Table of Contents

IRS Form 4768 – Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes – In the complex world of estate planning and tax obligations, dealing with U.S. estate taxes and generation-skipping transfer (GST) taxes can be overwhelming, especially during a time of loss. IRS Form 4768 serves as a crucial tool for executors, trustees, and qualified heirs seeking additional time to file returns or pay taxes. This comprehensive guide explores everything you need to know about Form 4768, including its purpose, eligibility, filing process, and deadlines. Whether you’re an executor managing an estate or a tax professional assisting clients, understanding this form can help avoid penalties and ensure compliance with IRS regulations.

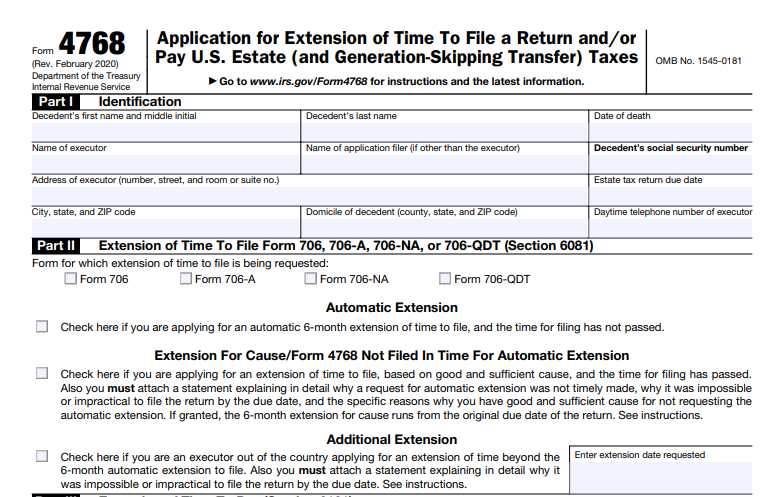

What Is IRS Form 4768?

IRS Form 4768, officially titled “Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes,” allows individuals to request extensions for specific estate-related tax forms. It primarily applies to extensions for filing or paying taxes associated with:

- Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return

- Form 706-A: United States Additional Estate Tax Return

- Form 706-NA: United States Estate (and Generation-Skipping Transfer) Tax Return for nonresident non-citizens

- Form 706-QDT: United States Estate Tax Return for Qualified Domestic Trusts

The form is divided into parts for different types of extensions: Part II for filing extensions under Section 6081, and Part III for payment extensions under Section 6161. Note that Form 4768 does not apply to extensions for Form 706-GS(T) or Form 706-GS(D); those require Form 7004 instead.

As of 2025, there are no significant legislative changes affecting Form 4768, but always check the IRS website for the latest revisions. The current version was last updated in February 2020, with the about page reviewed in January 2025.

Who Needs to File Form 4768?

Form 4768 is typically filed by:

- Executors of estates required to submit Form 706 or Form 706-NA

- Qualified heirs filing Form 706-A

- Trustees or designated filers for Form 706-QDT

If multiple executors are involved, only one needs to sign the form. Authorized representatives, such as attorneys or CPAs, can also file on behalf of the estate with a valid power of attorney.

You should consider filing if you anticipate needing more time due to complexities like asset valuation, litigation, or international elements. For instance, estates with assets in multiple jurisdictions or those involving future payment rights (e.g., annuities) often qualify for extensions based on reasonable cause.

Key Deadlines for IRS Form 4768

Timing is critical when dealing with estate taxes. Here’s a breakdown of standard due dates and extension timelines:

| Form | Original Due Date | Automatic Extension Period |

|---|---|---|

| Form 706 / 706-NA | 9 months after decedent’s death | 6 months |

| Form 706-A | 6 months after taxable disposition or cessation of qualified use | 6 months |

| Form 706-QDT | April 15 of the year following a taxable event (or 9 months after surviving spouse’s death) | 6 months |

- Automatic Filing Extension: File Form 4768 by the original due date of the return to get an automatic 6-month extension. No explanation is required unless you’re outside the U.S.

- Extension for Cause: If you miss the automatic extension deadline, you can still apply within 6 months of the original due date by providing a detailed explanation of good cause.

- Additional Extensions: Available only for executors outside the country, these can extend beyond the initial 6 months but require a separate Form 4768 and justification.

- Payment Extensions: Initial requests cannot exceed 12 months, with possible annual renewals up to 10 years for reasonable cause. File as early as possible, ideally by the tax due date.

If the due date falls on a weekend or holiday, it shifts to the next business day. For 2025 filings, confirm any adjustments via the IRS website.

How to Complete and File IRS Form 4768

Filling out Form 4768 requires careful attention to detail. Download the latest PDF from the IRS website. Here’s a step-by-step overview:

- Part I: Identification: Enter the decedent’s name, Social Security Number (SSN), date of death, and details about the executor or filer.

- Part II: Filing Extension: Check the box for automatic, for-cause, or additional extension. For non-automatic requests, attach a written statement explaining the need.

- Part III: Payment Extension: Specify the requested extension date and complete Part IV, which includes tax estimates, cash shortages, and payment plans. Attach supporting documentation for reasonable cause.

- Signatures: Sign and date the form. Include contact information.

Filing Methods:

- Mail to: Internal Revenue Service Center, Attn: Estate & Gift, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042-2915.

- Use certified mail or private delivery services for proof of timely filing.

- Electronic filing is not available for Form 4768.

If an extension is granted for payment, the IRS will respond with Form 4768-A. Pay any taxes due with interest, and consider furnishing a bond if required.

Automatic vs. Additional Extensions: What’s the Difference?

- Automatic Extensions: Simple and straightforward—file on time for a no-questions-asked 6-month delay in filing. This does not extend payment deadlines.

- Additional or For-Cause Extensions: These require justification, such as impracticality due to asset liquidity issues or being out of the country. They can provide more time but are discretionary and reviewed by the IRS.

Remember, separate forms may be needed for different extensions or amended returns.

IRS Form 4768 Download and Printable

Download and Print: IRS Form 4768

Extensions for Payment: Handling Tax Liabilities

If you can’t pay the full tax by the due date, use Part III to request relief. Provide evidence of reasonable cause, like insufficient liquid assets or ongoing litigation. Pay as much as possible upfront to minimize interest. Extensions are granted in 12-month increments, with a cap of 10 years for estates.

For closely held businesses, consider elections under Section 6166 for deferred payments, but note that payments designated for this are non-refundable if liability persists.

Interest, Penalties, and Common Pitfalls

Even with an extension, interest accrues on unpaid taxes from the original due date. Failure to file or pay within the extended period can trigger penalties. To avoid issues:

- File early and accurately.

- If no return is ultimately required (e.g., estate value below thresholds), notify the IRS with a letter including probate details.

- Consult a tax professional for complex estates.

Frequently Asked Questions About IRS Form 4768

Can I get an extension if I’m outside the U.S.?

Yes, additional extensions are specifically available for executors abroad, provided you explain the impracticality of timely filing.

Does Form 4768 extend both filing and payment?

No—filing and payment extensions are separate. You must request each individually.

What if my extension request is denied?

For payment extensions, appeal within 10 days using the instructions on Form 4768-A.

Are there state-specific requirements?

Some states, like the District of Columbia, require attaching Form 4768 to their estate tax forms. Check local rules.

How do I know if my estate needs Form 706?

If the gross estate exceeds the federal exemption (adjusted annually; check IRS for 2025 amounts), filing is required.

Final Thoughts on Managing Estate Tax Extensions

Navigating IRS Form 4768 can provide much-needed breathing room during estate administration. By understanding the form’s requirements and deadlines, you can ensure a smoother process and avoid costly errors. Always use the most current IRS resources and consider professional advice for personalized guidance. For the latest forms and instructions, visit the official IRS website.