Table of Contents

IRS Form 1120 – U.S. Corporation Income Tax Return – For C corporations navigating the complexities of federal taxation, IRS Form 1120—the “U.S. Corporation Income Tax Return”—is the cornerstone of compliance. Whether you’re a small business owner searching for “Form 1120 instructions 2025,” a CFO optimizing deductions under the 21% corporate rate, or a tax professional handling consolidated groups, this SEO-optimized guide delivers everything you need. From eligibility and 2025 updates to a line-by-line walkthrough, we’ll help you avoid penalties like the escalated late-filing fine (up to $510 for returns over 60 days late) and ensure accurate reporting by the April 15, 2026 deadline for calendar-year filers.

Sourced from the IRS’s official 2024 instructions (applicable to 2025 returns) and recent notices, this resource aligns with the latest on Corporate Alternative Minimum Tax (CAMT) relief and e-filing mandates. Ready to streamline your corporate tax strategy? Let’s get started.

What Is IRS Form 1120?

Form 1120 is the primary federal income tax return for domestic C corporations, enabling them to report income, gains, losses, deductions, credits, and calculate tax liability under IRC Section 11. At a flat 21% rate on taxable income, it aggregates financial data from books and records, supports special elections (e.g., consolidated returns via Form 851), and integrates with schedules like M-3 for large entities (assets ≥ $10M).

Unlike pass-through entities (S corps on Form 1120-S), C corporations pay entity-level tax, with dividends taxed again at the shareholder level—double taxation that underscores the need for precise deductions like the dividends-received deduction (50-65%). For 2025, filers must address CAMT under Section 55 (15% on adjusted financial statement income for large corps) and report digital assets or Qualified Opportunity Fund (QOF) investments via Form 8997.

This form isn’t optional: Even zero-income corporations must file to maintain good standing and claim carryovers like net operating losses (NOLs).

Who Must File IRS Form 1120 in 2025?

All domestic C corporations—unless electing S status (Form 1120-S) or exempt under Section 501—must file Form 1120, regardless of income. Special rules apply to foreign-owned entities and certain disregarded structures.

Eligible Entities

| Entity Type | Filing Requirement | Key Notes |

|---|---|---|

| Domestic C Corporations | Required | Report all income; attach Schedule M-3 if assets ≥ $10M. |

| Consolidated Groups | Required (parent files) | Check Item A, Box 1a; attach Form 851. |

| Foreign-Owned Disregarded Entities | Pro forma 1120 + Form 5472 | If 25%+ foreign-owned; report transactions. |

| Qualified Opportunity Funds | Required with Form 8996 | Even if no income; certify QOF status. |

| LLCs Electing Corporate Status | Required + Form 8832 | Attach election copy for first year. |

Exclusions: S corporations (1120-S), exempt orgs with unrelated business income (990-T), personal holding companies (attach Schedule PH), or controlled foreign corporations (1120-F). E-filing mandatory if filing 10+ returns in 2024 (per Reg. §301.6037-2).

Recent Changes to IRS Form 1120 for Tax Year 2025

The IRS’s 2024 instructions (Rev. Jan 2025) govern 2025 filings, with post-release updates emphasizing CAMT and penalties. Key changes:

- Penalty Increase: For 2025-due returns, late-filing penalty (over 60 days) is the smaller of tax due or $510 (up from $485).

- CAMT Relief: Waived underpayment penalties for estimated taxes tied to CAMT (Notice 2024-66); new simplified status determination method (Sept 2025).

- Schedule C Worksheet Update: Incorporates Section 250 impacts on dividends-received deductions (GILTI/FDII).

- E-Filing Expansion: Mandatory for 10+ returns; new payment/transcript options (March 2025).

- Digital Assets/QOF: Enhanced questions; attach Form 8997 if investments held in 2025.

No major form redesign, but fiscal filers use 2024 form for 2025 years ending in 2026.

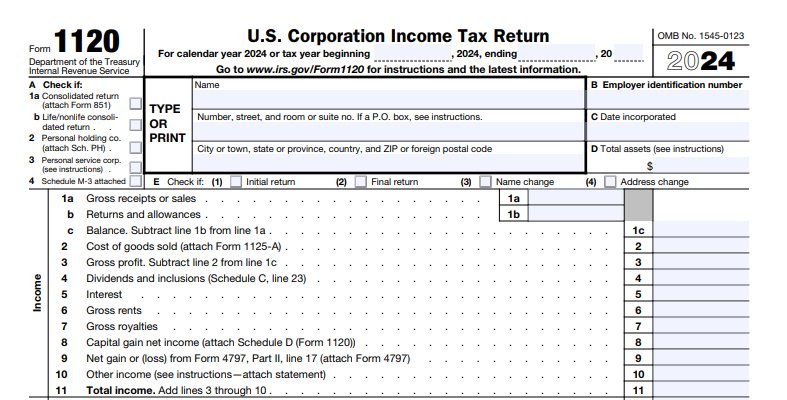

IRS Form 1120 Download and Printable

Download and Print: IRS Form 1120

Step-by-Step Guide: How to Complete IRS Form 1120 for 2025

Use the 2024 form for 2025 filings; e-file via IRS Modernized e-File (MeF). Gather P&L, balance sheets, and subsidiary data. Based on 2024 instructions:

Preparation

- Verify EIN/name match IRS records.

- Check for special status (e.g., consolidated, PHC).

- Complete attachments first (e.g., Schedule D for capital gains).

Page 1: Income and Deductions

- Lines 1-3: Gross receipts ($), returns/allowances, cost of goods sold (Form 1125-A).

- Lines 4-11: Dividends (Schedule C), interest, rents, royalties, capital gains (Schedule D), other income.

- Lines 12-27: Deductions—officers (Form 1125-E if receipts ≥$500K), salaries, repairs, bad debts, rents, taxes/licenses, interest (Form 8990), charitable (10% limit), depreciation (Form 4562), depletion, pensions, benefits, other (attach statement).

- Line 28: NOL deduction (attach computation).

- Line 29: Taxable income before NOL/special deductions.

- Line 30: Taxable income (after NOLs, etc.).

Example: $1M gross receipts – $400K COGS – $200K deductions = $400K taxable × 21% = $84K tax.

Schedule C: Dividends and Special Deductions

- Lines 1-14: Dividends received, exclusions (50%/65%/100%).

- Use updated worksheet for Section 250 adjustments.

Schedule J: Tax Computation

- Lines 1-11: Tax at 21%, recapture, alternative minimum, base erosion (Form 8991).

- Lines 12-22: Credits (Form 3800), payments, overpayment/refund.

Schedule K: Other Information

- Report business codes, foreign transactions, NOLs, QOF investments.

Schedule L: Balance Sheet

- Assets/liabilities at book value; reconcile to tax basis if Schedule M-1 used.

Schedule M-1/M-3: Reconciliation

- M-1 for small corps; M-3 mandatory for $10M+ assets (book-to-tax differences).

Filing

- Due: 15th day of 4th month after year-end (April 15, 2026, calendar); extend via Form 7004 (6 months, pay estimates by original due).

- E-File/Mail: MeF preferred; mail to Ogden, UT, if paper.

- Payments: EFTPS by due date; attach Form 7004 if extending.

Common Mistakes to Avoid When Filing Form 1120

Errors can trigger audits or penalties—here’s how to steer clear:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Late Filing | Missing April 15 deadline | Calendar reminders; file Form 7004 early. |

| Inaccurate Income Reporting | Omitting sources like dividends | Cross-check P&L; use Schedule C worksheet. |

| Wrong Form Type | Filing 1120-S without election | Verify status; attach Form 8832 if electing. |

| Missing Schedules | Forgetting M-3 or 5472 | Attach in order; e-file to validate. |

| EIN/Name Mismatch | Typos in header | Confirm via IRS transcript; check Item E for changes. |

Retain records 3-7 years; amend via Form 1120-X.

Why File Form 1120 Accurately? Real-World Benefits for 2025

A mid-sized manufacturer with $5M taxable income could save $50K+ via proper R&D credits (Form 6765) and NOL carryforwards, per IRS examples. With CAMT relief, large corps avoid underpayment hits, freeing cash for investments amid 2025’s economic shifts.

Final Thoughts: Master Your 2025 Form 1120 Filing Today

IRS Form 1120 is your C corporation’s gateway to compliance and savings, but 2025’s penalty hikes and CAMT tweaks demand precision. By tackling eligibility, updates, and common pitfalls head-on, you’ll file confidently by April 2026.

Download the 2024 form/instructions from IRS.gov and partner with a CPA for complex scenarios. Explore our guides on Schedule M-3 or Form 3800 for deeper dives. Questions on “corporate tax deductions 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your situation.