Table of Contents

W4 Form 2025 Printable – It’s crucial for you to understand the significance of the W4 Form 2025, also known as the Employee’s Withholding Certificate, as it directly impacts your federal income tax withholding. This updated version offers enhanced guidance and simplifies the process, ensuring you accurately reflect your financial situation. Having a printable form at your disposal allows you to complete it conveniently while maintaining a record for your personal files. Stay informed about the latest changes to maximize your tax strategy and avoid potential pitfalls.

Key Takeaways:

- Purpose: The W4 form is vital for determining the federal income tax withholding from an employee’s paycheck.

- Latest Version: The 2025 form includes updates that improve clarity and usability, making it important to use the most current version.

- Expanded Guidance: Enhanced instructions on Page 2 provide a comprehensive list of scenarios for using the IRS’s Tax Withholding Estimator.

- Condensed Reference: A shorter list of situations has been included for quick reference between Step 1 and Step 2 of the form.

- Placeholder Amounts: Many dollar amounts in worksheets are now placeholder values, pending updates from the IRS for final amounts.

- Printable Access: The ability to download and print the W4 form is convenient for those who prefer physical documentation.

- Filling Out: A detailed guide is available to help employees correctly fill out each section of the form to avoid common mistakes.

Understanding the W4 Form

Before you navigate through the complexities of your taxes, it’s necessary to grasp the fundamental role of the W4 form in your financial planning.

Definition and Purpose

At its core, the W4 form, also known as the Employee’s Withholding Certificate, is a document that informs your employer how much federal income tax to withhold from your paycheck. This form plays a vital role in ensuring that you pay the right amount of tax throughout the year.

Legal Framework and Requirements

At the federal level, the W4 form is required by the IRS as part of the tax withholding process. Employers must collect this form from their employees to comply with tax laws and regulations, ensuring that they withhold the appropriate taxes based on your individual circumstances.

A variety of factors influence the requirements for completing the W4 form, including your filing status, the number of dependents you claim, and any additional income or considerations that may affect your tax liability. It’s important to note that while you are not obliged to submit a new form every year, updating your W4 when your financial situation changes is advisable.

Importance of Accurate Withholding

An accurate W4 form is vital for effective tax management and can impact your financial well-being significantly. If your withholding is too low, you may face a substantial tax bill come tax season. Conversely, excessive withholding means you’re giving the government an interest-free loan with your hard-earned money.

Due to this balance being so important, ensuring that your W4 accurately reflects your situation is critical. Mistakes or outdated information can lead to overpayment or underpayment of taxes, which can result in penalties or a financial burden. Always stay informed about updates, like those in the 2025 W4 form, and adjust your withholding as necessary to protect your financial interests.

Overview of the 2025 W4 Form

Now is the time to understand the W4 Form for 2025, as it serves as a vital instrument for managing your federal income tax withholding. This updated version brings necessary changes that enhance clarity and usability, ensuring you have a smoother experience when filling it out as part of your tax management strategy.

Why the 2025 Version Is Important?

Behind every financial decision, there are factors that significantly impact your tax situation. The 2025 version of the W4 Form includes expanded guidance, critical changes that reflect current financial climates, and adjustments for various life situations. Staying updated with this form ensures you’re appropriately managing your withholdings.

Key Features and Structure of the Form

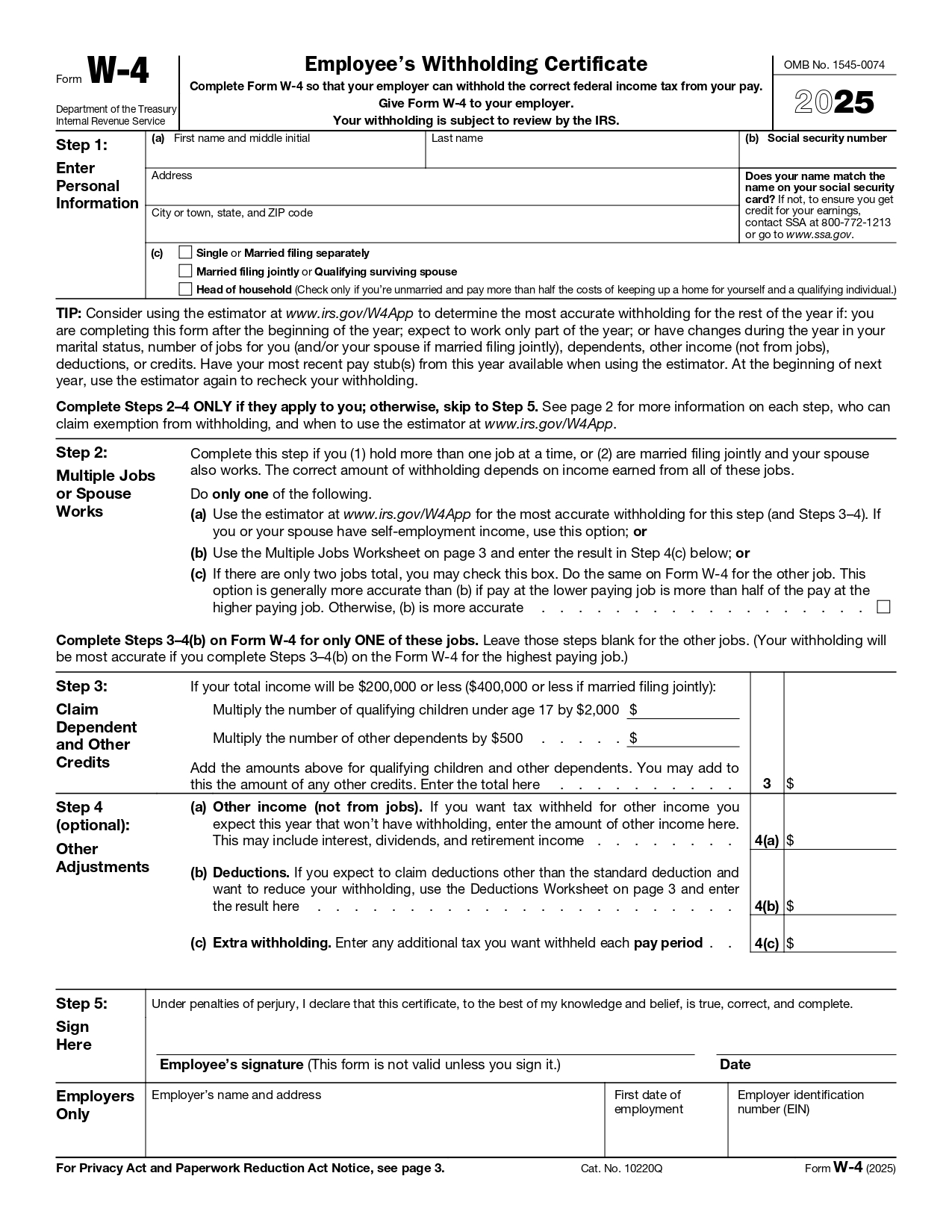

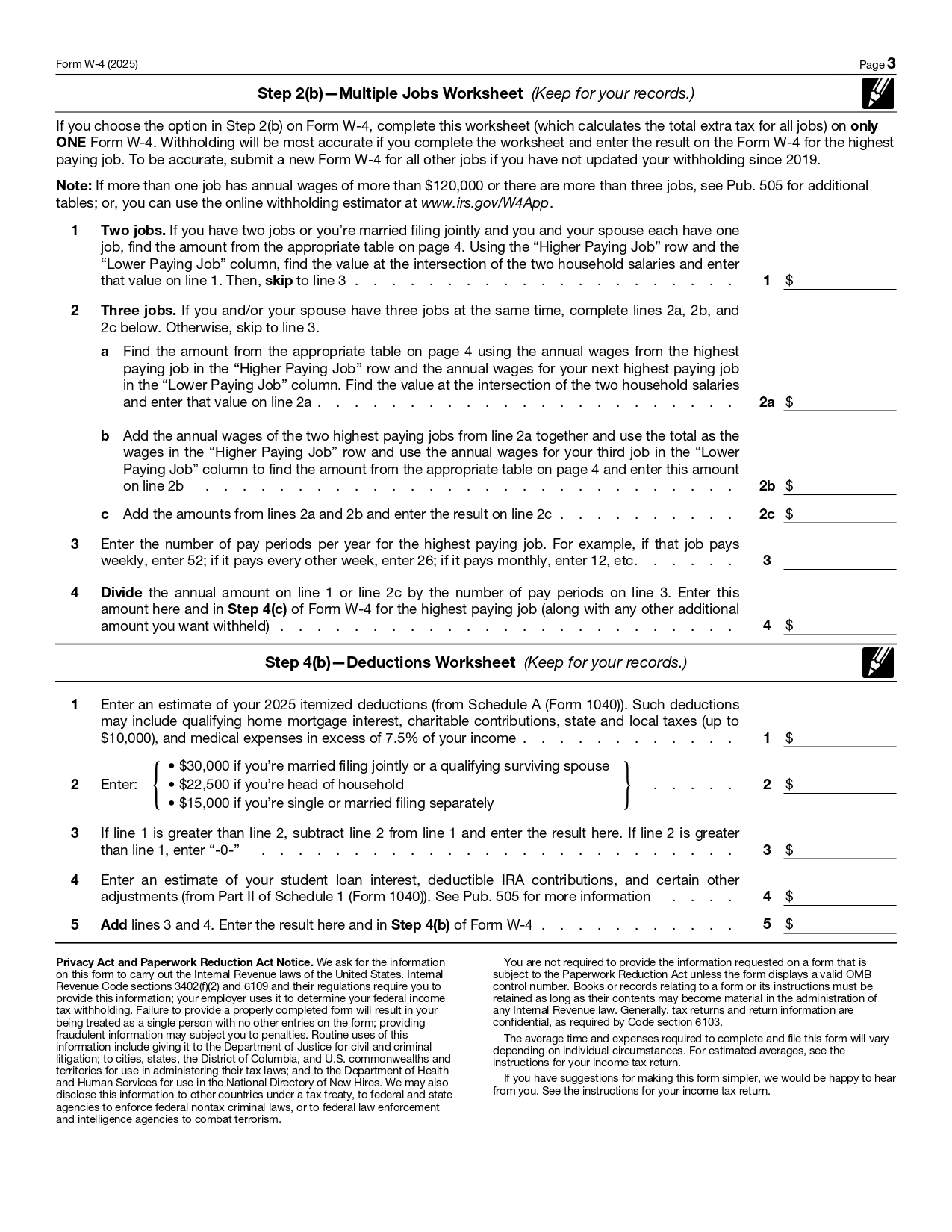

Between its redesigned sections and improved instructions, the 2025 W4 Form is structured to simplify the process. Key features include:

- Expanded Guidance on various scenarios for using the form.

- Shorter List Note for quick-matching reference between steps.

- Placeholder Dollar Amounts to accommodate pending values.

- Life Changes Section that addresses marital status and dependents.

Assume that using this updated form makes filing and adjustments easier for you, promoting better accuracy in withholding calculations.

But there’s more to the 2025 W4 Form than meets the eye. The key structural elements ensure that you can easily identify and complete the necessary sections without confusion. They include:

- Personal Information for accurate identification.

- Multiple Jobs or Spouse Working section to consider combined incomes.

- Claim Dependents for additional withholding adjustments.

- Adjustments for Other Income that may affect your overall tax status.

Assume that familiarizing yourself with these features can lead to more precise financial planning.

Historical Context: Changes Over the Years

Form W4 has undergone significant transformations throughout the years, striving to reflect the ongoing changes in the tax landscape. Each iteration aims to address taxpayer needs and complexities effectively.

Features of previous versions have seen major shifts, such as the elimination of personal exemptions following tax reform and the introduction of simplified filing processes. With these changes, the emphasis has shifted toward ensuring that you can navigate your tax situation effectively while minimizing potential over-withholding. This evolution signifies a positive move towards transparency and ease of use, ultimately allowing you to take control of your financial future.

W4 Form 2025 Printable

You can download the W-4 Form 2025 in a printable format using the link provided below. The official version of the updated 2025 W-4 Form will be made available once the IRS completes and releases it. However, as of the time this article was written, the most recent official form available is still the 2024 W-4 Form.

That said, the IRS has already published a draft version of the 2025 W-4 Form, offering a preview of potential changes and updates. While this draft is not yet finalized and is subject to change, it provides valuable insights for both employees and employers preparing for the upcoming tax year. If you’re interested in reviewing the draft version, you can download it from the official IRS website or through the link provided here.

For those needing to fill out a W-4 form before the official 2025 release, it is important to use the current 2024 version until further notice. Remember to stay updated with IRS announcements to ensure compliance with the latest tax regulations.

Resources

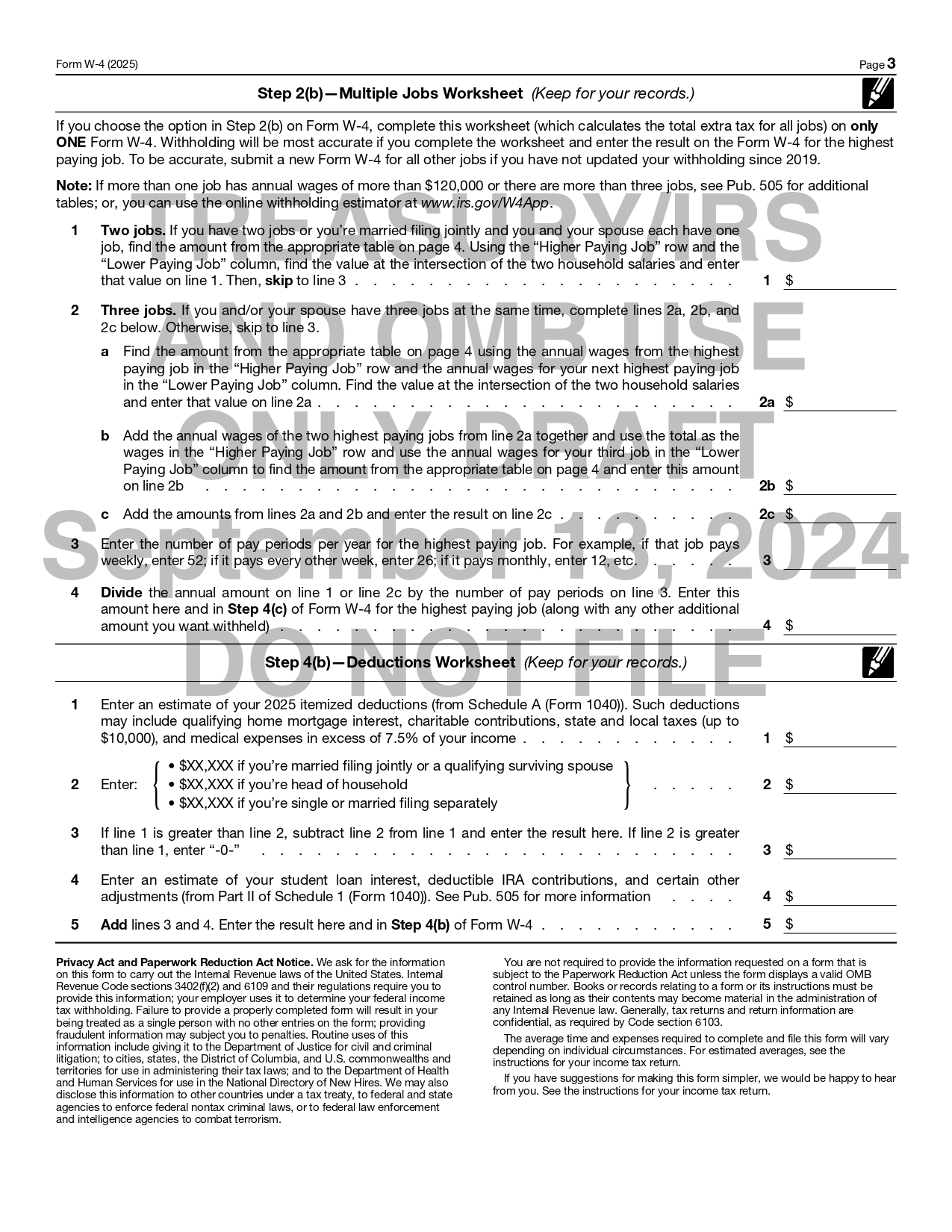

W-4 Form 2025 Images

W4 Form 2025 Draft

Significant Changes in the 2025 W4 Form

For those navigating their taxes, understanding the updates in the 2025 W4 form can significantly enhance your experience. This year’s form introduces several key changes which aim to improve clarity and make the withholding process more user-friendly.

Expanded Guidance for Employees

Employees will benefit from an expanded guidance section in the updated W4 form. The instructions now include a comprehensive list of scenarios where you should consider using the IRS’s Tax Withholding Estimator, such as after the year has begun or when making significant life changes.

The Impact of Life Changes on Withholding

One of the most impactful changes revolves around recognizing how life events can affect your withholding.

At any point, if you experience a change in marital status, add or lose dependents, or receive nonemployment income, these situations may necessitate an adjustment to your W4. The new form encourages you to revisit your withholding to ensure it aligns with your current financial situation, promoting better accuracy in your tax filings.

Placeholder Dollar Amounts and Their Significance

Beside the updates for guidance, the 2025 W4 form introduces placeholder dollar amounts in its worksheets. These placeholders will be updated once the IRS confirms the final values, ensuring that you’re guided by the latest and most relevant figures.

Considering these placeholders, it’s important for you to remain vigilant. As final amounts are determined, check your entries to avoid missing out on crucial adjustments that could impact your withholding and overall tax strategy. Staying proactive will ensure accuracy in your tax planning, reflecting any shifts in your financial landscape.

Completing the 2025 W4 Form

Despite the complexities that often accompany tax forms, completing the 2025 W4 Form can be straightforward if you understand the steps involved. This guide will help you navigate each section with ease, ensuring that you fulfill your tax withholding requirements efficiently.

Step-by-Step Instructions for Filling Out the Form

Beside the main details of your employment, the W4 form requires specific information to ensure accurate withholding. Here’s a brief overview of each section:

| Section | Description |

| Personal Information | Provide your name, address, Social Security number, and filing status. |

| Multiple Jobs or Spouse Working | Indicate if you or your spouse has more than one job. |

| Claim Dependents | List any dependents you want to claim for tax benefits. |

| Adjustments | Specify other income, deductions, and any extra withholding amounts. |

Common Mistakes to Avoid

Form completion errors can lead to problematic withholding issues. You should always double-check your information before submission.

It’s vital to carefully review details such as your filing status and number of dependents. Common mistakes include providing inaccurate personal information, failing to account for multiple jobs, and neglecting to update the form after significant life changes. Simple oversights can result in either over-withholding, which affects your take-home pay, or under-withholding, potentially resulting in tax debts come filing season.

Tips for Estimating Withholding Accurately

Formulating an accurate estimate of your withholding involves several considerations. Here are some key steps to enhance your calculation:

- Utilize the IRS Tax Withholding Estimator for a tailored assessment.

- Annualize any nonemployment income that might affect your liabilities.

- Keep your financial and family situations current, as they can impact your tax situation.

After you have completed the necessary calculations, consider updating your W4 frequently, especially after any life-changing events.

In addition, ensuring you evaluate your needs periodically helps maintain a balance in your withholding. Taking the time to reassess your financial circumstances can prevent tax-related surprises and align your withholdings more closely to your actual tax commitments.

Using the IRS Tax Withholding Estimator

Not every employee is aware of the IRS Tax Withholding Estimator, a valuable tool designed to help you determine the right amount of tax to withhold from your paycheck. This online resource simplifies the process of estimating your tax obligations, ensuring that you don’t overpay or underpay your taxes throughout the year.

What is the Tax Withholding Estimator?

Beside providing clarity on your tax situation, the IRS Tax Withholding Estimator allows you to input various financial details to give tailored withholding recommendations based on your unique circumstances.

Scenarios When to Use the Estimator?

When life changes occur, such as those outlined in the newly updated W-4 form, it’s beneficial to utilize the estimator. This includes adjustments due to marital status changes, the birth of a child, or variations in your income like bonuses or freelance work.

Even if you haven’t experienced major life events, it’s still wise to use the estimator periodically, especially at the start of the year or when you begin a new job. Filling out the W-4 accurately ensures that your withholding aligns with both your current financial status and future tax obligations. It’s an important step in avoiding unwanted surprises during tax season.

Interpreting the Results from the Estimator

Estimator results offer you a clear picture of how much tax should be withheld, guiding you to fill out your W-4 form with confidence. You’ll receive a detailed suggestion based on the information you provided, helping you manage your tax situation more effectively.

And when you review the estimator’s recommendations, it’s important to cross-reference them with your overall financial goals. Understanding these results enables you to make informed decisions and adjust your withholding as necessary, ultimately leading to a more stable financial future. Be proactive when in doubt!

Submitting the W4 Form

For many employees, understanding where to submit the completed W4 form is crucial to ensure accurate tax withholding. You typically submit your W4 form to your employer’s human resources or payroll department. This process can vary slightly by organization, so it’s a good idea to check with your HR representative for specific submission guidelines.

Where to Submit the Completed Form?

By submitting your W4 form directly to your employer, you facilitate the timely adjustment of your federal income tax withholding. Ensure that your HR department has your latest information to reflect any changes in your personal circumstances.

Deadlines for Submission

An effective understanding of submission deadlines for your W4 form is vital to avoiding over- or under-withholding of taxes throughout the year. Generally, you should submit your updated W4 form as soon as any significant life change occurs or when you begin a new job. Timely updates will ensure your withholdings align with your current tax liabilities.

Understanding these deadlines is crucial, especially if you are submitting a new W4 form at the start of the tax year. If you start a new job, you should fill out your W4 on your first day of work. Additionally, significant life changes, such as marriage or the birth of a child, should prompt a re-evaluation of your withholding preferences without delay.

Can You Change Your W4 Form After Submission?

Change is entirely possible regarding your W4 form after submission, and you are encouraged to do so as your financial situation evolves. As life events or financial circumstances change, you can submit a new W4 at any time during the year to adjust your federal income tax withholding.

Form submissions can be made to reflect changes such as a new job, divorce, or changes in dependents. This flexibility allows you to manage your finances more effectively, ensuring that your withholding better matches your tax obligations. If you find your tax situation shifting, take action promptly to adjust your W4, safeguarding yourself against unexpected tax liabilities. Always verify your revised form with your employer to ensure everything is in order.

Special Considerations for Unique Employment Situations

To accurately complete your W4 form, it’s crucial to consider unique employment situations that may affect your federal income tax withholding. Different circumstances require tailored approaches to ensure your withholding reflects your specific financial situation. Below are some important factors to keep in mind.

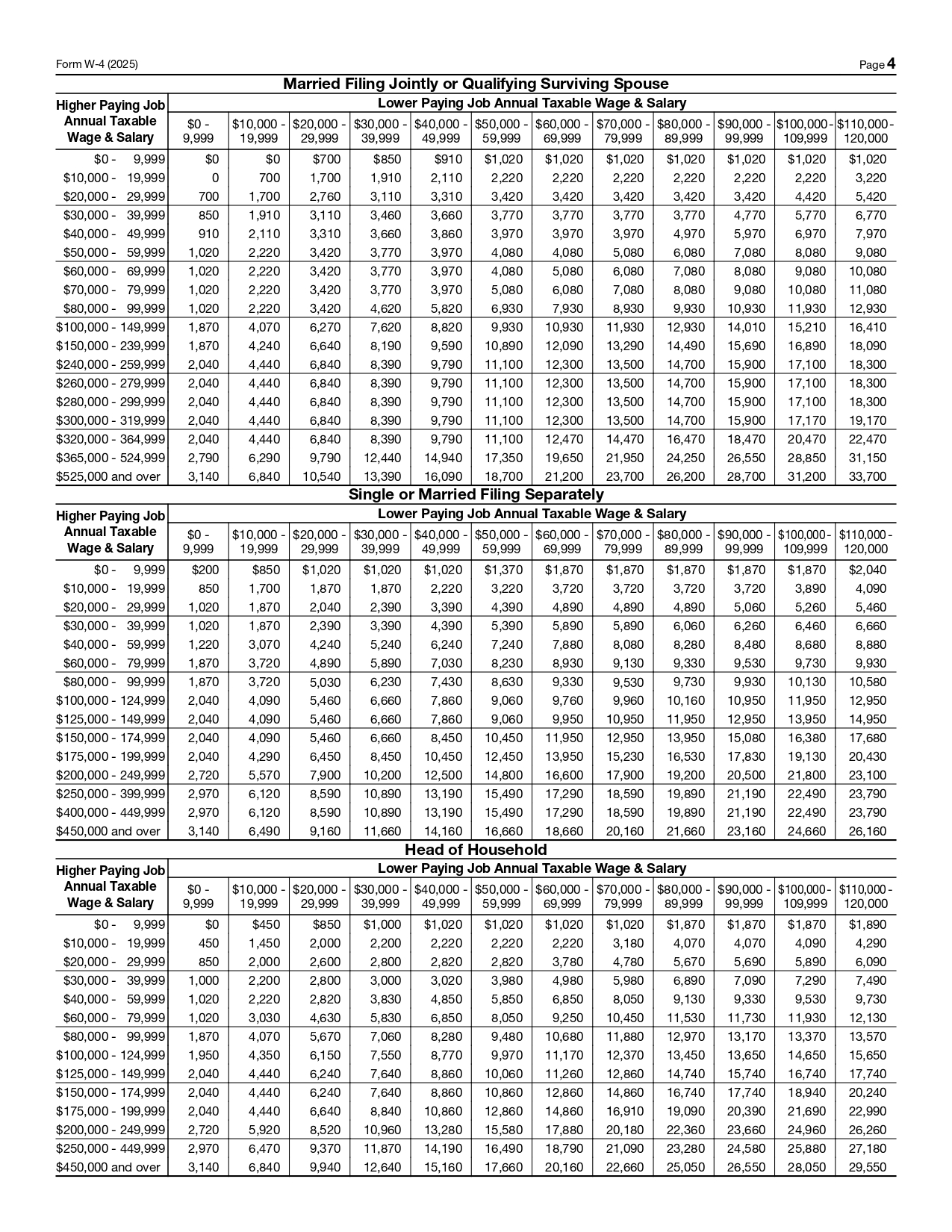

Multiple Jobs or Spouse Working

Spouse your overall income may be impacted if you or your spouse has multiple jobs. It’s vital to account for all sources of income on your W4 form, as this affects the amount withheld from your paychecks. Utilize the IRS Tax Withholding Estimator for precise calculations to avoid under-withholding or over-withholding.

Non-Residence and Expatriate Considerations

On navigating tax withholding as a non-resident or expatriate can be complex. Employees in these situations often have distinct requirements based on their residency status and the nature of their foreign income. You may need to refer to the IRS guidelines to understand how your income will be taxed and what forms to fill out.

Employment for expatriates often involves earning income both within the United States and abroad. It’s crucial that you consult the IRS’s expanded guidance on withholding to ensure you’re making the right elections on your W4. If you’re a non-resident alien, specific tax rules apply, and utilizing resources like the Tax Withholding Estimator can help you navigate these intricacies.

Self-Employment and 1099 Filers

Expatriate if you are self-employed or a 1099 filer, your tax obligations differ significantly from those in traditional employment. Being responsible for your own tax payments means you should keep accurate records of your income and expenses. Completing your W4 may still be relevant if you also have a regular job, but understanding estimated tax payments is key.

In fact, many 1099 filers overlook the importance of setting aside funds for tax liabilities, which can lead to significant penalties. Be proactive in calculating your expected tax liability to avoid any surprises when tax season arrives. By utilizing an organized approach to your finances, you can manage your self-employment obligations efficiently while ensuring compliance with all applicable tax regulations.

The Role of Employers in the W4 Process

Your responsibility as an employer in the W4 process is key to ensuring proper federal income tax withholding for your employees. This involves accurately processing the W4 forms submitted by your employees and adjusting their tax withholding amounts accordingly. In case of any discrepancies or changes, timely action is vital to maintain compliance and avoid penalties.

Employer Responsibilities in Withholding

Between collecting, reviewing, and storing W4 forms, you play a significant role in managing employee withholdings. It’s important to ensure that the information provided is accurate and up-to-date, as errors can lead to incorrect tax withholding and potential financial consequences for both the employee and your business.

Updating Employee Records

Along with processing new and updated W4 forms, it’s imperative to keep employee records current. Accurate documentation allows you to reflect any changes in withholding status and ensures that employees are not over- or under-withheld during the tax year.

Further, you should regularly review your employee records to account for changes such as marital status, number of dependents, or nonemployment income, as these factors can affect withholding calculations. Encouraging employees to re-evaluate their W4 forms, especially after significant life events, helps maintain precise tax withholding throughout the year.

Communicating Changes to Employees

Against a backdrop of changing tax laws and individual circumstances, it’s imperative to keep employees informed about any updates regarding the W4 process. Providing guidance on when and how to complete a new W4 can help them make informed decisions about their tax withholding.

Employee communication should include details about deadlines for submitting updated forms, any changes in withholding rates, and how to access resources like the IRS Tax Withholding Estimator. Keeping the lines of communication open encourages transparency and empowers your employees to take control of their tax situations, which ultimately contributes to a compliant and efficient workplace. Be sure to highlight the importance of regularly updating their withholding information to adapt to their personal circumstances, thus avoiding potential issues down the line.

Record Keeping and Documentation

Many aspects of managing your taxes hinge on effective record keeping and documentation. One key element in this process is ensuring that you have copies of all relevant forms, including your W4 form, on hand for reference and verification.

Importance of Keeping a Copy of the W4 Form

Below is the critical reason for retaining a copy of your W4 form: it serves as a record for your federal income tax withholding choices. This documentation supports you in verifying your withholding status, especially if you encounter discrepancies or unexpected tax obligations during filing season.

Other Related Documentation to Retain

Around your W4 form, it is wise to keep other significant tax-related documents. This includes pay stubs, previous tax returns, and any records of life changes, such as marriage or childbirth, that affect your withholding and tax situation.

The importance of these documents cannot be overstated. They not only provide evidence of your income and withholding history but also aid in accurately calculating your tax liability. Having these records organized helps you respond effectively to any inquiries from the IRS and ensures smooth processing when you file your taxes.

How Long to Keep Tax Records?

Copying the IRS guidelines, you should keep your tax records, including your W4 form, for at least three years after filing your returns. This retention period helps protect you against potential audits and offers proof of your past actions should any issues arise.

It is advisable to retain documents related to your taxes longer if they involve more complex situations, such as a claim for loss from bad debt or worthless securities, as these may require a longer documentation period. Ensuring that you hold onto these records not only strengthens your position in case of an audit but aids you in managing your future tax situations effectively.

FAQs About the W4 Form 2025

All your questions about the W4 form 2025 are important as you navigate tax withholding. Below are answers to some frequently asked questions that can help you make informed decisions regarding your financial responsibilities.

How Often Should You Review Your W4 Form?

Among the best practices is to review your W4 form whenever you experience a significant life change, such as marriage, divorce, or the birth of a child. It’s also wise to check it annually or whenever you start a new job, ensuring that your withholding aligns with your current financial situation and tax obligations.

What Happens If You Don’t Submit a W4?

About the consequences of not submitting a W4 form, you may face a higher-than-expected tax burden. If you don’t provide your employer with a completed W4 form, they are obligated to withhold tax at the highest rate, which might lead to larger deductions from your paycheck and a possible tax bill at the end of the year.

Indeed, failing to submit a W4 means that your employer will default to withholding taxes as if you are single with no applicable deductions. This can lead to an over-withholding scenario where you receive a larger refund, but it might adversely affect your cash flow throughout the year. To avoid unexpected financial strain, it’s in your best interest to always keep your form updated.

Can You Make Tax Adjustments Throughout the Year?

One notable aspect of the W4 form is its flexibility; you can indeed make tax adjustments at any time during the year. If your financial situation changes—like taking on a new job, receiving a raise, or experiencing major life events—you should promptly update your W4 to reflect these changes.

Also, addressing adjustments throughout the year helps you maintain a more accurate withholding amount, potentially reducing the likelihood of owing money during tax season. The draft version of the 2025 W4 introduces several updates, including a streamlined approach to reporting changes. Stay proactive to ensure that your tax withholding aligns with your current circumstances!

State-Specific Variations of the W4 Form

Keep in mind that different states have their own tax withholding requirements that may vary significantly from the federal W4 form. Consequently, you may need to fill out additional state-specific forms to ensure accurate withholding. This is pertinent if you reside or work in a state with income tax, as these forms will help direct your employer on how much state tax to deduct from your paycheck.

Overview of State Tax Withholding Forms

After understanding the federal W4 form, it’s imperative to familiarize yourself with your state’s specific tax withholding forms. Each state has distinct rules and regulations governing tax withholdings, so make sure to check what applies to you in your state.

How State Requirements Differ from Federal?

Above all, it’s important to recognize that state tax requirements can differ greatly from federal laws, primarily in terms of tax rates and filing processes. While the federal W4 form helps you calculate your federal income tax withholding, your state form will focus on any applicable state taxes, which could have varying deductions and allowances.

Hence, it’s beneficial to thoroughly research your state’s specific rules, as some states may not require a W4-like form at all, while others might have additional steps for claiming exemptions or specifying deductions. Ignoring these differences may result in inaccurate withholdings that could lead to a larger tax bill or penalties later on.

Resources for State-Specific Information

On your quest for understanding state-specific requirements, check your state’s department of revenue or taxation website, where you can usually find downloadable forms and detailed instructions tailored to your situation.

Another helpful approach is to consult with a tax professional who is savvy in your state’s laws. They can provide you with personalized advice and ensure that you’re compliant with your state’s unique tax regulations, helping you navigate potential pitfalls related to state tax compliance.

Implications of Incorrect Withholding

Once again, it’s vital to understand the implications of incorrect withholding when completing your W4 Form. Accurate withholding is vital not just for your finances but for your overall peace of mind during tax season. Missteps in this area can lead to substantial consequences, impacting your budget and financial stability.

Consequences of Under-withholding

Across the board, under-withholding can result in a significant tax bill when you file your return. If you don’t have enough withheld, you may find yourself owing the IRS money, which could also incur penalties and interest, placing a strain on your financial resources.

Consequences of Over-withholding

Overwithholding can lead to a cash flow challenge as funds that could be used for daily expenses are withheld from your paycheck. You may think you’re doing the right thing by being cautious, but this can create unnecessary financial strain over time.

Implications of over-withholding also extend to the delay in accessing your money. Since the IRS takes its time to process tax refunds, you could end up waiting months to receive the money you’ve overpaid. This means potentially missing opportunities for savings or investments during that time.

Rectifying Withholding Mistakes

At any point, if you discover that your withholding levels are incorrect, it’s important to take immediate action. Adjusting your W4 form promptly helps ensure your tax liability aligns more closely with your actual withholding needs for the tax year.

Also, keeping an eye on your pay stubs and tax withholding can provide insight into any discrepancies. If you’ve experienced changes such as a new job, marriage, or dependents, consider revising your W4 regularly to avoid potential withholding mistakes that can lead to financial consequences down the line.

Online Resources and Tools for the W4 Form

All employees will benefit from understanding the various online resources and tools available for the W4 Form, especially the 2025 Employee’s Withholding Certificate. Utilizing these resources can simplify the process of filling out the form and help ensure accurate withholding for your federal taxes.

Accessing the Official Form from the IRS

Along with updates in 2025, accessing the official W4 Form is straightforward. You can find the latest version directly on the IRS website, which provides the official draft released on September 13, 2024. This ensures that you are using the most current and accurate form for your withholding needs.

Additional Resources for Tax Preparation

Official tax preparation resources go beyond just the W4 Form. Tools like the IRS Tax Withholding Estimator can help you make informed decisions based on your personal tax situation. It’s vital to refer to these resources particularly after life changes like marriage or having a child, which can significantly impact your withholding strategy.

Plus, many online platforms offer calculators and guides that can streamline your tax preparations. These resources can provide insights into expected refunds or liabilities, allowing you to adjust your W4 with confidence. Additionally, various tax software programs can help you track changes across the year and ensure that your withholding aligns with your financial goals.

Community and Professional Support Networks

Form support networks play a significant role in your tax preparation process. Engaging with local tax professionals or community groups can provide valuable opportunities for personalized advice and assistance tailored to your circumstances. Such networks can also offer insights into shared experiences, ensuring you are not navigating the complexities of tax withholding alone.

Networks of tax enthusiasts and professionals often host workshops and informational sessions to address common queries about the W4 form and related tax matters. These sessions can also serve as a way to discuss recent updates to the form, such as those seen in 2025, ensuring you stay informed and able to maximize your potential refunds while minimizing any unexpected taxes owed.

Summing Up

On the whole, the 2025 W4 Form is an vital tool for you to manage your federal income tax withholding effectively. With the recent updates aimed at enhancing clarity and usability, you can better navigate life changes that impact your withholding. By utilizing the printable version, you can easily fill out the form, maintain records, and ensure accuracy in your tax situation. Stay informed and proactive in adjusting your withholding to align with your financial needs.

FAQs About the W4 Form 2025

1. When is the deadline to submit a new W4 form?

The deadline to submit a new W4 form is typically at the beginning of the year or whenever you start a new job. It’s also advisable to submit a new form whenever there’s a significant change in your personal circumstances, such as marriage, divorce, or the birth of a child. For current employees, you can submit a W4 at any time during the year if you wish to adjust your withholding.

2. Do you need to submit a W4 every year?

You are not required to submit a new W4 every year. However, it is recommended that you review and update your W4 form periodically, especially after any major life events that may affect your tax situation, such as a change in income, marital status, or number of dependents.

3. How can you adjust your W4 during the year?

To adjust your W4 during the year, you must complete a new W4 form with your updated information and submit it to your employer’s HR or payroll department. Make sure to reflect any changes in your personal circumstances that could affect your withholding, such as additional jobs or changes in dependents.

4. What happens if you don’t submit a W4?

If you do not submit a W4, your employer is required to withhold taxes as if you are a single filer with no allowances, which may result in higher withholding than necessary. This could lead to a larger tax refund when you file your return, but it may also mean lower take-home pay throughout the year.

5. Can I use the W4 form if I work multiple jobs?

Yes, the W4 form includes sections for reporting multiple jobs or if you have a spouse who works. When filling out the form, you should provide information about all jobs to ensure accurate withholding from each employer. The form’s guidance suggests using the IRS’s Tax Withholding Estimator for the most accurate calculation.

6. Is there a way to find guidance on filling out the W4 form?

Yes, detailed guidance is provided in the instructions accompanying the W4 form. It is also recommended to use the IRS Tax Withholding Estimator tool, which can help you determine how much tax should be withheld based on your specific circumstances. The updated form for 2025 includes an expanded list of scenarios where this estimator can be helpful.

7. Where can I find the official 2025 W4 form for printing?

The official 2025 W4 form is available on the IRS website. You can download and print the form directly from their site. Make sure to verify that you are using the most recent version to ensure that your information is accurate and up-to-date. You can find the draft form here.