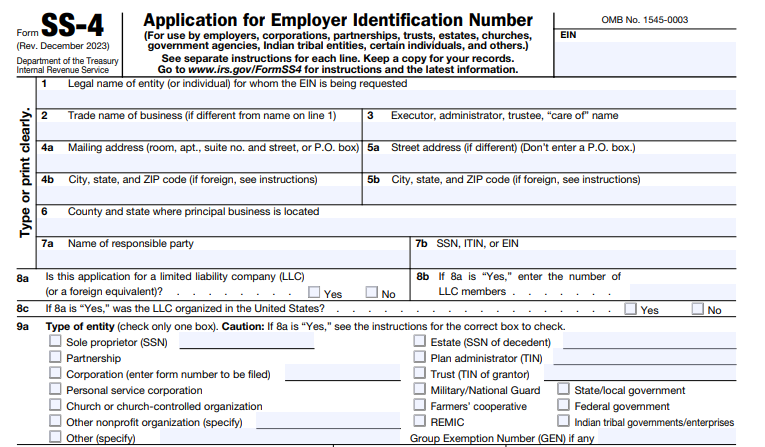

IRS Form SS-4 – Application for Employer Identification Number – An Employer Identification Number (EIN) serves as a unique nine-digit federal tax ID for businesses and organizations in the United States. Often called a Federal Tax Identification Number, it works like a Social Security Number for entities. Many businesses, nonprofits, trusts, and estates need an EIN for tax filing, hiring employees, opening bank accounts, and other purposes.

Form SS-4, Application for Employer Identification Number, lets you apply for an EIN by mail or fax. The IRS strongly recommends the free online application for faster processing—often instant.

This guide covers everything about IRS Form SS-4, including who needs an EIN, application methods, and step-by-step instructions based on the latest IRS guidelines as of 2025.

What Is an Employer Identification Number (EIN)?

The IRS assigns a nine-digit EIN (formatted as XX-XXXXXXX) to identify:

- Employers

- Sole proprietors

- Corporations

- Partnerships

- Nonprofits

- Trusts

- Estates

- Government agencies

- Other entities

for tax purposes.

You use it on business tax returns, payroll filings, and forms sent to the IRS or Social Security Administration (SSA). An EIN applies only to business activities and cannot replace a personal SSN or ITIN.

The IRS issues EINs for free, and you can obtain one immediately online in many cases.

Who Needs an EIN?

You generally need an EIN if you:

- Have employees

- Operate as a partnership, LLC, or corporation

- File employment, excise, or alcohol/tobacco/firearms tax returns

- Withhold taxes on income paid to a non-resident alien

- Administer trusts (except certain revocable grantor-owned trusts), estates, or retirement plans

- Represent tax-exempt organizations, farmers’ cooperatives, or real estate mortgage investment conduits

Even without federal tax requirements, banks or states may require an EIN for accounts or licenses. Sole proprietors without employees might not need one for federal taxes but often get one for privacy or business needs.

Note: Entities should have only one EIN. You need a new one only for major ownership or structure changes.

How to Apply for an EIN

The IRS offers several application methods. Online remains the fastest and most popular.

1. Apply Online (Recommended Method)

The IRS online EIN assistant at IRS.gov/EIN is free and available if your principal business is in the U.S. or territories.

- Eligibility — You must be the responsible party (owner or controller) with a valid SSN, ITIN, or EIN.

- Hours — Monday–Friday, 7 a.m. to 10 p.m. Eastern Time.

- Process — Answer questions, submit, and get your EIN immediately if approved. Print the confirmation letter.

- Limits — One EIN per responsible party per day; complete in one session (times out after 15 minutes of inactivity).

Form your entity with your state first to avoid issues.

2. Apply Using Form SS-4 (Mail or Fax)

Download Form SS-4 (Rev. December 2023) from IRS.gov and use it for mail or fax applications.

- Fax → Send to 855-641-6935 (U.S.) or 855-215-1627 (international). Expect your EIN in about 4 business days.

- Mail → Send to Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999 (U.S.) or EIN International Operation for others. Processing takes 4–6 weeks.

3. Apply by Phone (International Applicants Only)

Call 267-941-1099 (Monday–Friday, 6 a.m.–11 p.m. ET). Domestic applicants cannot use this method.

Important: Limit one EIN per responsible party per day across all methods.

IRS Form SS-4 Download and Printable

Download and Print: IRS Form SS-4

Step-by-Step Guide to Completing IRS Form SS-4

Follow these key instructions when filling out Form SS-4 (based on December 2023 revision):

- Line 1: Enter the legal name of the entity or individual (exactly as on founding documents).

- Line 2: Enter trade name or DBA if different.

- Lines 4–6: Provide mailing address, physical address (if different), county, and state.

- Lines 7a–b: Name the responsible party (individual who controls the entity) and their SSN/ITIN/EIN.

- Lines 8a–c: Indicate if it’s an LLC, number of members, and classification.

- Line 9a: Check the entity type (e.g., sole proprietor, corporation, partnership, trust).

- Line 10: Specify the reason for applying (e.g., started new business, hired employees).

- Lines 11–12: Enter start date and accounting year closing month.

- Lines 13–15: Report expected employees, wages, and first payroll date.

- Line 16–17: Describe principal business activity and line of merchandise/services.

- Line 18: Indicate if you had a prior EIN.

- Third-Party Designee: Optional authorization for someone to discuss the application.

- Signature: Sign as an authorized person.

Use only allowed characters in names (A-Z, 0-9, -, &). Report changes to responsible party or address using Form 8822-B within 60 days.

Common Mistakes to Avoid When Applying for an EIN

- Applying for multiple EINs for the same entity.

- Using a nominee instead of the true responsible party.

- Not forming the entity legally before applying.

- Paying third-party services (EINs are always free from the IRS).

FAQs About Form SS-4 and EINs

How long does it take to get an EIN?

Instant online; 4 days by fax; 4–6 weeks by mail.

Can I use my EIN immediately?

Yes for most purposes (bank accounts, licenses). Wait 2 weeks for e-filing or TIN matching.

What if I lose my EIN?

Check old notices, bank records, or call 800-829-4933.

Do I need a new EIN if I change my business name?

No—just notify the IRS if needed.

For the latest Form SS-4, instructions, and online tool, visit IRS.gov. Always apply directly through official IRS channels to avoid scams.