Table of Contents

2024 W-4 Form Printable – Navigating tax obligations can be a daunting task for many, especially when it comes to understanding and filling out the right forms. As 2024 approaches, the IRS has updated the W-4 Form, an essential document for accurately determining tax withholdings. This change has left many individuals and employers scrambling to comprehend the new requirements and implications, highlighting a common problem in staying up-to-date with tax regulations.

New Article: W4 Form 2025.

The complexity of the 2024 W-4 Form Printable version adds to the confusion. Without clear guidance, mistakes can easily be made, leading to incorrect withholdings, potential penalties, or an unexpected tax bill. For both employees and employers, this uncertainty creates unnecessary stress and administrative burdens, emphasizing the need for a straightforward, accessible guide to navigating this crucial form.

Fortunately, understanding the W-4 Form 2024 doesn’t have to be a challenge. With the right resources and explanations, anyone can master the essentials of this form, ensuring compliance and peace of mind. Our comprehensive guide offers clear, step-by-step instructions and tips for filling out the W-4 Form 2024 Printable, simplifying the process for everyone involved. Whether you’re an employee trying to figure out your withholdings or an employer seeking to assist your team, our guide is the solution you need to navigate this tax season with confidence.

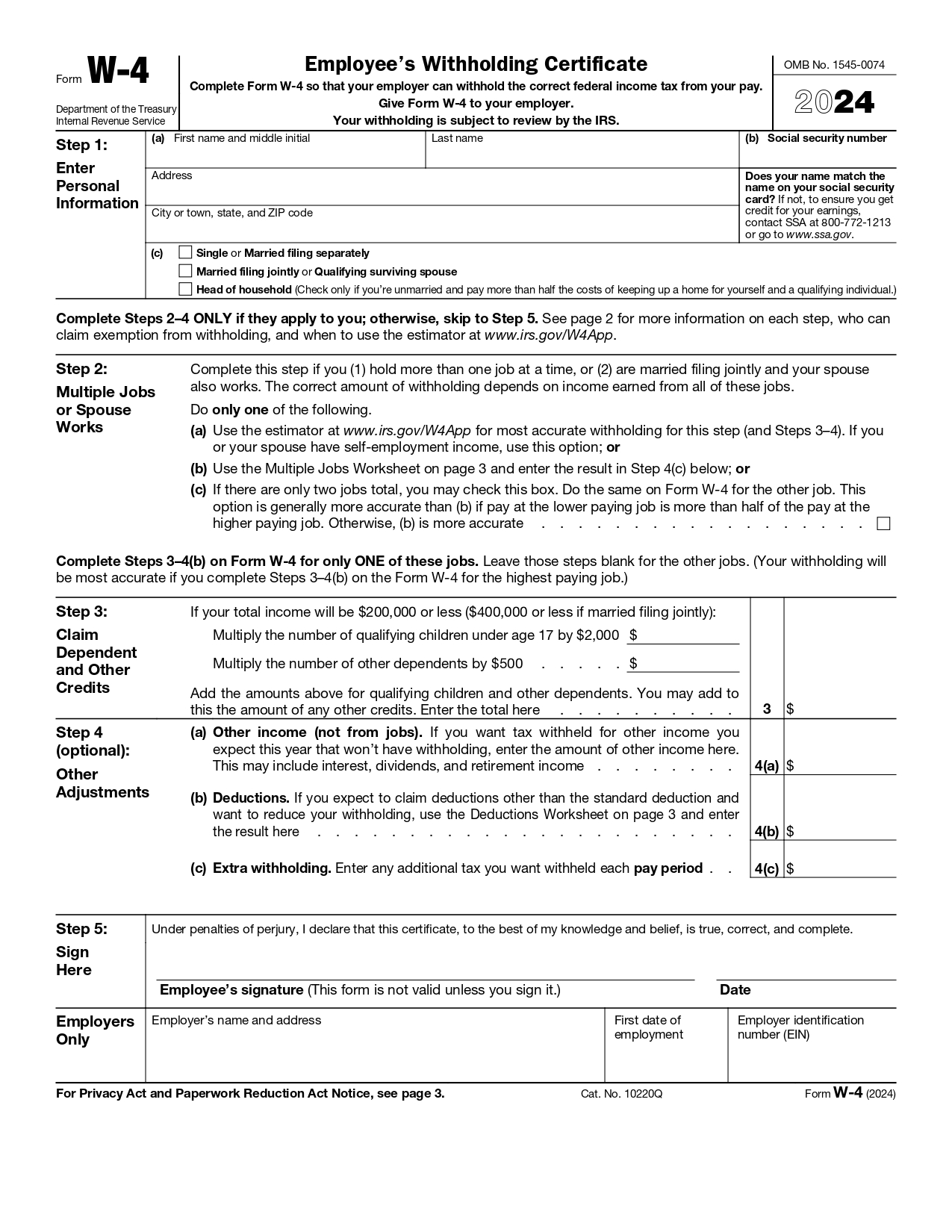

The W-4 Form is a critical document used by employers in the United States to determine the amount of federal income tax to withhold from an employee’s paycheck. As we step into 2024, it’s essential to understand the specific changes and updates that have been made to the W-4 Form. This chapter aims to demystify the 2024 version of the W-4 Form, outlining its purpose, significance, and the key updates that differentiate it from previous years.

What is the 2024 W-4 Form?

The W-4 Form, officially known as the Employee’s Withholding Certificate, is a form used by employees to indicate their tax situation to their employer. The information provided on the form, such as filing status, number of dependents, and any additional income or deductions, allows employers to calculate the correct amount of federal income tax to withhold from each paycheck.

Key Features of the 2024 W-4 Form

In 2024, the IRS introduced several updates to the W-4 Form to reflect changes in tax laws and regulations. Some of the notable features include:

- Simplified Layout: The 2024 version of the form has been designed for easier understanding and completion, with clearer instructions and a more intuitive structure.

- Adjustments for Inflation and Tax Brackets: The form takes into account the latest tax bracket adjustments and inflation rates, ensuring that withholdings are more accurately aligned with current economic conditions.

- Enhanced Accuracy in Withholding: The updated form allows for more precise calculation of tax withholdings, reducing the chances of a large tax bill or significant refund at the end of the year.

- Additional Income Considerations: There are sections that cater to other income sources, such as freelance or gig economy work, ensuring that taxes on these earnings are appropriately withheld.

- Customization Options: Employees have more flexibility to tailor their withholdings based on individual financial goals, such as adjusting for a preferred tax refund amount or anticipated tax credits.

The 2024 W-4 Form plays a pivotal role in ensuring that employees are taxed correctly according to their individual circumstances. By staying informed about the features and updates of this form, both employers and employees can manage their tax responsibilities more effectively, leading to a smoother financial experience throughout the year. This chapter has provided a comprehensive overview of what the 2024 W-4 Form is and how it functions, setting the stage for more detailed discussions in subsequent chapters.

2024 W-4 Form Printable Version

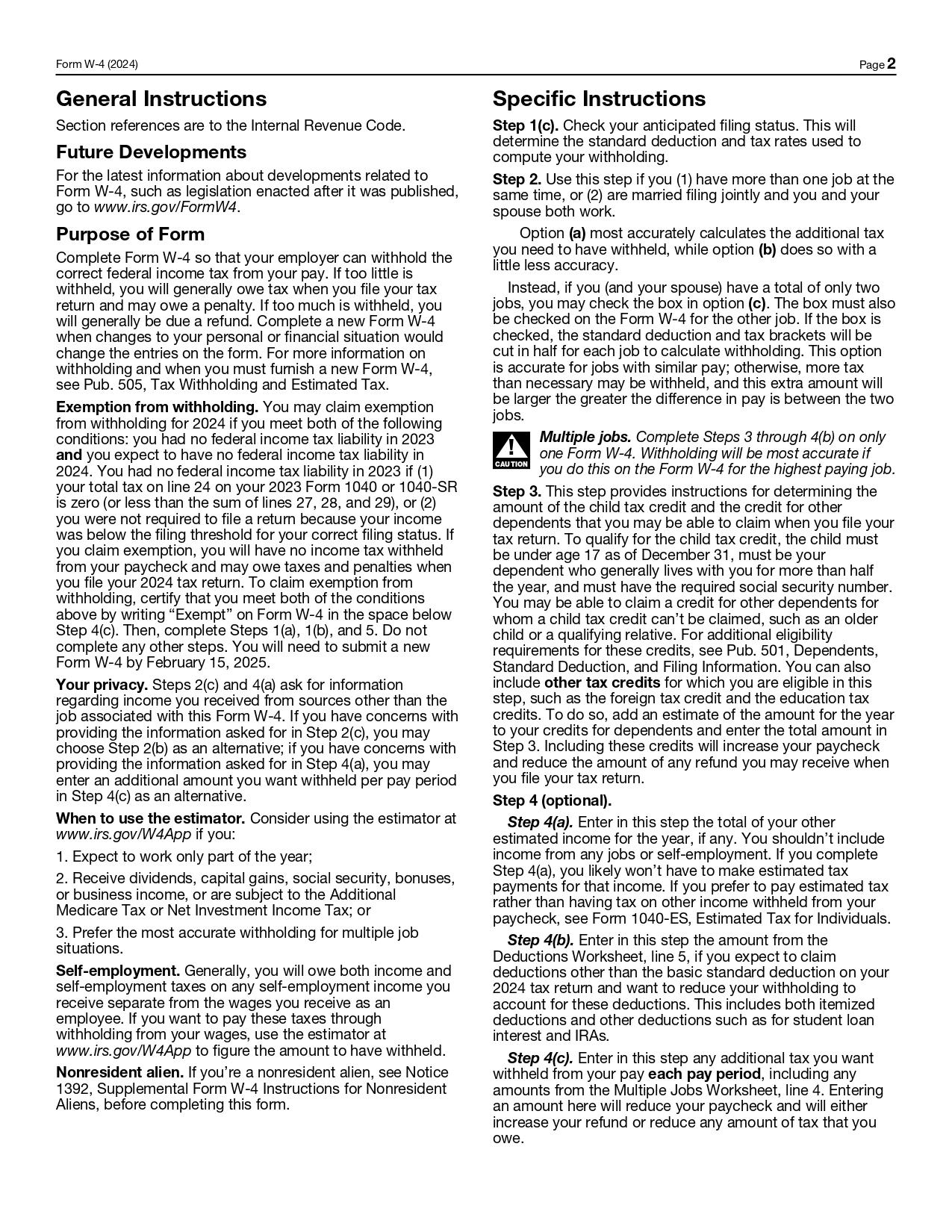

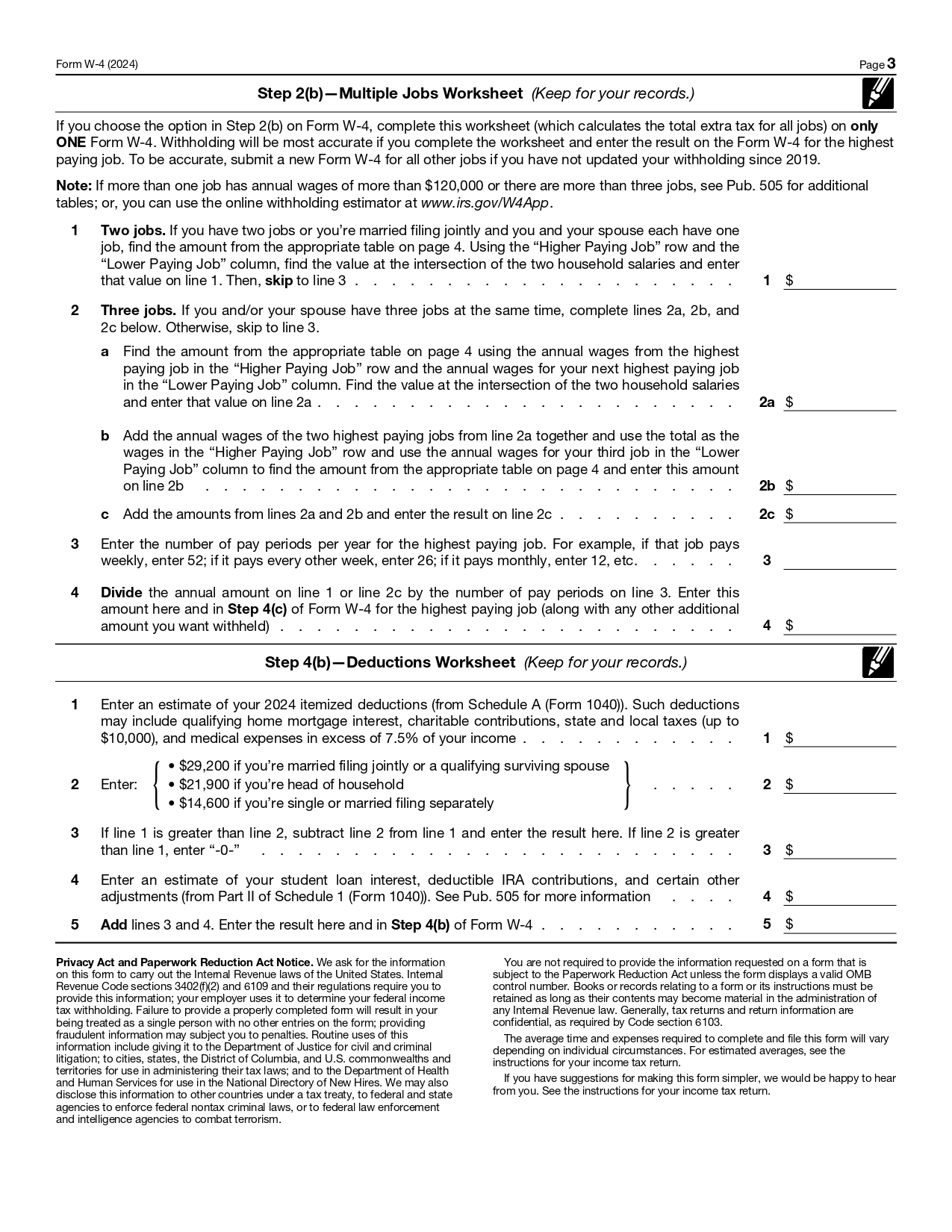

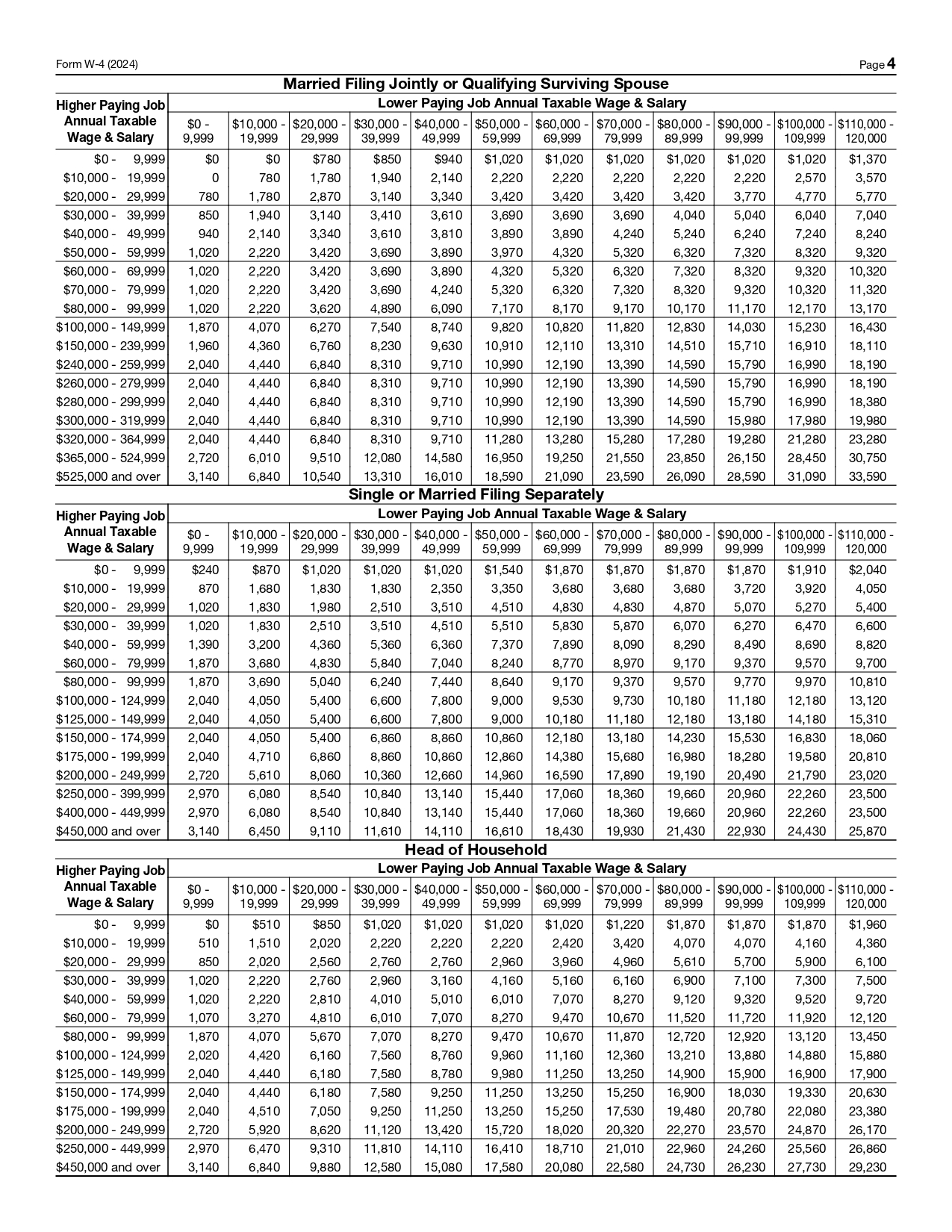

Understanding the importance of the W-4 Form for both employees and employers, this chapter provides direct access to the newly released 2024 W-4 Form in a printable format. Issued by the Internal Revenue Service (IRS), this form is crucial for accurate tax withholdings. We offer both a PDF version, ideal for official use, and a JPG sample for quick reference.

The 2024 W-4 Form has been made available in a user-friendly printable format. This ensures that you can easily obtain, print, and fill out the form at your convenience. The printable version is identical to the one provided by the IRS, ensuring that you stay compliant with the latest tax regulations.

Download the 2024 W-4 Form Printable PDF Version

For the official and printable version of the W-4 Form, please click on the following link: Download 2024 W-4 Form PDF. This PDF version is the recommended format for submission to your employer, as it ensures clarity and compliance with IRS standards.

View 2024 W-4 Forms in JPG Format

For a quick reference, we also provide a JPG image of the 2024 W-4 Form. This can be particularly useful for a preliminary review before completing the official document. However, please note that the JPG is only a sample and should not be used for official purposes. Below are the 2024 W-4 Forms in JPG Format.

Why Print the 2024 W-4 Form in PDF Version?

We strongly recommend using the PDF version of the 2024 W-4 Form for the following reasons:

- Accuracy and Clarity: The PDF format maintains the original layout and specifications set by the IRS, ensuring that all information is accurately conveyed.

- Official Acceptance: Employers and the IRS require the form in its official format, which is best represented by the PDF version.

- Ease of Use: The PDF format is widely accepted and can easily be printed and filled out.

Having access to the 2024 W-4 Form in a printable format is essential for accurate tax withholdings and compliance with federal tax regulations. By providing both PDF and JPG formats, we aim to facilitate a better understanding and easier handling of this crucial tax document. Remember, while the JPG sample serves as a handy reference, the PDF version should be used for all official purposes.