Table of Contents

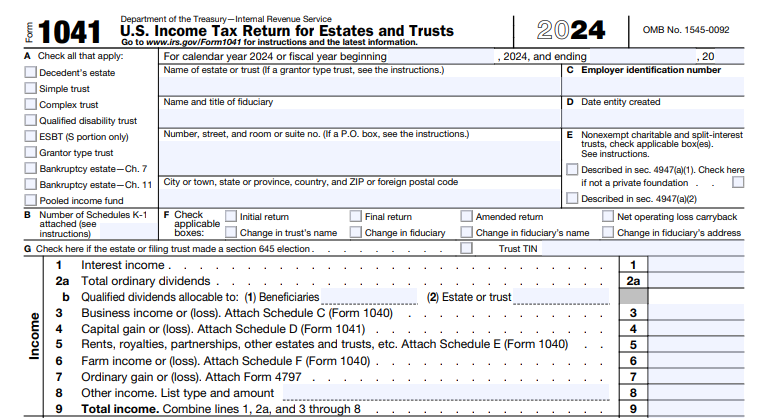

IRS Form 1041 – U.S. Income Tax Return for Estates and Trusts – Managing the tax affairs of a deceased loved one’s estate or a family trust can be emotionally and administratively challenging, especially with the IRS’s strict deadlines approaching. IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts, is the essential tool for reporting income, deductions, and distributions for these entities. For tax year 2024 (filed in 2025), key updates include a $5,000 exemption for qualified disability trusts (not subject to phaseout), a 20% capital gains rate applying above $15,450 of income, and enhanced e-filing schemas for 2025 production. With over 14% growth in Form 1041 filings from 2020 to 2021 amid an aging population, fiduciaries must act swiftly to avoid penalties up to 5% per month for late filing.

This SEO-optimized guide covers IRS Form 1041 instructions for 2025, who needs to file, step-by-step completion, common errors, and filing tips. Download the latest 2024 form (usable for early 2025 short years) from IRS.gov and file by April 15, 2025, for calendar-year entities to ensure compliance. Whether you’re an executor settling an estate or a trustee distributing assets, accurate reporting minimizes taxes and honors your fiduciary duties.

What Is IRS Form 1041?

IRS Form 1041 is the annual income tax return filed by the fiduciary (executor, administrator, or trustee) of a domestic estate, trust, or bankruptcy estate. It reports the entity’s gross income, allowable deductions, income distributed to beneficiaries (via Schedule K-1), and any tax owed under IRC Sections 641-683. Unlike Form 706 (estate tax return), Form 1041 focuses on income generated post-death or during the trust’s operation, such as interest, dividends, rents, or capital gains.

For 2025 filings:

- Exemptions: Simple trusts get a $300 deduction; complex trusts and estates $100 (or $5,000 for qualified disability trusts).

- Tax Rates: Compressed brackets start at 10% up to $3,100, reaching 37% over $15,200; capital gains at 0%/15%/20% based on income thresholds.

- Schedules: Includes A (charitable deductions), B (income distribution), D (capital gains), G (tax computation), I (AMT), J (accumulation distributions), and K-1 (beneficiary shares).

E-filing is encouraged via Modernized e-File (MeF) providers approved for TY2025, with schemas released in November 2025 for production. Failure to file can trigger audits, especially for foreign trusts or nonresident beneficiaries.

Who Must File IRS Form 1041 in 2025?

Not every estate or trust requires Form 1041, but fiduciary oversight is critical to determine eligibility. File if the entity meets these thresholds for tax year 2024 (due 2025):

Estates

- Gross income of $600 or more.

- Nonresident alien beneficiary.

- Any taxable income.

Trusts

- Simple Trusts: Gross income $600+; must distribute all income annually.

- Complex Trusts: Any taxable income; can accumulate or distribute income.

- Qualified Disability Trusts: Exemption up to $5,000 regardless of phaseout.

- Grantor Trusts: Generally no Form 1041 (report on grantor’s Form 1040), but post-death revocable trusts (QRTs) may elect under Section 645.

Foreign estates file Form 1040-NR instead. Obtain an EIN via Form SS-4 before filing—never use the decedent’s SSN. For bankruptcy estates, file if income thresholds are met.

| Entity Type | Filing Threshold | Special Notes for 2025 |

|---|---|---|

| Domestic Estate | $600 gross income or nonresident alien beneficiary | Section 645 election for QRTs due by first return date. |

| Simple Trust | $600 gross income | Must distribute all income; no accumulation. |

| Complex Trust | Any taxable income | Report accumulation distributions on Schedule J. |

| Qualified Disability Trust | Any income | $5,000 exemption (no phaseout). |

IRS Form 1041 Download and Printable

Download and Print: IRS Form 1041

Step-by-Step Guide: How to Fill Out IRS Form 1041 for 2025

Completing Form 1041 requires gathering financial statements, brokerage reports (1099s), and beneficiary details. Use tax software for accuracy, as e-filing is mandatory for most attachments like Schedule D. File by April 15, 2025, for calendar years; extend via Form 7004 for 5.5 months. Here’s a line-by-line overview based on 2024 instructions (applicable for 2025 filings).

Step 1: Header and Identification

- Name and Address: Enter estate/trust name, fiduciary’s details, and EIN.

- Item A: Check “Initial return,” “Final return,” “Amended return,” or type (e.g., “Decedent’s estate”).

- Item B: Nonexempt charitable/noncharitable pooled income fund? Check if applicable.

- Item C: Tax shelter? Rarely for estates/trusts.

- Item D: Section 663(b) election for 65-day income distribution? Check if claiming.

- Item E: Section 645 election? Check and attach electing trust details.

- Item F: Fiscal year? Specify if not calendar.

Step 2: Income (Lines 1-9)

- Line 1: Interest income (1099-INT).

- Line 2a/2b: Total/qualified dividends (1099-DIV).

- Line 3: Business income/loss (attach Schedule C).

- Line 4a/4b: Capital gain/loss (attach Schedule D; use 2024 Tax Rate Schedule for rates).

- Lines 5-8: Rents/royalties (Schedule E), ordinary gains/losses (Form 4797), other income.

- Line 9: Total income (sum Lines 1-8).

Step 3: Deductions (Lines 10-21)

- Line 10: Tax-exempt interest? Report for allocation.

- Line 11: State/local taxes (SALT) paid; cap at $10,000 for trusts/estates.

- Line 12: Other deductions (attach statement; e.g., fiduciary fees, legal costs—not personal expenses).

- Line 15a/15b: Income distribution deduction (from Schedule B, Line 15; attach K-1s).

- Line 18: Adjusted total income (Line 9 minus Lines 11-15b + Line 17).

- Line 20: Section 199A deduction (qualified business income).

- Line 21: Exemption ($100/$300 or $5,000 for disability trusts).

Step 4: Tax Computation (Lines 22-28)

- Line 22: Taxable income (Line 21 minus exemption).

- Line 23: Tax on Line 22 (use 2024 Schedule; attach Schedule G if complex).

- Line 24: Alternative minimum tax (attach Schedule I if applicable).

- Line 25: Excess deductions on termination? Carry to beneficiaries.

- Line 26: NIIT (Form 8960).

- Line 27: Other taxes (e.g., household employment via Schedule H).

- Line 28: Total tax (sum 23-27).

Step 5: Payments and Refund (Lines 29-37)

- Line 29: Estimated payments (Form 1041-ES).

- Line 30: Allocated to beneficiaries (Form 1041-T).

- Line 32: Overpayment/refund or balance due.

- Sign and date; attach required schedules/K-1s.

Prepare Schedule K-1 for each beneficiary, detailing their share of DNI (distributable net income). Mail to IRS address based on state; e-file for faster processing.

| Section | Key Lines | Common Attachments |

|---|---|---|

| Header | Name, EIN, Items A-F | Form SS-4 (if new EIN) |

| Income | 1-9 | 1099s, Schedule D/E |

| Deductions | 10-21 | Schedule B, Statement for Line 12 |

| Tax | 22-28 | Schedule G/I, Form 8960 |

| Payments | 29-37 | Form 1041-V (voucher) |

Common Mistakes to Avoid When Filing Form 1041

Fiduciaries often face audits due to errors—68% of first-time executors make at least one. Steer clear of these pitfalls:

- Using Decedent’s SSN: Always obtain/use EIN; delays processing.

- Underreporting Income: Omit IRD (e.g., final paychecks) or foreign assets; triggers 20% penalties under IRC 6662.

- Invalid Deductions: Claiming funeral/medical expenses (use Form 706) or personal beneficiary costs.

- Forgetting K-1s: File with return but fail to send copies to beneficiaries by due date; they can’t file without them.

- Missing Extensions: Use Form 7004 timely; late filing incurs 5% monthly penalty.

- Grantor Trust Errors: Filing unnecessarily during grantor’s life.

Review the will/trust document first and retain records for 3+ years.

Frequently Asked Questions (FAQs) About IRS Form 1041

When is the deadline for Form 1041 in 2025?

April 15, 2025, for calendar-year filers; 15th day of 4th month after fiscal year-end. Extend with Form 7004.

Do grantor trusts file Form 1041?

No, during the grantor’s life; report on their Form 1040. Post-death QRTs may elect via Section 645.

What if the estate has no income under $600?

No filing required, unless nonresident alien beneficiary.

Can I e-file Form 1041?

Yes, via approved MeF providers; schemas available December 2025.

How do I handle capital gains on Form 1041?

Report on Schedule D; 20% rate over $15,450 for 2024.

Final Thoughts: File Form 1041 Accurately to Protect Your Legacy in 2025

IRS Form 1041 ensures estates and trusts fulfill their tax obligations while maximizing benefits for beneficiaries through proper distributions and deductions. With 2025 e-file enhancements and stable thresholds, now’s the time to gather documents and consult a tax advisor—especially for complex trusts or international elements. Use IRS Pub. 559 for executors and Pub. 541 for partnerships in estates.

This guide is informational; not tax advice. Verify with IRS.gov or a professional.

Related Searches: IRS Form 1041 instructions 2025, who files Form 1041 estates trusts, Schedule K-1 Form 1041 guide, common errors Form 1041 filing, e-file Form 1041 providers.