Table of Contents

IRS Form W-8EXP – Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting – In today’s global economy, foreign entities often interact with U.S. financial systems, making it essential to understand tax withholding requirements. IRS Form W-8EXP plays a crucial role for specific foreign organizations seeking exemptions from U.S. tax withholding. This comprehensive guide covers everything you need to know about Form W-8EXP, including its purpose, who should use it, how to complete it, and recent updates as of 2025.

What Is IRS Form W-8EXP?

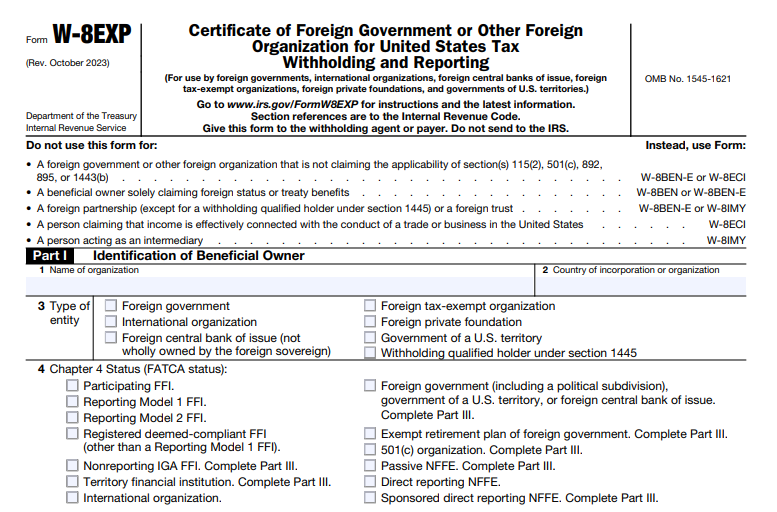

IRS Form W-8EXP, officially titled “Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting,” is a document used by certain foreign entities to certify their status and claim exemptions or reduced rates from U.S. tax withholding. It applies to income subject to withholding under Chapters 3 and 4 of the Internal Revenue Code, including fixed or determinable annual or periodical (FDAP) income like interest, dividends, rents, and royalties.

The form helps establish that the entity is not a U.S. person and is the beneficial owner of the income. It supports exemptions under sections such as 892 (for foreign governments and international organizations), 895 (for foreign central banks), 501(c) (for tax-exempt organizations), 115(2) (for U.S. territory governments), and 1445 (for withholding qualified holders, including qualified foreign pension funds or QFPFs). By submitting this form to a withholding agent—such as a payer, financial institution, or partnership—the entity can avoid or reduce the standard 30% withholding tax on U.S.-source income.

Key withholding scenarios include:

- U.S. source FDAP income under sections 1441-1443.

- Withholding on dispositions of U.S. real property interests (USRPI) under section 1445.

- Effectively connected taxable income (ECTI) allocable to foreign partners under section 1446(a).

- Withholdable payments under FATCA (Chapter 4, sections 1471-1474).

Do not confuse Form W-8EXP with other W-8 series forms like W-8BEN-E (for entities claiming treaty benefits) or W-8IMY (for intermediaries).

Who Needs to File IRS Form W-8EXP?

Form W-8EXP is specifically for the following eligible foreign entities receiving U.S.-source income subject to withholding:

- Foreign governments (integral parts or controlled entities).

- International organizations (as defined under section 7701(a)(18)).

- Foreign central banks of issue (wholly or non-wholly owned).

- Foreign tax-exempt organizations (e.g., under section 501(c)).

- Foreign private foundations.

- Governments of U.S. territories.

- Withholding qualified holders under section 1445, including qualified foreign pension funds (QFPFs) and their qualified controlled entities, or foreign partnerships where all interests are held by qualified holders.

These entities must provide the form to the withholding agent before receiving payments to claim exemptions. For example, a foreign tax-exempt organization might use it to avoid withholding on investment income, while a QFPF could claim exemption from FIRPTA withholding on U.S. real estate dispositions.

Do not use this form if:

- You’re an individual (use Form W-8BEN).

- The entity is acting as an intermediary (use Form W-8IMY).

- Income is effectively connected with a U.S. trade or business (use Form W-8ECI).

- You’re a foreign partnership not qualifying as a withholding qualified holder.

Failure to provide a valid Form W-8EXP may result in full 30% withholding.

IRS Form W-8EXP Download and Printable

Download and Print: IRS Form W-8EXP

How to Fill Out IRS Form W-8EXP: Step-by-Step Guide

Filling out Form W-8EXP requires accurate information and supporting documentation. The form has four parts, and completion depends on the entity’s status and the type of income. Always refer to the latest instructions for details.

Part I: Identification of Beneficial Owner

- Line 1: Enter the organization’s full legal name.

- Line 2: Country of incorporation or organization.

- Line 3: Check the appropriate entity type (only one box, unless dual status applies).

- Line 4: Select Chapter 4 (FATCA) status if receiving withholdable payments (e.g., exempt beneficial owner).

- Lines 5-6: Permanent and mailing addresses (no P.O. boxes unless it’s the only address).

- Line 7: U.S. TIN (e.g., EIN) if required (mandatory for 501(c) or private foundation claims).

- Lines 8a-8b: GIIN (for certain FFIs) and foreign TIN (FTIN) if applicable.

- Line 9: Optional reference numbers (e.g., account info).

Part II: Qualification Statement for Chapter 3 Status

Complete if claiming exemptions under Chapter 3 (sections 1441-1443, 1445, or 1446).

- Line 10: For foreign governments under section 892.

- Line 11: For international organizations.

- Line 12: For non-wholly owned foreign central banks under section 895.

- Line 13: For tax-exempt organizations; attach required statements, determination letters, or opinions.

- Line 14: For U.S. territory governments.

- Line 15: For withholding qualified holders (e.g., QFPFs).

Part III: Qualification Statement for Chapter 4 Status

Required for FATCA-related withholdable payments.

- Lines 16-22: Check applicable boxes (e.g., nonreporting IGA FFI, exempt retirement plan) and provide details like GIIN or sponsor names.

Part IV: Certification

Sign and date by an authorized official, certifying the information’s accuracy and agreeing to notify of changes. Electronic signatures are allowed if properly authenticated.

Submit the form to the withholding agent, not the IRS. Retain copies for records.

Validity Period and Renewal of Form W-8EXP

Form W-8EXP is generally valid indefinitely until circumstances change (e.g., entity status). However:

- For controlled entities of foreign governments, it’s valid for three years (e.g., signed in 2023 expires December 31, 2026).

- Under section 1445, validity is two years.

- Notify the withholding agent within 30 days of any changes and submit a new form.

Recent Updates to IRS Form W-8EXP in 2025

The latest revision (October 2023) includes updates for qualified foreign pension funds (QFPFs) under final regulations published in December 2022, allowing self-certification for exemptions from section 1445 withholding on USRPI dispositions. This addresses prior inconsistencies where QFPFs used varied methods.

Other changes:

- Revised purpose section for clarity on withholding regimes.

- Updates to Line 13c for non-private foundation status per Revenue Procedure 2017-53.

- No major 2025-specific updates beyond drafts, but entities should check IRS.gov for the October 2025 revision if finalized.

QFPFs must still use Form W-8BEN-E for treaty benefits on dividends or interest, potentially requiring dual forms.

Tips for Compliance and Avoiding Common Mistakes

- Consult a tax professional for complex statuses like QFPFs or dual Chapter 3/4 claims.

- Attach all required documentation (e.g., IRS determination letters, affidavits).

- Use the latest form version from IRS.gov to ensure compliance.

- For FATCA, verify GIIN and Chapter 4 status accurately.

Understanding IRS Form W-8EXP can help foreign organizations minimize U.S. tax liabilities and streamline reporting. Always download the form and instructions directly from the IRS website for the most current version. If you’re unsure about your eligibility, seek advice from a qualified tax advisor.