Table of Contents

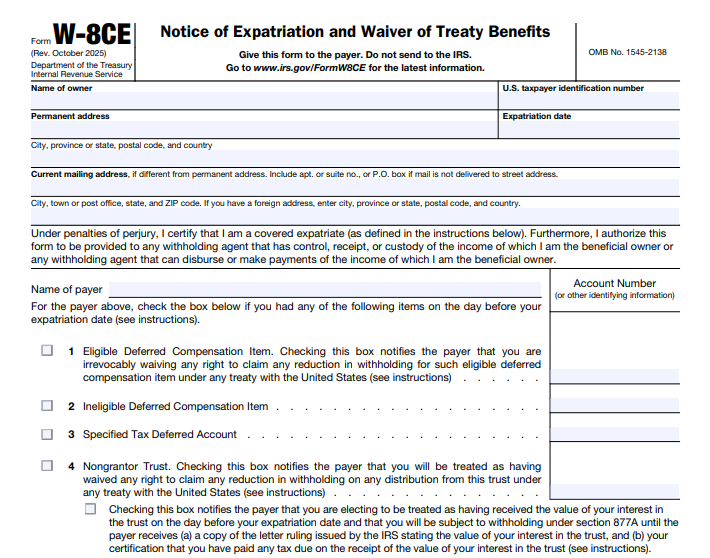

IRS Form W-8CE – Notice of Expatriation and Waiver of Treaty Benefits – Renouncing U.S. citizenship or long-term residency is a profound decision with far-reaching financial implications, but for covered expatriates, managing U.S. tax obligations on deferred compensation and trust distributions requires proactive steps. IRS Form W-8CE, Notice of Expatriation and Waiver of Treaty Benefits, is the critical document that notifies payers—such as trustees or employers—of your expatriate status, ensuring proper 30% withholding on eligible items while irrevocably waiving treaty reductions to comply with Section 877A of the Internal Revenue Code. As the IRS released the updated Form W-8CE (Rev. October 2025) in late 2024, with no major structural changes but clarified timing under Notice 2009-85, this form remains essential for expatriates avoiding double taxation pitfalls.

This SEO-optimized guide, based on the official 2025 Form W-8CE instructions and IRS Publication 519 (U.S. Tax Guide for Aliens), explores the form’s purpose, who files it, step-by-step completion, deadlines, and strategies for compliance. If you’re a covered expatriate navigating exit taxes or trust payouts, Form W-8CE prevents withholding surprises—file it before your first distribution to safeguard your assets. Download the 2025 PDF from IRS.gov and submit within 30 days of expatriation to stay ahead.

What Is IRS Form W-8CE?

Form W-8CE is a notification form used by covered expatriates to alert payers (e.g., trustees of U.S. trusts or employers with deferred compensation) of their expatriate status, triggering 30% withholding on certain U.S.-source income items under Section 877A. It also serves as an irrevocable waiver of any treaty-based reductions in withholding rates, ensuring the payer applies the full statutory rate without foreign tax treaty relief.

The concise one-page form (OMB No. 1545-2138) includes:

- Line 1: Expatriation details and waiver checkbox for eligible deferred compensation (e.g., pensions, deferred comp under Section 409A).

- Line 2: Identification of the item subject to withholding (e.g., trust distribution, IRA payout).

- Line 3: Payer notification certification.

- Signature: Under penalties of perjury, dated.

For 2025 (Rev. October 2025), instructions align with Notice 2009-85, requiring submission before the first post-expatriation distribution or within 30 days of expatriation to avoid payer liability. Submit directly to the payer—no IRS filing required—making it a payer-focused compliance step rather than a taxpayer return. Failure to provide it can result in overwithholding or payer penalties, while checking the waiver box confirms ineligibility for treaty benefits on covered items.

Key Fact: Covered expatriates—those with average annual net income tax >$201,000 (2025 threshold, up from $190,000 in 2024), net worth >$2 million, or non-compliance with U.S. tax obligations—face this 30% regime on deferred items, regardless of new citizenship.

Who Must File Form W-8CE?

Covered expatriates must provide Form W-8CE to any payer of eligible deferred compensation or trust distributions before receiving payments, as required by Section 877A and Notice 2009-85. This includes:

- Individuals: U.S. citizens or long-term residents (green card holders) who expatriate via Form 8854, becoming covered under Section 877A.

- Eligible Items: Deferred compensation (pensions, nonqualified plans, IRAs), U.S. trust distributions, or specified tax deferred accounts.

- Payers: Trustees, employers, IRA custodians, or financial institutions making distributions.

Threshold: Applies only to covered expatriates—those failing the $201,000 income test, $2 million net worth test, or certification of tax compliance on Form 8854.

Exceptions:

- Non-covered expatriates: No form needed; standard treaty withholding applies.

- Distributions before expatriation: Not subject.

- No eligible items: Skip the form.

Provide to each payer separately; retain a copy for records.

Step-by-Step Guide: How to Complete IRS Form W-8CE for 2025

The 2025 Form W-8CE is a one-page PDF—download from IRS.gov and complete in black ink or digitally (no e-signature required). Submit to payer; no IRS copy.

1. Line 1: Expatriation Details and Waiver

- Enter expatriation date (from Form 8854).

- Check box if waiving treaty benefits for eligible deferred compensation (irrevocable; required for compliance).

- If not waiving, note that withholding may be reduced, but payers often apply 30% anyway.

2. Line 2: Item Identification

- Describe the item (e.g., “Distribution from XYZ Trust” or “Pension payment from ABC Corp”).

- Specify type (e.g., Section 409A deferred comp, trust interest).

3. Line 3: Certification

- Confirm you’re a covered expatriate.

- State the form notifies the payer of status and waiver.

4. Signature and Date

- Sign under perjury; date (must be timely).

- Include name and title if applicable.

Pro Tip: Submit before first distribution to avoid payer withholding at higher rates or penalties; attach to Form 8854 if initial expatriation filing.

Deadlines and How to Submit Form W-8CE for 2025

Provide Form W-8CE to the payer on or before the earlier of 30 days after expatriation or the day before the first distribution post-expatriation. No IRS filing deadline—it’s payer-specific.

- Initial Expatriation: Attach to Form 8854 (due with your final U.S. return, generally June 15 following expatriation year).

- Ongoing Distributions: Renew annually or upon payer request.

- Amendments: Resubmit if status changes (rare post-waiver).

Payers retain; you keep copies for 3 years. Late submission may trigger 30% withholding without treaty relief.

Common Mistakes to Avoid When Filing Form W-8CE

Non-compliance can lead to overwithholding or payer penalties—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Late Submission | Missing 30-day window. | File before first distribution; calendar alert. | 30% withholding; no treaty relief. |

| No Waiver Checkbox | Forgetting irrevocable election. | Check if claiming treaty would reduce; consult advisor. | Payer applies full rate anyway. |

| Incomplete Item ID (Line 2) | Vague description. | Specify trust/pension name, Section (e.g., 409A). | Payer confusion; delayed processing. |

| Wrong Expatriation Date | From Form 8854 mismatch. | Use certified date; attach 8854 copy if needed. | Invalid notice. |

| Not Providing to All Payers | Overlooking multiple sources. | Submit to each trustee/employer separately. | Selective withholding issues. |

| No Record Retention | Losing payer copy. | Keep signed originals 3 years. | Audit disputes. |

Resubmit if errors; no penalty for good-faith.

IRS Form W-8CE Download and Printable

Download and Print: IRS Form W-8CE

2025 Updates and Special Considerations for Form W-8CE

The 2025 Form W-8CE (Rev. October 2025) is largely unchanged:

- OMB No.: 1545-2138; Cat. No. 61813N.

- Thresholds: Covered expatriate income >$201,000 (up from $190,000); net worth $2M.

- Timing: 30 days post-expatriation or pre-distribution (Notice 2009-85).

- Eligible Items: Deferred comp (409A), trusts, pensions; no change.

- Waiver: Irrevocable; applies per item.

- Payer Relief: Proper W-8CE protects from liability.

For dual-citizens/minors, exceptions apply (Pub. 519). Monitor Form 8854 for expatriation certification.

Final Thoughts: Navigate Expatriation Taxes with Form W-8CE in 2025

IRS Form W-8CE is a vital compliance step for covered expatriates, notifying payers of your status to enforce 30% withholding while waiving treaty perks irrevocably. For 2025, submit within 30 days of expatriation or pre-distribution to avoid surprises—essential for trusts and pensions. With thresholds at $201,000 income/$2M net worth, confirm coverage via Form 8854 first.

Consult Pub. 519 or a tax advisor for waivers. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form W-8CE

What is Form W-8CE used for in 2025?

Notifying payers of covered expatriate status for 30% withholding on deferred items.

When must Form W-8CE be submitted?

Within 30 days of expatriation or before first distribution.

Who is a covered expatriate for Form W-8CE?

Those with >$201,000 income, $2M net worth, or tax non-compliance.

Is the treaty waiver on Form W-8CE irrevocable?

Yes—once checked, no reductions under U.S. treaties.