persons can ensure smooth tax withholding and compliance with U.S. regulations. If you have questions, refer to official IRS guidance or seek expert advice.