Table of Contents

IRS Releases W2 Form 2024 (UPDATED) – The Internal Revenue Service (IRS) has recently updated and released the W2 Form for the year 2024. This essential document, pivotal for both employers and employees during tax season, has undergone several changes. Understanding these updates is crucial for accurate and compliant tax filing. In this comprehensive guide, we delve into the specifics of the W2 Form 2024, ensuring you stay informed and prepared.

New Article: W-2 Form 2025.

What Is the W2 Form 2024?

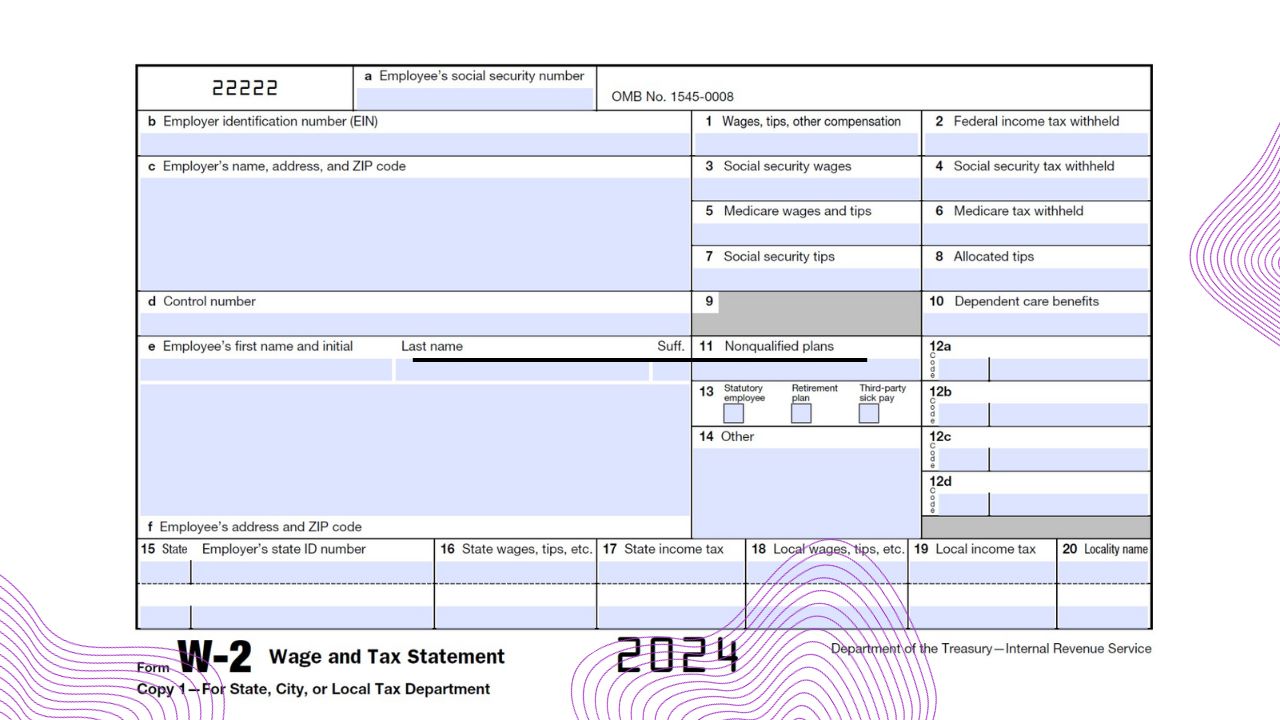

The W2 Form, also known as the Wage and Tax Statement, is a critical IRS document. It details an employee’s annual earnings and the taxes withheld from their paycheck. Employers are required to furnish this form to their employees and the IRS annually. The W2 Form 2024 includes information on federal and state income taxes, Social Security taxes, and Medicare taxes withheld. It’s essential for both employers and employees to understand the components of this form, as it affects income tax returns and compliance with federal and state tax laws.

The W2 Form 2024 is an integral document for both employees and employers in the United States, serving as a record of an individual’s earnings and tax withholdings for the year. Here are more insights into its importance and components:

- Detailed Earnings Information: Beyond just the gross wages, the W2 Form includes specific details such as tips, bonuses, and other forms of compensation. This comprehensive breakdown helps employees understand the full scope of their taxable income.

- Tax Withholding Details: The form shows the total amount withheld for federal and state income taxes. This is crucial for employees to understand how much tax they have already paid throughout the year and helps in determining if they will receive a refund or owe additional taxes when filing their tax return.

- Social Security and Medicare Contributions: Boxes 4 and 6 on the W2 Form indicate the amounts withheld for Social Security and Medicare taxes, respectively. These contributions are part of the Federal Insurance Contributions Act (FICA) taxes and are essential for funding the Social Security and Medicare programs.

- Retirement Plan and Other Benefits: The W2 Form also indicates whether the employee is covered by a retirement plan at work. This information can impact the employee’s eligibility for certain tax deductions or credits related to retirement savings.

- State and Local Tax Information: For employees in states with state income tax, the W2 Form provides details on the state and local taxes withheld. This is essential for filing state tax returns and understanding state-specific tax obligations.

- Verification for Tax Credits and Deductions: Information on the W2 Form is used to verify eligibility for various tax credits and deductions, such as the Earned Income Tax Credit (EITC) or education-related deductions. Accurate W2 information is crucial for maximizing these benefits.

- Essential for Tax Filing: The W2 Form is a primary document used in preparing individual tax returns. It provides the necessary information to complete forms like the IRS Form 1040 and determines whether additional taxes are owed or if a refund is due.

- Legal Requirement for Employers: Employers are legally required to provide W2 Forms to their employees and the IRS by January 31st each year. This ensures that employees have sufficient time to file their taxes and helps the IRS in tax collection and enforcement activities.

The W2 Form 2024 is more than just a statement of earnings; it is a comprehensive record that plays a pivotal role in the tax filing process. It reflects an employee’s financial relationship with their employer and the government, encompassing earnings, tax withholdings, and contributions to social welfare programs. Understanding the nuances of this form is essential for accurate tax filing and financial planning.

What Are the New Changes in the W2 Form 2024?

The IRS continually updates tax forms to reflect current tax laws and regulations. For 2024, there are several updates to the W2 Form that employers and employees should note. These changes are designed to simplify the process and ensure accuracy in tax reporting. It’s important to stay abreast of these changes, as they can affect how you report income and deductions. The IRS website and tax professionals can provide detailed insights into these updates.

What Are the Key Deadlines for the W2 Form 2024?

One of the most critical aspects of dealing with the W2 Form is adhering to the IRS deadlines. For the 2024 tax year, the deadline for employers to send out W2 Forms to their employees and file them with the IRS is January 31, 2025. Late submissions can result in penalties, making it essential to mark this date in your calendar. Employers should start preparing these forms well in advance to avoid last-minute rushes and potential errors.

Why Is Electronic Filing Recommended for W2 Form 2024?

The IRS recommends the electronic filing of W2 Forms for their efficiency and accuracy. Electronic submissions are processed faster, reducing the likelihood of errors and delays. For the W2 Form 2024, employers submitting a significant number of forms are encouraged to file electronically. This method is not only more efficient but also environmentally friendly, reducing the need for paper forms.

How Should Employers Prepare for the W2 Form 2024?

Preparing the W2 Form can be a complex task. Employers should ensure that all employee information is accurate and up-to-date. It’s also crucial to understand the specific guidelines for filling out the form, such as using the correct font and ink color, and avoiding alterations like erasures or whiteouts. Employers should also verify that they are using the latest version of the form, as outdated forms can lead to compliance issues.

Preparing for the W2 Form 2024 requires meticulous attention to detail and a thorough understanding of tax regulations. Here are additional steps and considerations for employers:

- Maintain Accurate Payroll Records: Throughout the year, it’s vital for employers to maintain accurate and detailed payroll records. This includes tracking hours worked, calculating wages, and recording any other compensations like bonuses or commissions. Accurate payroll records are the foundation for correct W2 forms.

- Stay Informed About Tax Law Changes: Tax laws and regulations can change yearly, impacting how W2 forms are filled out. Employers should stay informed about any new tax law changes or adjustments to withholding rates that could affect the W2 forms for 2024.

- Use Reliable Payroll Software: Many employers benefit from using payroll software systems that can automate much of the W2 preparation process. These systems can help ensure accuracy, manage employee data, calculate withholdings, and even generate the W2 forms, reducing the likelihood of errors.

- Train Your Payroll Staff: Ensure that your payroll staff is well-trained and knowledgeable about the W2 form and its requirements. They should be familiar with the specific fields of the form, understand the importance of deadlines, and know how to handle any special situations like reporting employee benefits or deferred compensation.

- Communicate with Employees: Proactively communicate with employees about the W2 form. Encourage them to review their personal information in your payroll system and report any changes, such as a new address, before the end of the year. This can prevent issues when it’s time to distribute the forms.

- Plan for Distribution: Decide in advance how you will distribute the W2 forms to your employees. Whether you’re mailing them, handing them out in person, or providing them electronically, have a plan in place to ensure timely and secure delivery.

- Prepare for Special Situations: Be ready to handle special situations, such as employees who have left the company during the year, or those with unique compensation structures. Understanding how to report different types of earnings and benefits is crucial.

- Review and Double-Check Before Submission: Before submitting the W2 forms to the IRS and distributing them to employees, conduct a thorough review. Check for common errors like incorrect Social Security numbers, typos in names or addresses, and inaccurate wage or tax information.

- Understand the Filing Options: Know the options and requirements for filing W2 forms with the Social Security Administration (SSA). Depending on the number of W2 forms, electronic filing might be mandatory. Even for smaller employers, e-filing is often the more efficient and secure option.

- Set Up a System for Corrections: Have a system in place for correcting W2 forms if errors are discovered after distribution. Understanding how to file W2c (Corrected Wage and Tax Statement) forms promptly is important to maintain compliance and avoid penalties.

By following these steps, employers can effectively prepare for the W2 Form 2024, ensuring compliance with IRS regulations and providing accurate tax information to their employees. Preparation, attention to detail, and proactive communication are key to a smooth W2 filing process.

What Common Mistakes Should Be Avoided in W2 Form 2024?

Errors in W2 Forms can lead to complications with the IRS and impact employees’ tax filings. Common mistakes include incorrect Social Security numbers, misreported earnings, and incorrect tax amounts. Double-checking these details can save time and prevent issues down the line. Employers should also be aware of the common pitfalls in calculating tax withholdings and ensure that these figures are accurate.

How Can Employees Understand Their W2 Form 2024?

Employees should review their W2 Form 2024 carefully upon receipt. Ensure that your personal information is correct and that the earnings and tax withholdings align with your records. Any discrepancies should be reported to your employer immediately. It’s also a good practice for employees to understand the various boxes and codes on the W2 Form, as this knowledge can help understand your tax obligations and potential refunds.

Understanding the W2 Form 2024 is crucial for employees to ensure their tax information is accurate and to comprehend their tax obligations. Here are additional steps and tips for employees to effectively review and understand their W2 forms:

- Familiarize Yourself with the Form’s Structure: The W2 Form is divided into multiple sections, each labeled with specific codes and boxes. Familiarizing yourself with these sections can help you understand the breakdown of your earnings, taxes withheld, and other deductions. The IRS provides a detailed explanation of each box on their website, which can be a valuable resource.

- Verify Your Personal Information: Double-check your name, address, Social Security Number, and employer’s information. Any errors in these fields can lead to processing delays or issues with your tax return.

- Understand Your Income Breakdown: Boxes 1 through 6 detail your wages and taxes withheld. Box 1 shows your total taxable wages, tips, and other compensation. Boxes 2 through 6 break down the federal income tax, Social Security tax, and Medicare tax withheld from your earnings. Understanding these figures is essential for knowing how much tax you’ve already paid throughout the year.

- Review Additional Contributions and Benefits: Other boxes on the W2 Form include information on retirement plan contributions, dependent care benefits, and other employer-provided benefits. Review these sections to understand how these contributions affect your taxable income.

- Compare with Previous Year’s Form: If possible, compare your W2 Form 2024 with the previous year’s form. This comparison can help you spot significant differences or inconsistencies in your income or withholdings.

- Use Online Tools and Calculators: There are various online tools and calculators available that can help you understand how your W2 information affects your tax return. These tools can provide an estimate of your potential refund or amount owed.

- Seek Clarification If Needed: If you have questions or something is unclear on your W2 Form, don’t hesitate to ask your employer’s payroll or HR department for clarification. It’s better to address any uncertainties before filing your taxes.

- Consult with a Tax Professional: If you find the form too complex or have unique tax situations, consulting with a tax professional can be beneficial. They can provide personalized advice and help you understand how your W2 information impacts your overall tax situation.

By taking these steps, employees can gain a thorough understanding of their W2 Form 2024, ensuring they are well-prepared for tax filing and aware of their tax responsibilities and potential refunds.

Why Is Compliance Important for W2 Form 2024?

Both employers and employees must understand the importance of compliance when it comes to the W2 Form. Accurate and timely filing is not just a legal requirement but also a responsibility to ensure the smooth functioning of the tax system. Non-compliance can lead to audits, penalties, and other legal issues, making it crucial to take this process seriously.

Where Can Additional Resources and Support Be Found for W2 Form 2024?

For those seeking more information or assistance with the W2 Form 2024, numerous resources are available. The IRS website offers detailed guides, and many tax professionals and software programs can provide support in preparing and filing these forms. Additionally, there are online forums and communities where employers and employees can share advice and experiences related to W2 filing.

W2 Form 2024 PDF

In the digital age, the accessibility and convenience of electronic documents are paramount, and this is particularly true for essential tax documents like the W2 Form 2024. The W2 Form 2024 PDF version offers a streamlined, efficient way for employers to distribute and for employees to receive their wage and tax statements. This digital format not only ensures quick and secure delivery but also facilitates easier storage and retrieval of records. Employers can download the W2 Form 2024 PDF from the official IRS website or through their payroll software, ensuring they have the most current version that complies with the latest tax regulations. For employees, receiving a PDF version of the W2 form means they can easily upload it to tax preparation software, reducing errors and simplifying the process of filing their tax returns. The W2 Form 2024 PDF is an indispensable tool in the modern approach to handling tax-related documentation, offering both convenience and compliance in a digital format.

The release of the W2 Form 2024 by the IRS is a significant event for the tax season. Staying informed about the changes and requirements is essential for a smooth and compliant tax filing process. By understanding the nuances of this form, both employers and employees can ensure accuracy and avoid potential issues with the IRS. As tax laws and regulations continue to evolve, staying updated and seeking professional advice when necessary is key to successful tax reporting.