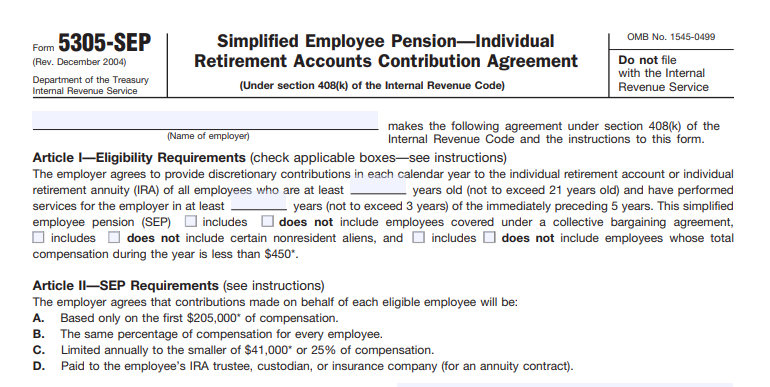

IRS Form 5305-SEP – Simplified Employee Pension – Individual Retirement Accounts Contribution Agreement – In today’s competitive job market, offering robust retirement benefits can be a game-changer for small businesses and self-employed individuals. One popular option is the Simplified Employee Pension (SEP) plan, established using IRS Form 5305-SEP. This form, officially titled “Simplified Employee Pension – Individual Retirement Accounts Contribution Agreement,” provides a straightforward way to set up retirement contributions without the complexities of traditional pension plans. Whether you’re a sole proprietor or a small business owner, understanding Form 5305-SEP can help you attract talent and secure your financial future.

What Is IRS Form 5305-SEP?

IRS Form 5305-SEP is a model document created by the Internal Revenue Service (IRS) to establish a SEP plan. A SEP is essentially a retirement plan where employers contribute directly to individual retirement accounts (IRAs) for eligible employees, including themselves if self-employed. Unlike more elaborate retirement plans, SEPs have minimal administrative costs and no annual filing requirements like Form 5500.

The form outlines the agreement between the employer and employees, specifying how contributions will be made to traditional IRAs. It’s designed for simplicity: employers can deduct contributions as business expenses, and employees benefit from tax-deferred growth on those funds. Note that this form cannot be used for Roth IRAs or if the employer maintains other qualified plans (except another SEP).

Who Should Use Form 5305-SEP?

Form 5305-SEP is ideal for small businesses, partnerships, corporations, and self-employed individuals looking for an easy retirement plan setup. It’s particularly suitable if:

- You want flexible contributions that can vary year to year.

- Your business has fluctuating income.

- You employ fewer than 25 people, though there’s no size limit.

However, avoid this form if:

- You use leased employees.

- You want to allow employee elective deferrals (use Form 5305A-SEP instead).

- Your plan year isn’t the calendar year.

Eligible employees must be at least 21 years old, have worked for you in at least 3 of the last 5 years, and earn at least $750 in 2025 (up from $750 in 2024). Employers can set less restrictive criteria but not more. Exclusions apply to union employees with bargained retirement benefits or nonresident aliens without U.S. income.

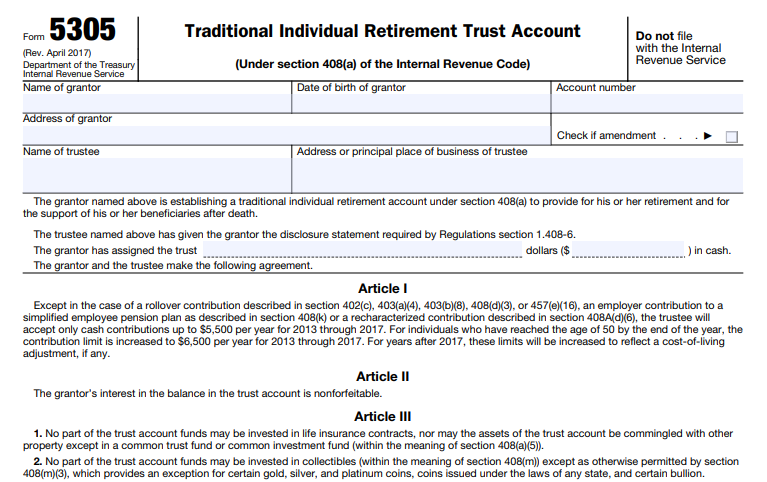

How to Establish a SEP Plan Using Form 5305-SEP

Setting up a SEP is straightforward and can be done retroactively up to your tax filing deadline (including extensions). Here’s the step-by-step process:

- Execute a Written Agreement: Complete Form 5305-SEP without modifications. Include your business name, employee participation requirements, and the contribution formula (typically a uniform percentage of compensation).

- Inform Employees: Provide each eligible employee with a copy of the completed form, its instructions, and statements about IRA options, amendments, and contribution notifications. Annual contribution notices are due by January 31 of the following year.

- Set Up IRAs: Establish a traditional IRA for each eligible employee at a qualified financial institution. Employees manage their investments.

Do not file the form with the IRS; keep it in your records. The agreement is adopted once IRAs are set up and information is distributed.

IRS Form 5305-SEP Download and Printable

Download and Print: IRS Form 5305-SEP

2025 SEP Contribution Limits and Rules

Contributions are employer-only and discretionary—you don’t have to contribute every year, but if you do, they must be uniform for all eligible employees. For 2025:

- Maximum Contribution: The lesser of 25% of an employee’s compensation or $70,000.

- Compensation Cap: Contributions are based on the first $350,000 of compensation.

- Minimum Compensation for Eligibility: $750.

For self-employed individuals, calculate compensation as net earnings minus half your self-employment tax and your own SEP contribution. Contributions are deductible on your business tax return and must be made by your tax filing deadline (including extensions). Employees are immediately 100% vested.

| Key 2025 Limits | Amount |

|---|---|

| Max Contribution per Employee | $70,000 or 25% of compensation (whichever is less) |

| Compensation Considered | Up to $350,000 |

| Min Compensation for Participation | $750 |

Excess contributions can be withdrawn penalty-free by your tax deadline but may incur taxes if left in the account.

Benefits of Using a SEP Plan

SEPs offer several advantages:

- Tax Benefits: Employer contributions are tax-deductible, and growth is tax-deferred for employees.

- Flexibility: No mandatory annual contributions, and easy setup.

- Low Costs: Minimal paperwork and no setup fees compared to 401(k)s.

- Employee Attraction: Helps retain talent by providing retirement security.

Withdrawals before age 59½ may face a 10% penalty, and distributions are taxed as ordinary income. Rollovers to other IRAs are allowed.

Common FAQs About Form 5305-SEP

Can I amend the SEP agreement?

Yes, but notify employees within 30 days of changes.

What if I miss the contribution deadline?

Contributions for a year can be made up to your tax return due date, including extensions.

Are SEPs subject to ERISA?

Generally, no annual reporting is required, but certain IRA restrictions may trigger ERISA rules.

How do I handle terminated employees?

If they were eligible during the year, they must receive contributions even if they leave before the deposit.

For the latest updates, always check the IRS website, as limits adjust annually for inflation.

Final Thoughts

IRS Form 5305-SEP simplifies retirement planning for small businesses, offering tax advantages and flexibility. By establishing a SEP, you invest in your employees’ futures while potentially reducing your taxable income. Consult a tax professional to ensure compliance, especially with 2025’s updated limits. Ready to get started? Download the form from the IRS site and take the first step toward a secure retirement strategy.