Table of Contents

IRS Form 172 – Net Operating Losses (NOLs) For Individuals, Estates, and Trusts – In the complex world of tax planning, net operating losses (NOLs) can provide significant relief for taxpayers facing financial setbacks. If your deductions exceed your income in a given year, you might qualify for an NOL, allowing you to offset taxable income in other years. IRS Form 172 is the key document for calculating and managing these losses for individuals, estates, and trusts. This comprehensive guide breaks down everything you need to know about Form 172, including how to calculate NOLs, carryover rules, and recent updates, to help you optimize your tax strategy.

What Is a Net Operating Loss (NOL)?

A net operating loss occurs when your allowable tax deductions surpass your gross income for the year, typically stemming from business activities, employment, casualty or theft losses from federally declared disasters, moving expenses, or rental properties. NOLs are not just for corporations; individuals, estates, and trusts can also benefit by using them to reduce taxable income in prior or future years.

For example, if you’re a small business owner or freelancer and experience a loss due to high expenses, an NOL can help you recover some of that by applying the loss against profitable years. Importantly, NOLs exclude certain items like capital losses exceeding gains, nonbusiness deductions over nonbusiness income, prior NOL deductions, and qualified business income (QBI) deductions under Section 199A.

Who Needs to Use IRS Form 172?

Form 172 is specifically designed for non-corporate taxpayers—individuals, estates, and trusts—who need to determine the amount of an NOL available for carryback or carryforward. If you’re filing Form 1040 (U.S. Individual Income Tax Return), Form 1040-NR, or Form 1041 (U.S. Income Tax Return for Estates and Trusts), and suspect an NOL, this form is essential.

Partnerships and S corporations don’t file Form 172 directly, but partners and shareholders can use their distributive shares to calculate personal NOLs. Keep detailed records for at least three years after using the NOL or until the carryforward expires, as the IRS may require verification.

Step-by-Step: How to Calculate an NOL Using Form 172

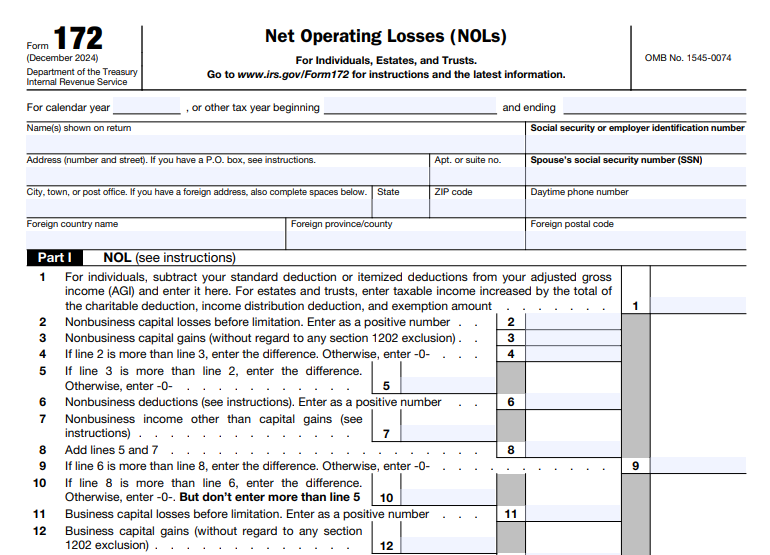

Calculating an NOL involves a structured process outlined in Form 172’s Part I. Here’s a breakdown:

- Complete Your Tax Return First: Start by filing your regular tax return for the NOL year. For individuals, subtract your standard or itemized deductions from adjusted gross income (AGI). For estates and trusts, adjust taxable income by adding back charitable deductions, income distribution deductions, and exemptions. A negative result signals a potential NOL.

- Figure the NOL Amount: Use Part I of Form 172 to compute the loss. Key lines include:

- Line 2: Enter nonbusiness capital losses (excluding Section 1202 exclusions for qualified small business stock).

- Line 6: List nonbusiness deductions, such as IRA contributions, alimony, or itemized deductions (excluding business-related ones like self-employed health insurance).

- Line 7: Input nonbusiness income, like dividends or interest (excluding wages or business profits).

- Line 17: Add back Section 1202 exclusions as a positive amount.

- Lines 19–22: Apply capital loss limitations—nonbusiness capital losses are limited to nonbusiness capital gains, while business losses have broader offsets.

- Line 23: Exclude any NOL deductions from prior years.

The final NOL is shown on Line 33 if negative.

- Handle Excess Business Losses: If your trade or business deductions exceed income plus a threshold (adjusted annually), use Form 461 to calculate the excess, which is treated as an NOL carryforward. Combine this with your Form 172 results using the provided worksheet.

If you have multiple NOLs, apply them starting with the earliest year.

IRS Form 172 Download and Printable

Download and print: IRS Form 172

NOL Carryback and Carryforward Rules Explained

One of the biggest advantages of NOLs is their flexibility in application:

- Carryback Rules: For NOLs arising in tax years after 2020, general carrybacks are eliminated, except for farming losses, which can be carried back two years. Farming losses are defined as those from cultivating or raising agricultural commodities, excluding contract work. To claim a carryback, file Form 1045 (Application for Tentative Refund) or an amended return (Form 1040-X or 1041).

- Waiving Carryback: You can elect to forgo carryback and only carry forward by attaching a statement to your timely filed return (including extensions). This election is irrevocable if made on time.

- Carryforward Rules: Unused NOLs can be carried forward indefinitely. However, for post-2017 NOLs carried to years after 2020, the deduction is limited to 80% of taxable income (calculated without the NOL, QBI, or Section 250 deductions, minus pre-2018 NOLs). Use Part II of Form 172 to figure the carryover deduction for each year, adjusting for items like capital losses, QBI deductions, and modified taxable income.

For joint returns where filing status changes, allocate the NOL based on each spouse’s contribution.

Recent Changes to NOL Rules for 2025

As of 2025, NOL rules remain largely consistent with post-2020 reforms, with no major alterations specifically targeting NOLs in recent legislation like the One Big Beautiful Bill Act. However, broader tax changes—such as new deductions for seniors ($6,000 additional for those 65+ from 2025–2028) and tip/overtime reporting relief—could indirectly affect income calculations that feed into NOLs. Always check for updates, as itemized deduction limits and bonus depreciation extensions set for 2026 might influence future NOL strategies.

How to File IRS Form 172 and Related Forms

Form 172 isn’t filed separately; it’s used to support your NOL calculations when amending returns or applying for refunds. Attach it to Form 1045 for quick refunds on carrybacks or include the calculations in your amended return. For software users like TaxSlayer or Intuit ProSeries, Form 172 is integrated for e-filing, with availability confirmed for March 2025 prints.

Related forms include:

- Form 1045 for tentative refunds.

- Form 461 for excess business losses.

- Schedule A (Form 1040) for itemized deductions.

Consult IRS Publication 536 for additional guidance, though it’s no longer being revised as of October 2024.

Real-World Examples of Using Form 172

Consider a married couple filing jointly with a $5,000 farming NOL. If they carried it back to a year of separate filings, only the spouse responsible for the loss claims it. In another scenario, a single taxpayer with a $1 million Schedule C loss might have a $738,000 excess business loss after Form 461, treated as an NOL carryforward.

These examples illustrate how Form 172 ensures accurate allocation and maximizes tax benefits.

Maximizing Your Tax Benefits with NOLs

Navigating IRS Form 172 can turn a financial loss into a strategic advantage, reducing your tax burden over multiple years. Whether you’re an individual dealing with business setbacks or managing an estate, understanding NOL calculation and carryover rules is crucial. For personalized advice, consult a tax professional, as rules can vary based on your situation.

Stay updated with IRS resources to ensure compliance and optimization. By leveraging Form 172 effectively, you can enhance your financial recovery and long-term tax planning.