Table of Contents

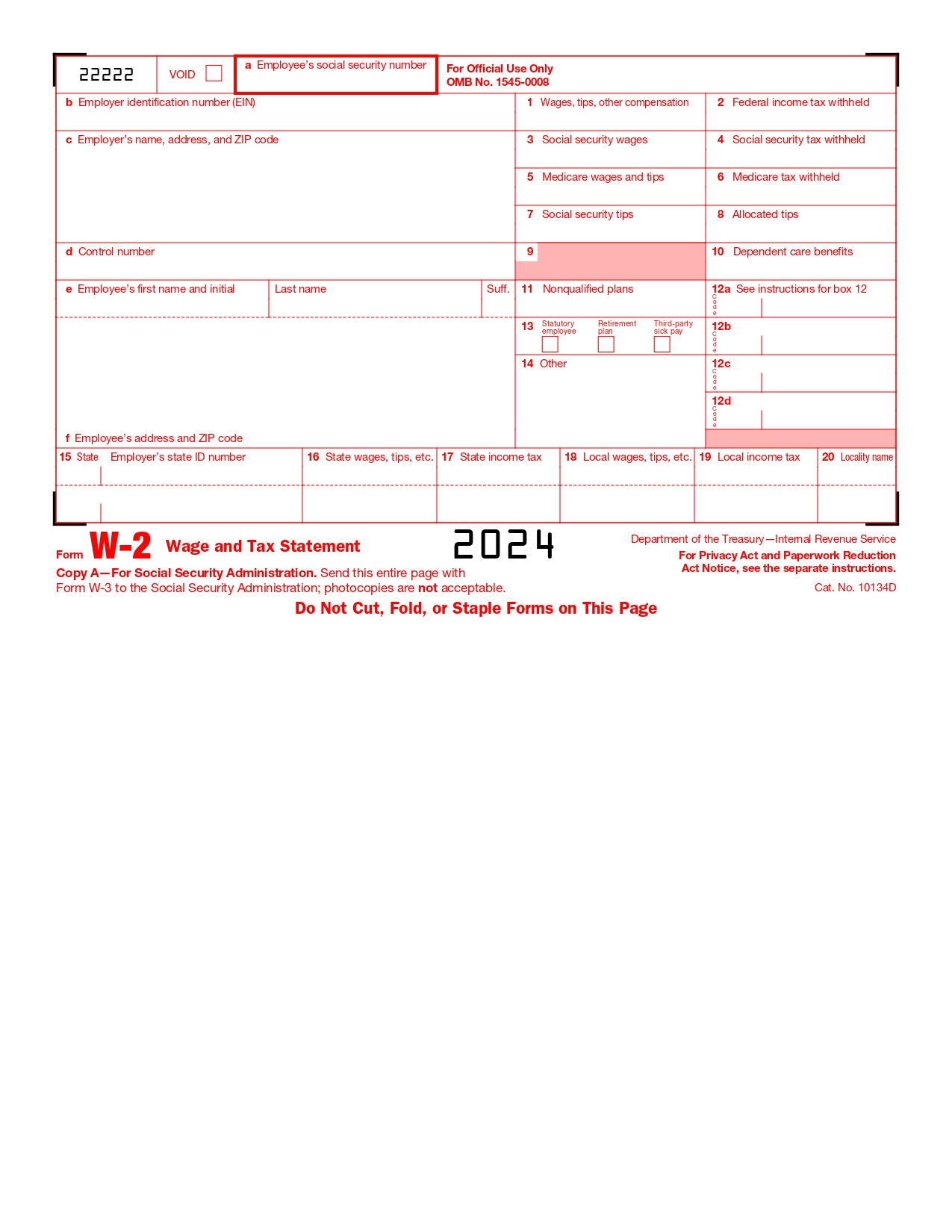

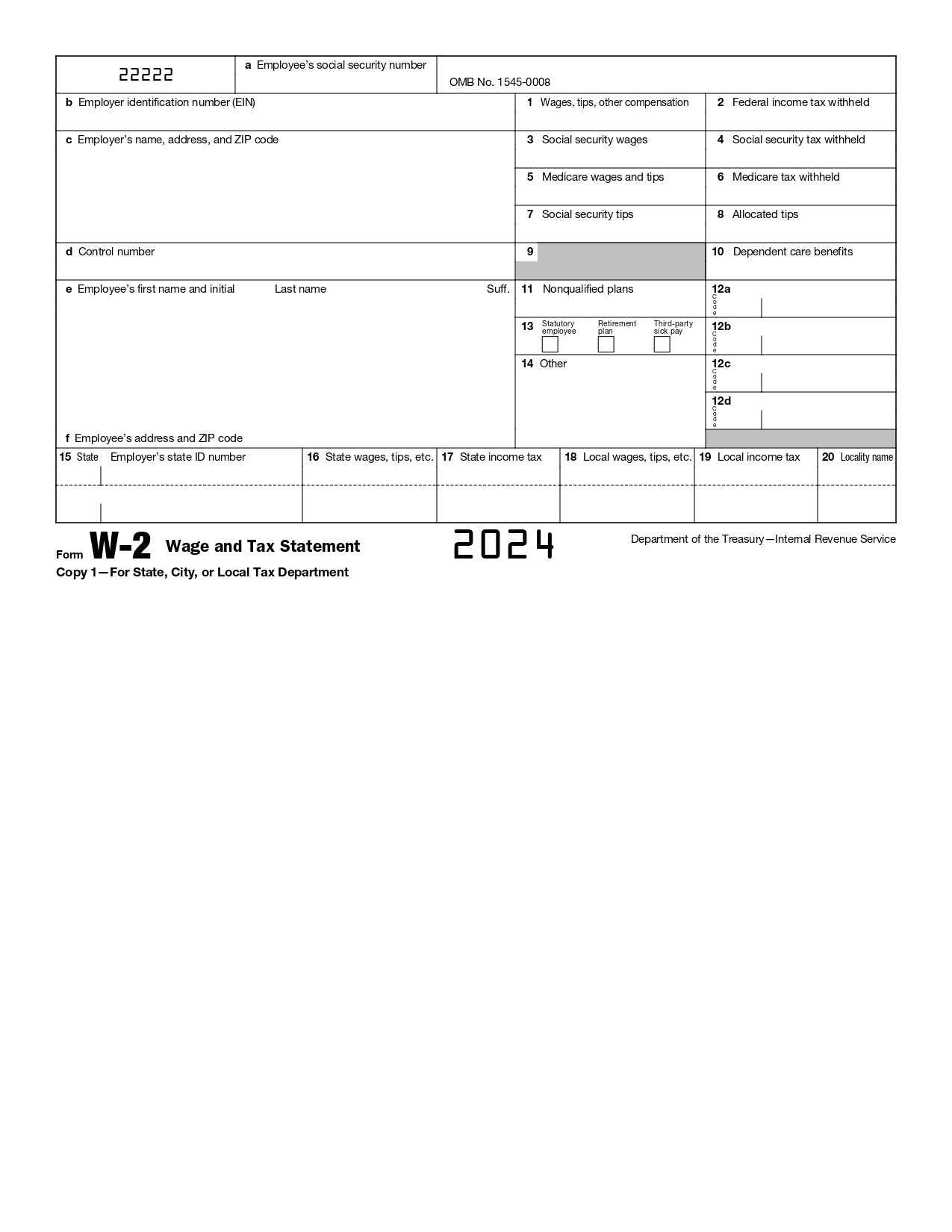

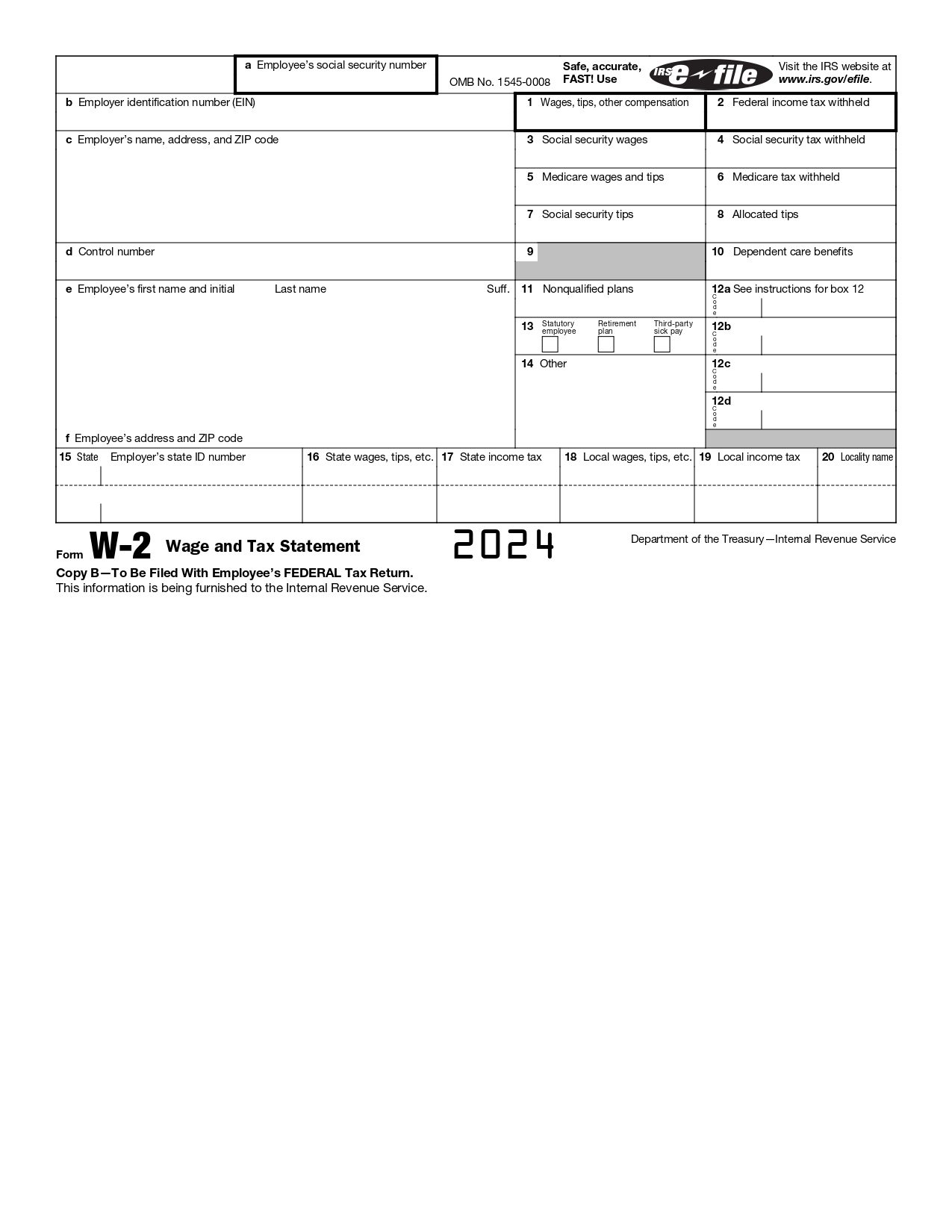

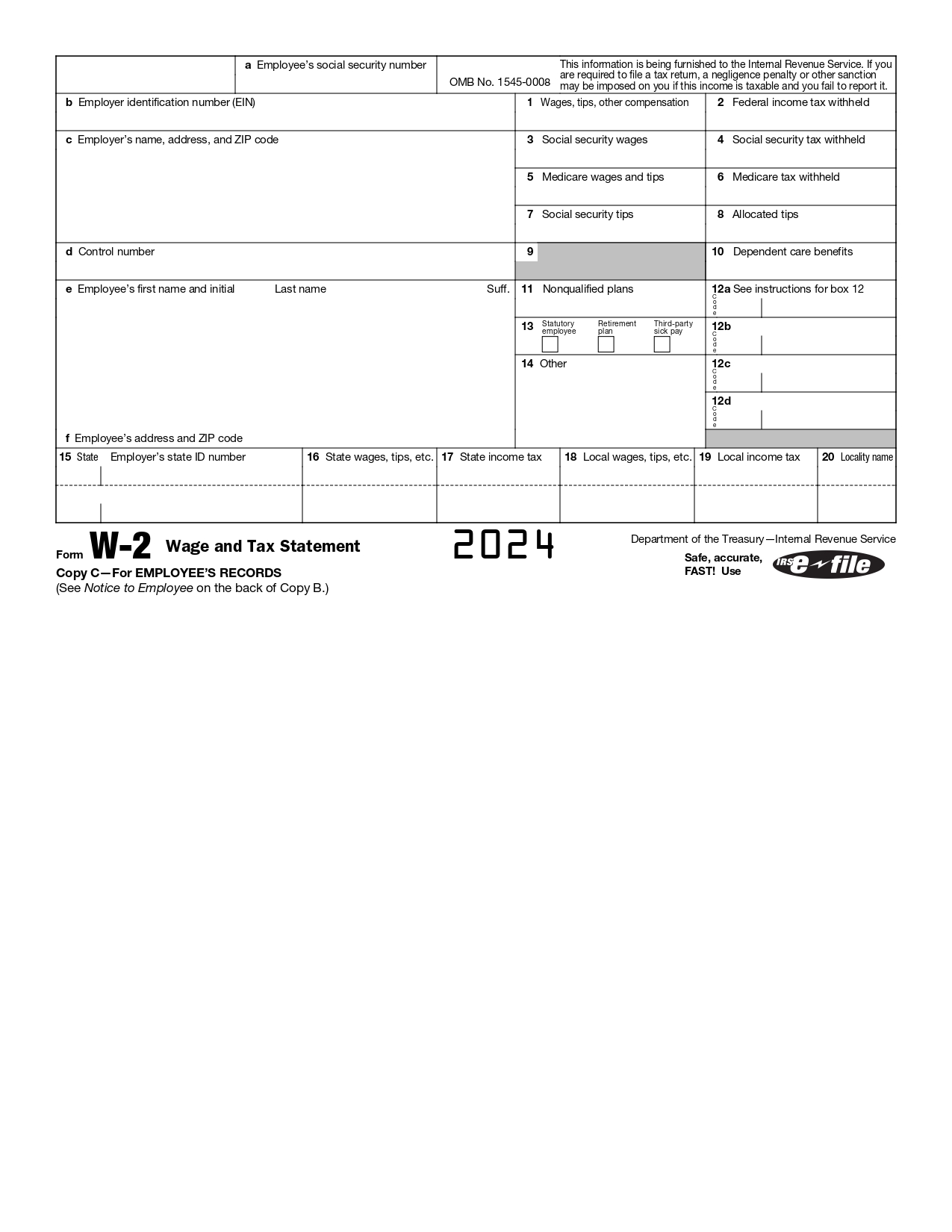

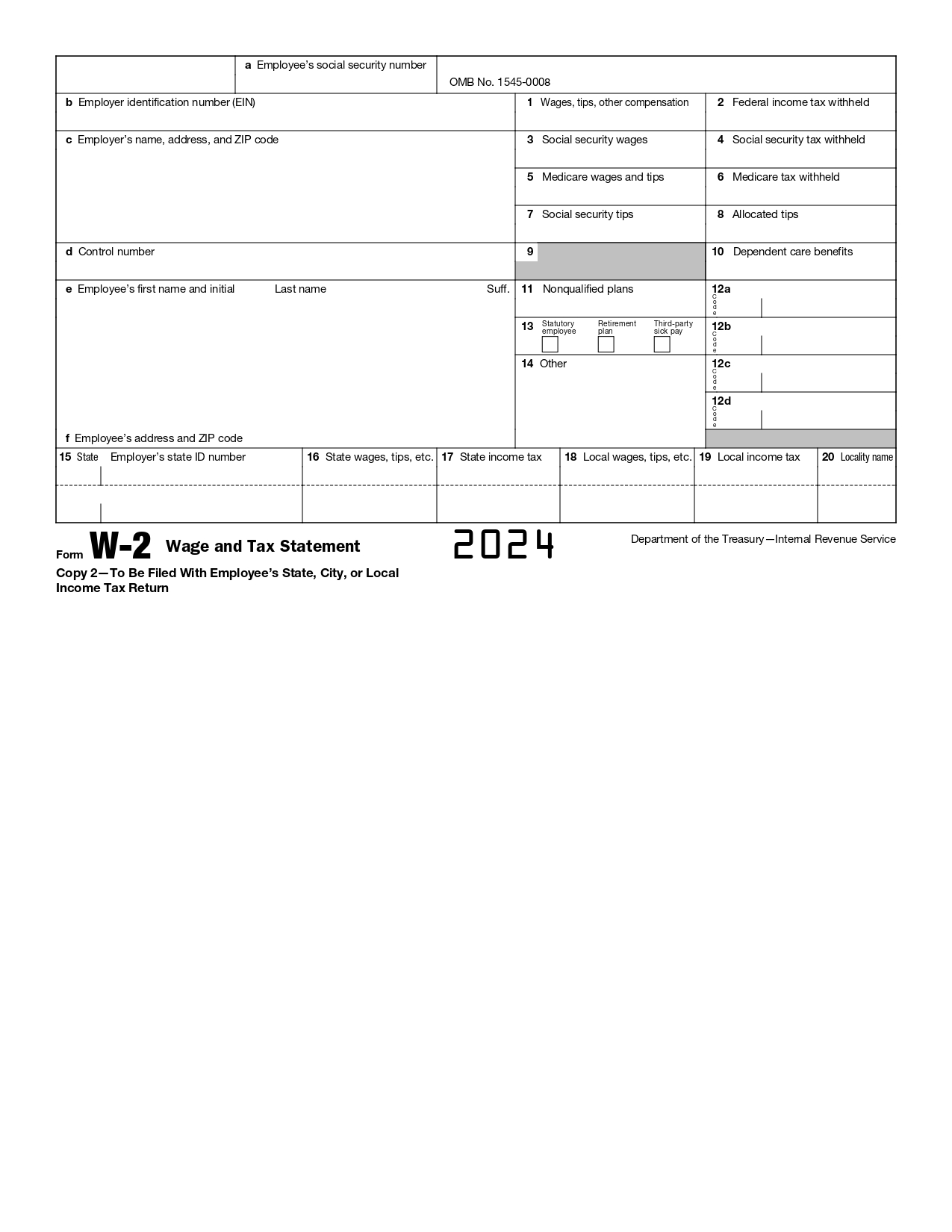

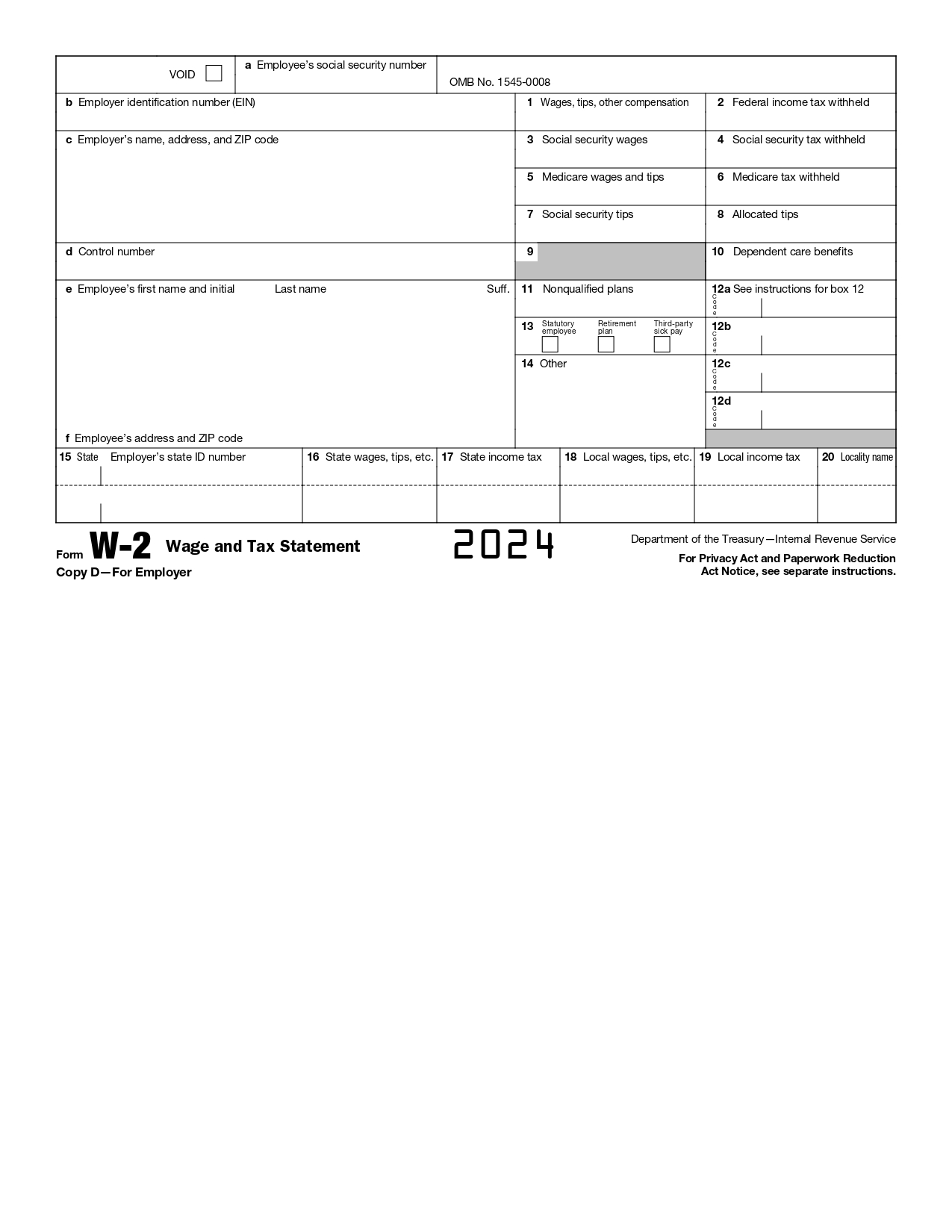

W2 Form 2024 Printable – As we step into the 2024 tax season, understanding and accessing the W2 Form becomes crucial for both employers and employees in the United States. The W2 Form, a critical component of the tax filing process, outlines an employee’s annual wages and the amount of taxes withheld from their paycheck. This guide provides an in-depth look at the printable W2 Form for 2024, ensuring you have all the necessary information at your fingertips.

New Article: W-2 Form 2025.

What is the W2 Form 2024?

The W2 Form 2024, also known as the Wage and Tax Statement, is a document that employers must send to their employees and the Internal Revenue Service (IRS) at the end of each year. It reports an employee’s annual earnings and the taxes withheld from their salary, including federal, state, and other taxes.

Importance of the W2 Form 2024

For the 2024 tax year, the W2 Form is essential for employees as it is required to file their tax returns accurately. It helps in determining if they are due for a refund or owe additional taxes. For employers, it’s a mandatory document that needs to be filed with the IRS to report their payroll expenses and taxes collected from employees.

How to Access the Printable W2 Form 2024?

- Employer’s Payroll System: Most employers provide access to the W2 Form through their online payroll systems. Employees can log in and download the form.

- IRS Website: The IRS offers printable versions of the W2 Form on their website. This is particularly useful for employers who need to fill out the form for their employees.

- Third-Party Websites: Various third-party websites also offer downloadable and printable W2 Forms. However, it’s crucial to use reputable sources to ensure the form is accurate and up-to-date.

Key Components of the W2 Form 2024

The W2 Form for 2024 includes several important sections:

- Employee’s personal and employment information: Including name, address, and Social Security Number.

- Wages, tips, and other compensation: Reflecting the total income earned.

- Federal income tax withheld: Showing the amount of federal tax withheld.

- State income tax and local income tax information: If applicable.

Filling Out the W2 Form

Employers must accurately fill out the W2 Form for each employee. This includes reporting the correct wages earned and taxes withheld. Any inaccuracies can lead to complications for both the employer and the employee.

Deadlines for the W2 Form 2024

The W2 Form must be sent to employees by January 31, 2024, and filed with the IRS. Late submissions can result in penalties.

The printable W2 Form for 2024 is a vital document for tax filing in the United States. Both employers and employees must ensure they access, complete, and file it correctly to comply with IRS regulations. Staying informed and prepared is key to a smooth tax filing experience.

W2 Form 2024 Printable

The “W2 Form 2024 Printable” is a digital version of the standard W2 Form that can be easily accessed, downloaded, and printed. This printable form is designed to streamline the process of tax filing for both employers and employees. With the digital shift in tax documentation, having a printable version of the W2 Form is more convenient and environmentally friendly.

You can get W2 Form 2024 Printable HERE.

Advantages of Using the W2 Form 2024 Printable

- Ease of Access: The printable W2 Form for 2024 can be quickly obtained online, saving time and reducing the need for physical copies.

- Accuracy and Editability: Digital forms reduce the likelihood of errors. If mistakes are made, they can be corrected without the need for a new form.

- Environmental Benefits: Using a printable form reduces paper waste, aligning with eco-friendly practices.

- Convenience for Remote Workers: In an era where remote work is prevalent, having access to a printable W2 form simplifies the process for employees who may not have easy access to office-based resources.

How to Download and Print the W2 Form 2024?

- Visit the IRS Website or Employer’s Payroll Portal: The IRS website is a primary source for downloading the W2 Form. Alternatively, many employers provide the form through their online payroll systems.

- Ensure Printer Readiness: Before printing, make sure your printer has enough ink and is loaded with standard letter-size paper.

- Download the Form: Once you locate the form, download it to your computer.

- Print the Form: Open the downloaded file and select the print option. Ensure the printout is clear and legible.

Tips for Filling Out the W2 Form 2024 Printable

- Double-Check Information: Ensure all personal information, such as Social Security Numbers and addresses, is accurate.

- Verify Financial Details: Cross-check the wage and tax information with your pay stubs to ensure accuracy.

- Consult with a Professional if Needed: If you are unsure about any aspect of the form, seek advice from a tax professional.

The W2 Form 2024 Printable is a vital tool for efficient and accurate tax filing. Its accessibility and ease of use make it an essential resource for employers and employees alike. By understanding how to access, print, and fill out this form correctly, you can ensure a smoother tax filing process.

FAQs

- Can I file my taxes without the W2 Form?

No, you need the information on the W2 Form to file your taxes accurately. - What if I don’t receive my W2 Form by the deadline?

Contact your employer first. If you still don’t receive it, you can contact the IRS for assistance. - Can I print the W2 Form from the IRS website?

Yes, the IRS website provides a printable version of the W2 Form.