IRS Form 8825 – Rental Real Estate Income and Expenses of a Partnership or an S Corporation – In the world of real estate investing, partnerships and S corporations often hold rental properties as key assets. Properly reporting income and expenses from these activities is crucial for tax compliance. IRS Form 8825, titled “Rental Real Estate Income and Expenses of a Partnership or an S Corporation,” serves as the essential tool for this purpose. This form helps entities detail their rental operations, calculate net income or losses, and integrate these figures into their overall tax returns. Whether you’re a real estate investor, tax professional, or business owner, understanding Form 8825 can streamline your filing process and help avoid costly errors.

As we approach the 2025 tax season, staying updated on form changes is vital. This guide covers everything from the basics to advanced filing tips, drawing from official IRS resources and expert insights to ensure accuracy.

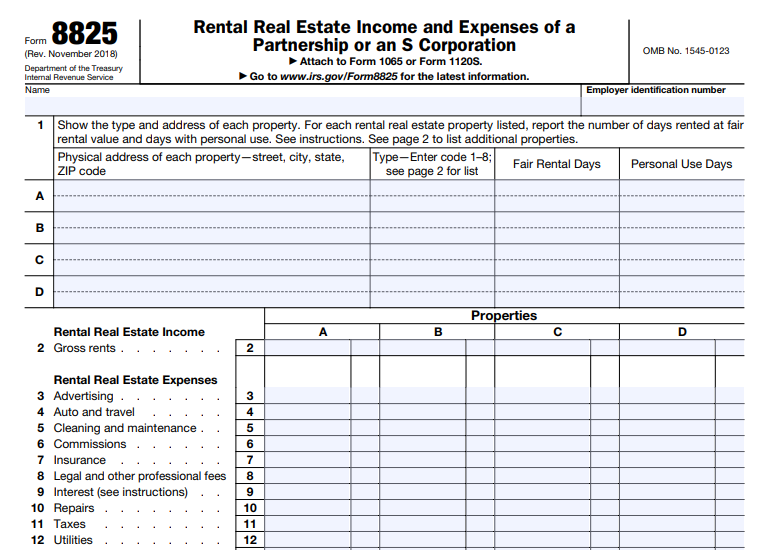

What Is IRS Form 8825 and Its Purpose?

IRS Form 8825 is specifically designed for partnerships and S corporations to report income and deductible expenses from rental real estate activities. It captures details like gross rents, other related income, and various expenses, ultimately calculating the net rental real estate income or loss. This net figure flows to Schedule K of Form 1065 (for partnerships) or Form 1120-S (for S corporations), where it’s distributed to partners or shareholders via Schedule K-1.

The form’s primary goal is to provide a clear breakdown of rental operations, ensuring compliance with passive activity rules and other tax provisions. It’s not for individual taxpayers—sole proprietors or single-member LLCs report rental income on Schedule E of Form 1040 instead. By using Form 8825, entities can accurately reflect how rental properties impact their overall taxable income, potentially qualifying for deductions that reduce tax liability.

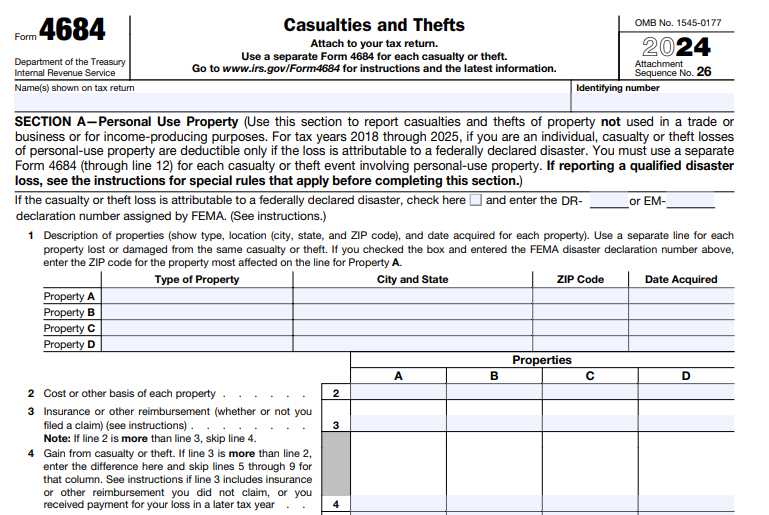

Example of IRS Form 8825 (Source: IRS official draft for illustrative purposes).

Key Updates to Form 8825 for the 2025 Tax Year

The IRS has introduced several modifications to Form 8825 for tax years beginning in 2025, based on draft releases. These changes aim to increase transparency, especially for larger entities, without altering what expenses are deductible.

- Separation of Income Types: Gross rents and “other income” (e.g., late fees, application fees, tenant reimbursements, or amenity income like parking or laundry) must now be reported separately on Lines 2a and 2b. This applies to all filers and helps the IRS better categorize revenue streams.

- New Schedule A (Form 8825): Entities required to file Schedule M-3 (typically those with $10 million or more in assets) must use this new schedule to break down “other deductions” on Line 17 into 20 specific categories, such as asset management fees, contract services, and prepayment penalties. Non-M-3 filers can still lump these into Line 17 without the schedule.

- Expanded Property Information Codes: A new Column (c) on Line 1 requires codes (A through I) for transactions like acquisitions, dispositions, or basis adjustments (e.g., Code A for nontaxable contributions under sections 721 or 351). This is mandatory only for M-3 filers.

- Form Layout Enhancements: Page 2 now accommodates four additional properties, allowing up to eight per form without extra pages in some cases.

These updates reflect the IRS’s push for more granular reporting in pass-through entities, particularly those with complex rental portfolios. Always use the December 2025 revision for 2025 filings, and check IRS.gov for final versions.

Who Must File IRS Form 8825?

Partnerships (filing Form 1065) and S corporations (filing Form 1120-S) engaged in rental real estate activities must attach Form 8825 to their returns. This includes entities that:

- Own and rent out properties like apartments, commercial spaces, or vacation homes.

- Receive flow-through income or losses from rental activities in other partnerships, estates, or trusts.

If your entity has no rental income but incurs related expenses (e.g., from a property under renovation), you may still need to file to report losses. However, do not use Form 8825 for trade or business activities, portfolio income, or non-real estate rentals—these go elsewhere on the return.

Passive activity limitations apply, so consult the instructions for Form 1065 or 1120-S. If multiple activities exist under these rules, attach statements to Schedule K and K-1s detailing net income/loss per activity.

What Information Do You Need to Report on Form 8825?

Form 8825 requires a per-property breakdown in columns A through H (up to eight properties per form; use multiples for more). Key sections include:

Property Details (Line 1)

- Physical address.

- Property type code (1-8, e.g., 2 for multi-family residence).

- Other information code (A-I, for M-3 filers).

- Fair rental days and personal use days (per section 280A).

Income (Lines 2a-2c)

- Gross rents (Line 2a).

- Other rental-related income (Line 2b).

- Total income per property (Line 2c).

Expenses (Lines 3-18)

Deductible costs like advertising, insurance, repairs, depreciation, and more. Total expenses per property on Line 18, with net income/loss on Line 19.

Summary and Additional Items (Lines 20-23)

- Totals across all properties.

- Net gains/losses from property dispositions (from Form 4797).

- Flow-through items from other entities.

Report everything accurately, as underreporting can trigger audits.

Step-by-Step Guide: How to Fill Out IRS Form 8825

Filling out Form 8825 involves gathering records like lease agreements, expense receipts, and depreciation schedules. Here’s a detailed walkthrough:

- Enter Entity Information: At the top, input the partnership or S corporation’s name and EIN.

- List Properties (Line 1): Detail each property’s address, type code, other info code (if applicable), fair rental days, and personal use days.

- Report Income (Lines 2a-2c): Enter gross rents on 2a and other income on 2b for each column. Sum to 2c.

- Detail Expenses (Lines 3-17):

- Line 3: Advertising costs.

- Line 4: Auto and travel.

- Line 5: Cleaning/maintenance.

- Line 6: Commissions (not including mortgage or sales).

- Line 7: Insurance (property/casualty).

- Line 8: Interest (may require Form 8990 for limitations).

- Line 9: Legal/professional fees.

- Line 10: Repairs (not capital improvements).

- Line 11: Taxes (real estate; check deductibility).

- Line 12: Utilities.

- Line 13: Wages/salaries.

- Line 14: Depreciation (attach Form 4562 if needed).

- Lines 15-16: Reserved.

- Line 17: Other deductions (use Schedule A for M-3 filers).

- Calculate Per-Property Totals (Lines 18-19): Sum expenses (18) and subtract from income (19).

- Complete Summary (Lines 20-23):

- 20a/b: Total income/expenses across properties.

- 21: Net from Form 4797.

- 22a/b: Flow-through items and entity details.

- 23: Overall net; transfer to Schedule K, Line 2.

If you have more than eight properties, attach additional forms and combine totals on one.

IRS Form 8825 Download and Printable

Download and Print: IRS Form 8825

Common Rental Real Estate Expenses and Reporting Tips

Deductible expenses on Form 8825 include everyday costs of operating rental properties. Here’s a breakdown:

| Expense Category | Examples | Reporting Notes |

|---|---|---|

| Advertising | Marketing to attract tenants | Line 3; fully deductible if ordinary and necessary. |

| Insurance | Property, liability coverage | Line 7; exclude title insurance (add to basis). |

| Repairs vs. Improvements | Fixing leaks (repair) vs. new roof (improvement) | Line 10 for repairs; capitalize improvements and depreciate on Line 14. |

| Depreciation | Wear and tear on buildings | Line 14; use MACRS rules, attach Form 4562 for new assets. |

| Interest | Mortgage payments | Line 8; subject to section 163(j) limits—file Form 8990 if applicable. |

| Other Deductions | Management fees, utilities | Line 17; detail on Schedule A if required. |

Tip: Distinguish repairs from improvements to avoid IRS reclassification. Keep detailed records for at least three years.

Special Rules for Partnerships and S Corporations

- Passive Activity Limitations: Rental activities are generally passive; losses may be limited based on participation. Group activities appropriately but report per property on Form 8825.

- Self-Rental and Personal Use: Code self-rentals as 7; track personal days to comply with section 280A.

- Flow-Through Items: Report net from K-1s on Line 22a.

- M-3 Filers: Mandatory use of Schedule A and codes for enhanced scrutiny.

Consult a tax advisor for complex scenarios like basis adjustments or section 1031 exchanges.

Related Forms and Attachments

- Form 4562: For depreciation details.

- Form 4797: Sales of business property.

- Form 8990: Business interest expense limitations.

- Schedule M-3: If assets ≥ $10M, triggers Schedule A.

- Additional Statements: For passive activity breakdowns.

Attach these to your Form 1065 or 1120-S as needed.

Tips for Accurate Filing and Avoiding Common Mistakes

- Gather Documentation Early: Use accounting software to track per-property data.

- Double-Check Calculations: Ensure totals on Lines 20-23 match all pages.

- Avoid Mixing Categories: Separate gross rents from other income; don’t deduct non-allowable items like federal taxes.

- Stay Updated: Monitor IRS.gov for final 2025 forms—drafts are for reference only.

- E-File for Efficiency: Platforms like TaxZerone simplify electronic filing with Form 1120-S.

- Common Pitfalls: Forgetting to attach Form 4562, misclassifying expenses, or ignoring interest limits.

By following these steps, you can minimize audit risks and maximize deductions.

Conclusion: Mastering Form 8825 for Tax Success

IRS Form 8825 is a cornerstone for partnerships and S corporations managing rental real estate. With the 2025 updates emphasizing detailed reporting, proactive preparation is key. Whether you’re handling a single apartment building or a portfolio of commercial properties, accurate completion ensures compliance and optimizes your tax position. For personalized advice, consult a certified tax professional. Stay informed, file on time, and leverage rental deductions to support your real estate ventures.