Table of Contents

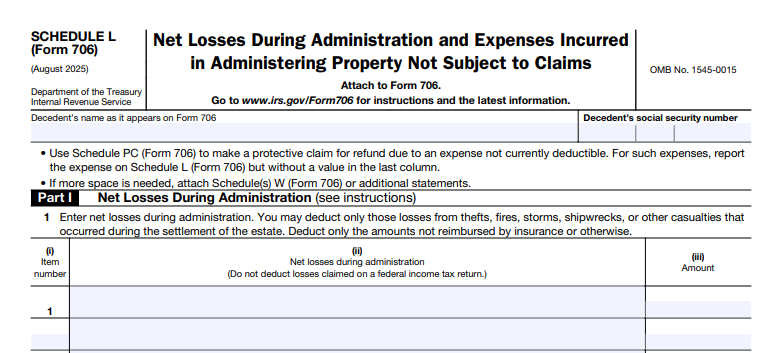

IRS Form 706 (Schedule L) – Net Losses During Administration and Expenses Incurred In Administering Property Not Subject to Claims – In the complex world of estate tax planning and administration, IRS Form 706—the United States Estate (and Generation-Skipping Transfer) Tax Return—serves as the cornerstone for reporting and calculating federal estate taxes. For decedents dying in 2025, estates exceeding the basic exclusion amount must file this form within nine months of death. Among its many schedules, Schedule L (Form 706) stands out for addressing specific deductions that can significantly reduce the taxable estate: net losses during administration and expenses incurred in administering property not subject to claims.

If you’re an executor, estate administrator, or tax professional navigating Form 706, understanding Schedule L is essential. This guide breaks down its purpose, requirements, and step-by-step completion process, drawing from the official IRS Instructions for Form 706 (Rev. September 2025) and related publications. Proper use of Schedule L can help minimize estate tax liability under Internal Revenue Code (IRC) Section 2053, ensuring compliance while maximizing allowable deductions.

What Is IRS Form 706 Schedule L?

Schedule L is a dedicated attachment to Form 706 used to claim deductions for two key categories of estate-related costs and losses:

- Net Losses During Administration: These are unreimbursed losses occurring after the decedent’s death but before the estate is fully settled, such as from casualties (e.g., fire, storm, theft) or dispositions of estate assets.

- Expenses Incurred in Administering Property Not Subject to Claims: These cover costs for managing assets included in the gross estate but exempt from general creditor claims, like property passing directly to beneficiaries via trusts or joint tenancy.

Unlike Schedule J (funeral and administration expenses subject to claims) or Schedule K (debts and liens), Schedule L focuses on non-claim-protected items. Deductions here flow to Form 706, Part 5 (Recapitulation), specifically lines 19 (net losses) and 20 (such expenses), reducing the tentative tax under the unified rate schedule.

For 2025 decedents, the basic exclusion amount is inflation-adjusted (see IRS Rev. Proc. 2025-15 for exact figures), but Schedule L deductions apply regardless of whether the estate meets the filing threshold—especially if electing portability of the deceased spousal unused exclusion (DSUE).

Key Tip: Always attach Schedule L if claiming these deductions. Use Schedule W (Form 706) for additional space, and retain supporting documents like invoices, insurance reports, and appraisals for IRS audits.

Purpose of Schedule L: Reducing Taxable Estate Under IRC Section 2053

The primary goal of Schedule L is to allow estates to deduct legitimate post-death losses and administrative costs that diminish the estate’s value without benefiting creditors. This aligns with IRC Section 2053, which permits deductions for expenses “actually and necessarily incurred in the administration of the decedent’s estate.”

- Net Losses: These prevent overvaluation of the estate by accounting for real economic hits during settlement.

- Non-Claim Expenses: These ensure fair taxation of property that bypasses probate, like revocable trusts or life insurance proceeds.

Deductions are limited to amounts paid within the statute of limitations (generally three years after filing Form 706 under IRC Section 6501). Estimates are allowable if verifiable and due before expiration—attach proof. If electing alternate valuation (six months post-death), exclude losses from value reductions.

Failure to report these can lead to penalties, but protective claims via Schedule PC (Form 706) allow future refunds for non-currently deductible items. For 2025 updates, note the redesigned Form 706 schedules for better efficiency, with no specific changes to Schedule L.

Part I: Reporting Net Losses During Administration on Schedule L

Part I of Schedule L captures “net losses” from events like sales at a loss, thefts, fires, storms, shipwrecks, or other casualties during estate administration. Only unreimbursed amounts qualify—subtract insurance recoveries or other compensation.

Eligibility and Exclusions

- Eligible Losses: Must occur after death, affect estate-held property, and be documented (e.g., police reports for theft, appraisals for fire damage).

- Exclusions:

- Losses reimbursed by insurance.

- Depreciation or market declines (unless electing alternate valuation—then exclude).

- Losses claimed on the estate’s income tax return (Form 1041) to avoid double-dipping.

- Pre-death losses.

Cross-reference the affected property to its listing on Schedules A–U (e.g., real estate on Schedule A).

How to Complete Part I

Use the table format on the form (or attached sheets):

| Item No. | Description (Cause, Property ID, Amount Collected) | Value (Date-of-Death or Alternate) |

|---|---|---|

| 1 | [e.g., Fire damage to Schedule A, Item 2 property; $5,000 loss after $2,000 insurance] | $3,000 |

| … | … | … |

| Total | [Sum to Line 2] |

- Line 1: List individual net losses.

- Line 2: Subtotal from form.

- Line 3: Total from attached Schedule(s) W.

- Line 4: Grand total—enter on Form 706, Part 5, Item 19.

Example: If estate real estate (valued at $500,000 on Schedule A) suffers storm damage yielding a $10,000 unreimbursed loss, describe it fully and deduct $10,000 here. IRS examiners verify via bills and policies.

Part II: Expenses Incurred in Administering Property Not Subject to Claims

Part II targets costs for preserving, collecting, or distributing property in the gross estate but not liable for general claims (per Treas. Reg. § 20.2053-8(d)). This includes non-probate assets like trusts or joint property.

What Qualifies as Deductible Expenses?

Deductible items are those “necessarily” tied to estate settlement:

- Trust administration fees (e.g., trustee commissions for revocable trusts).

- Asset collection costs (e.g., legal fees to gather jointly held property).

- Title clearance or transfer expenses (e.g., recording fees for beneficiary vesting).

Nondeductible Examples:

- Beneficiary-specific costs (e.g., their legal fees post-distribution).

- Ongoing maintenance unrelated to settlement.

- Expenses already deducted on Form 1041.

Per Treas. Reg. § 20.2053-8, expenses must be reasonable and supported by vouchers. For protective claims, list without values.

How to Complete Part II

Mirror Part I’s table:

| Item No. | Payee Name/Address | Nature of Expense (Property ID) | Value |

|---|---|---|---|

| 1 | [e.g., ABC Trust Co., 123 Main St.; Trustee fees for Schedule G trust property] | $15,000 | |

| … | … | … | … |

| Total | [Sum to Line 6] |

- Lines 1–5: Individual entries.

- Line 6: Subtotal.

- Line 7: Attached totals.

- Line 8: Grand total—enter on Form 706, Part 5, Item 20.

Pro Tip: If expenses relate to estimated asset values under Reg. § 20.2010-2(a)(7)(ii), report but omit values—include in Part 5, Items 10 and 23.

IRS Form 706 (Schedule L) Download and Printable

Download and Print: IRS Form 706 (Schedule L)

Step-by-Step Guide: How to Fill Out Schedule L for 2025 Filings

- Gather Documents: Collect appraisals, insurance claims, invoices, and probate records. Identify property via Form 706 schedules.

- Determine Valuation Date: Use date-of-death values unless electing alternate (attach election statement).

- Complete Tables: Number items sequentially; round to nearest dollar.

- Calculate Totals: Add lines and transfer to Form 706, Part 5.

- Attach and File: Include with Form 706 by the due date (extensions via Form 4768). E-file if eligible.

- Protective Claims: Use Schedule PC for future-deductible items.

For complex estates, consult IRS Publication 559 (Survivors, Executors, and Administrators) or a tax advisor.

Common Mistakes to Avoid When Filing Schedule L

- Double-Dipping: Don’t deduct losses/expenses claimed on Form 1041.

- Inadequate Documentation: IRS audits require proof—keep everything for at least three years.

- Misclassifying Expenses: Use Schedule J for claim-subject items; Schedule L only for non-claim property.

- Ignoring Alternate Valuation: This can disqualify certain loss deductions.

- Overlooking Inflation Adjustments: For 2025, confirm exclusion limits via IRS.gov.

Audits focus on large/unusual items (LUQs), so substantiate claims thoroughly.

2025 Updates and Resources for IRS Form 706 Schedule L

The September 2025 revision of Form 706 includes redesigned schedules for streamlined filing, but Schedule L’s core rules remain unchanged. Key notes:

- Estate tax closing letter fee reduced to $56 (effective May 21, 2025).

- Enhanced electronic payment options.

- No Schedule L-specific inflation adjustments, but general thresholds apply.

Trusted Resources:

- Download Form 706 and Schedule L: IRS.gov/Form706.

- Full Instructions: IRS Instructions for Form 706 (PDF).

- Regulations: Treas. Reg. § 20.2053-3 (losses) and § 20.2053-8 (expenses).

- Pub. 559: Guidance for executors.

For personalized advice, consult a CPA or estate attorney. Filing accurately not only avoids penalties but optimizes your estate’s tax position.

This article is for informational purposes only and not tax advice. Verify with the IRS for your situation.