Table of Contents

IRS Form 8959 – Additional Medicare Tax – The Additional Medicare Tax is a 0.9% surcharge on certain earned income for higher earners, introduced in 2013 as part of the Affordable Care Act. Taxpayers use IRS Form 8959 to calculate and report this tax on wages, self-employment income, and railroad retirement (RRTA) compensation that exceed specific thresholds based on filing status.

This guide covers what the Additional Medicare Tax is, who owes it, 2025 thresholds, how to complete Form 8959, and key filing tips—all based on official IRS sources for the 2025 tax year.

What Is the Additional Medicare Tax?

The standard Medicare tax rate is 1.45% for employees (matched by employers) and 2.9% for self-employed individuals, with no income limit. The Additional Medicare Tax adds 0.9% on Medicare wages, RRTA compensation, and self-employment income above threshold amounts.

- It applies only to the amount exceeding the threshold—not your entire income.

- Employers withhold this 0.9% on wages over $200,000 (regardless of filing status), but you calculate the exact liability on your tax return using Form 8959.

- Self-employed individuals pay it directly via their return.

- This tax funds Medicare and certain ACA provisions.

Thresholds are not indexed for inflation and remain fixed since 2013.

2025 Additional Medicare Tax Thresholds

The 0.9% tax kicks in when applicable income exceeds these amounts:

| Filing Status | Threshold Amount |

|---|---|

| Married Filing Jointly | $250,000 |

| Married Filing Separately | $125,000 |

| Single | $200,000 |

| Head of Household | $200,000 |

| Qualifying Surviving Spouse | $200,000 |

If you have both wages and self-employment income, subtract wages from the threshold when calculating the tax on self-employment income (but do not treat self-employment losses as reducing wages).

Who Must File Form 8959?

You must file Form 8959 if:

- Your Medicare wages, RRTA compensation, or self-employment income exceed your filing status threshold.

- Your employer withheld Additional Medicare Tax (even if you ultimately don’t owe it—you may get a refund).

- You have unreported tips or other adjustments requiring calculation.

Attach Form 8959 to your Form 1040, 1040-SR, 1040-NR, or 1040-SS.

IRS Form 8959 Download and Printable

Download and Print: IRS Form 8959

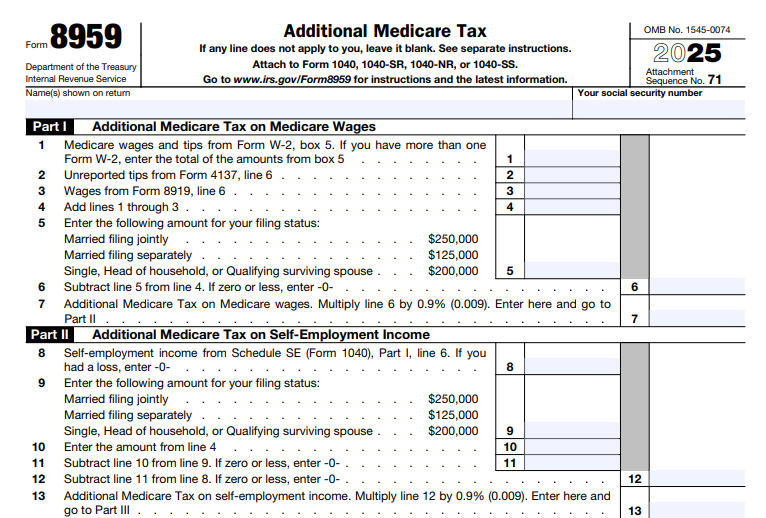

How to Complete Form 8959 (2025)

Form 8959 has five parts:

- Part I: Additional Medicare Tax on Medicare Wages

Report wages from Form W-2 (Box 5). Subtract the threshold and multiply excess by 0.9%. - Part II: Additional Medicare Tax on Self-Employment Income

Use net earnings from Schedule SE. Apply the reduced threshold if you have wages. - Part III: Additional Medicare Tax on RRTA Compensation

For railroad workers. - Part IV: Total Additional Medicare Tax

Sum amounts from Parts I–III. - Part V: Withholding Reconciliation

Report withheld amounts from W-2 (Box 6) and compare to liability.

The total owed (or overwithheld) flows to Schedule 2 (Form 1040), line 11.

Examples of Additional Medicare Tax Calculation

- Single filer with $225,000 in wages: Tax on $25,000 excess ($225,000 – $200,000) × 0.9% = $225 owed.

- Married filing jointly, one spouse with $230,000 wages, other with $10,000: Combined $240,000 < $250,000 threshold → No tax owed (but employer may have withheld on wages over $200,000—claim refund on Form 8959).

- Self-employed single filer with $150,000 net earnings + $100,000 wages: Wages reduce self-employment threshold to $100,000 ($200,000 – $100,000). Tax on $50,000 excess self-employment income × 0.9%.

Employer Withholding and Your Responsibilities

Employers must withhold 0.9% on wages over $200,000 per employee (no employer match). If withholding is insufficient (e.g., multiple jobs or self-employment), make estimated payments or adjust Form W-4.

Overwithholding? Claim credit on your return via Form 8959.

Tips to Avoid Surprises

- Use the IRS Withholding Estimator tool.

- Self-employed? Factor this into quarterly estimated taxes.

- Download the latest Form 8959 and instructions from IRS.gov/Form8959.

For personalized advice, consult a tax professional or refer to IRS Publication 505 (Tax Withholding and Estimated Tax) and Topic No. 560.

This information is based on IRS publications as of December 2025. Always check IRS.gov for the most current forms and guidance.