Table of Contents

IRS Form 941 – Employer’s Quarterly Federal Tax Return – Payroll taxes are a cornerstone of business compliance, funding Social Security, Medicare, and federal income tax withholding for millions of American workers. For most employers, IRS Form 941—the Employer’s Quarterly Federal Tax Return—is the essential tool for reporting these obligations quarterly. In 2025, with the Social Security wage base rising to $176,100 and Medicare rates holding steady at 1.45% each for employee and employer, accurate filing remains critical to avoid penalties up to 25% of unpaid taxes. This SEO-optimized guide, based on the March 2025 revision of Form 941 and its instructions, covers eligibility, deadlines, step-by-step filing, and updates to help businesses stay compliant amid electronic filing mandates for corrections via Form 941-X.

What Is IRS Form 941?

IRS Form 941 is a quarterly return used by employers to report federal income tax withheld from employee wages, plus both shares of Social Security and Medicare taxes (FICA). It reconciles deposits made during the quarter and calculates any balance due or overpayment. Unlike annual forms like W-2, Form 941 provides the IRS with timely payroll data to verify withholding and prevent underpayment.

Key purposes:

- Withholding Reporting: Tracks federal income tax deducted from paychecks.

- FICA Taxes: Reports Social Security (6.2% each, up to $176,100 wage base) and Medicare (1.45% each, unlimited).

- Adjustments and Credits: Handles corrections, sick/family leave wages (expired post-2021), and credits like employee retention.

The March 2025 revision (Rev. 3-2025) is usable for all quarters, with updates for election workers ($2,400 threshold) and electronic Form 941-X filing. Download the form and instructions from IRS.gov/Form941.

Who Needs to File IRS Form 941 in 2025?

Most employers with wages subject to withholding or FICA taxes must file Form 941 quarterly. Exceptions include small employers notified to file annual Form 944 (employment taxes ≤$1,000/year) or agricultural/household employers using Forms 943/944.

| Employer Type | Filing Required? | Threshold/Details |

|---|---|---|

| General Businesses | Yes | Any wages with withholding or FICA; file even if $0 due. |

| Small Employers | Possibly Form 944 | IRS notifies if annual taxes ≤$1,000; request switch by March 17, 2025. |

| Seasonal Employers | Yes, if wages paid | File only quarters with activity; check “Seasonal” box. |

| Household Workers | No—use Schedule H | Wages ≥$2,800 trigger FICA; report annually with 1040. |

| Election Workers | Yes, if ≥$2,400 | Subject to FICA in 2025. |

Use EIN; apply via IRS.gov if needed. Semiweekly depositors attach Schedule B.

Filing Deadlines and Extensions for Form 941 in 2025

Form 941 is due the last day of the month after each quarter. If all deposits are timely, add 10 calendar days. Holidays/weekends shift to next business day.

| Quarter | Period | Due Date | With Timely Deposits |

|---|---|---|---|

| Q1 | Jan-Mar | April 30, 2025 | May 10, 2025 |

| Q2 | Apr-Jun | July 31, 2025 | August 10, 2025 |

| Q3 | Jul-Sep | October 31, 2025 | November 10, 2025 |

| Q4 | Oct-Dec | January 31, 2026 | February 10, 2026 |

- Extensions: No automatic; request via Form 8809 (up to 30 days) or letter for hardship—filing only, not payment.

- Deposits: Monthly (by 15th) or semiweekly (1-3 days post-payroll); use EFTPS.

- Where to File: E-file via providers; paper to IRS centers per Pub. 42 (with/without payment).

E-file for instant acceptance; paper takes 4-6 weeks.

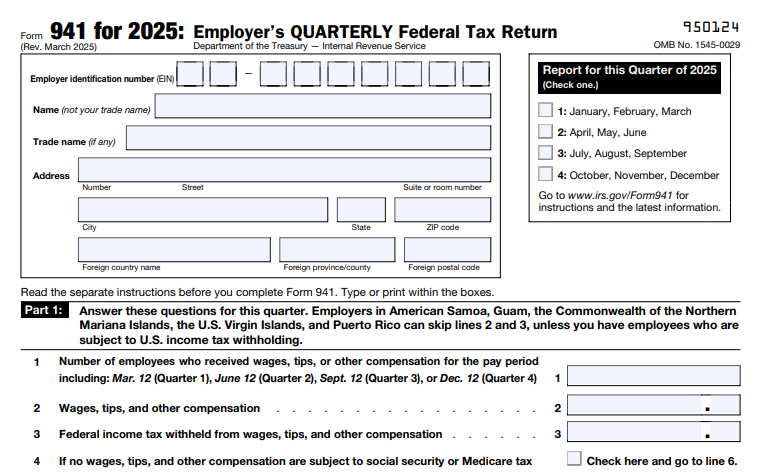

IRS Form 941 Download and Printable

Download and Print: IRS Form 941

Step-by-Step Guide to Completing IRS Form 941

Gather payroll records, W-4s, and deposit summaries. Use the March 2025 fillable PDF.

- Part 1: Report for Quarter – Check Q1-Q4 2025; EIN, name, address.

- Part 2: Business Info – Number of employees (line 1); check seasonal/closed if applicable.

- Line 2: Wages/Tips – Total paid (exclude exempt); from payroll.

- Line 3: Income Tax Withheld – Federal withholding per W-4.

- Line 5a: Social Security Wages – Up to $176,100/employee; ×6.2% = tax (line 5c).

- Line 5d: Medicare Wages/Tips – Unlimited; ×1.45% = tax (line 5e); add 0.9% Additional on >$200K (line 5f).

- Line 8: Tips – Allocated/actual; adjust for sick pay if needed.

- Line 9: Future-Filed Wages – Deferral credits (expired post-2021).

- Line 10: Deferred Amounts – COVID credits (lines 11a-11d removed for 2025).

- Line 12: Total Tax – Sum lines 3+5e+5f+5c+8+10-9.

- Line 13: Deposits – Total prior quarter payments.

- Line 14: Balance Due – Line 12 – 13; pay if >$1.

- Part 3: Third-Party Designee – Optional authorization.

- Part 4: Sign – Under perjury; date, title.

- Attach Schedules: B (semiweekly), R (credits), D (COBRA, expired).

E-file via MeF for speed; paper with Form 941-V voucher if paying.

2025 Payroll Tax Rates on Form 941

Rates stable, but wage base up 4.5% from 2024’s $168,600.

| Tax Type | Employee Rate | Employer Rate | Wage Base |

|---|---|---|---|

| Social Security | 6.2% | 6.2% | $176,100 |

| Medicare | 1.45% | 1.45% | Unlimited |

| Additional Medicare | 0.9% (>$200K) | 0% | Unlimited |

Household: $2,800 threshold; elections: $2,400. Example: $200K wages = $12,382 SS ($176,100×12.4%) + $2,900 Medicare ($200K×1.45%) = $15,282 total FICA.

E-Filing vs. Paper: Options for Form 941 in 2025

E-filing is recommended and required for Schedule R credits; paper for simple returns.

- E-Filing Pros: Instant acceptance, error checks, faster refunds; via MeF providers.

- Paper Pros: For <10 employees; mail by due date.

- Threshold: No min, but e-file for accuracy.

Providers like Tax1099 handle bulk; free via IRS Modernized e-File.

Common Mistakes When Filing Form 941 and How to Avoid Them

Errors trigger audits—top 2025 issues:

- Wage Base Errors: Exceeding $176,100 SS—track per employee quarterly.

- Deposit Mismatches: Line 13 ≠ EFTPS—reconcile monthly.

- Missing Schedules: Semiweekly without B—attach if >$50K/quarter.

- Late Deposits: Monthly/semiweekly lapses—use EFTPS reminders.

- Tip Reporting: Allocated tips on line 8—use Form 8027 annually.

Audit payroll software; reconcile with W-2s.

Penalties for Late or Incorrect Form 941 Filings in 2025

The IRS enforces strictly, with tiered penalties adjusted for inflation.

| Violation | Penalty | Max |

|---|---|---|

| Late Filing | 5%/month (max 25%) of unpaid tax | 25% |

| Late Payment | 0.5%/month + interest (0.5%/month) | 25% |

| Late Deposit | 2-15% of underpayment (days late) | 15% |

| Inaccurate Reporting | 20% negligence; 75% fraud | Varies |

Waivers for reasonable cause; first-time abatement possible. E-file cuts errors 90%.

Frequently Asked Questions About IRS Form 941

What’s the 2025 Social Security wage base?

$176,100—up from $168,600; taxes 6.2% each up to that.

Can I e-file Form 941?

Yes—via MeF providers; instant confirmation recommended.

What if I miss a deposit?

2-15% penalty based on days late; use EFTPS for timely.

Do seasonal employers file every quarter?

No—only if wages paid; check “Seasonal” box.

How to correct Form 941 errors?

File Form 941-X by next quarter’s due date; now e-file eligible.

Visit IRS.gov/Form941 for more.

Final Thoughts: Navigate IRS Form 941 Compliance Effortlessly in 2025

IRS Form 941 is your quarterly checkpoint for payroll taxes, ensuring timely reporting of FICA and withholding amid the $176,100 Social Security base and 1.45% Medicare rates. With March 2025 updates like e-file for corrections and election worker thresholds, staying ahead prevents 5-25% penalties—e-file by April 30 for Q1 to safeguard your business. Download the revision from IRS.gov today, reconcile deposits monthly, and consider payroll software for accuracy.

Payroll powers your team—compliant 941 powers your peace of mind.

This article is informational only—not tax advice. Consult IRS.gov or a professional.