Table of Contents

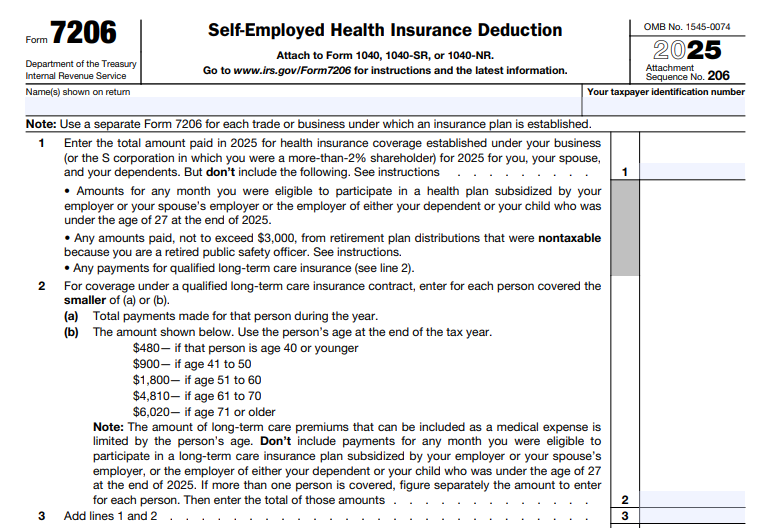

IRS Form 7206 – Self-Employed Health Insurance Deduction – Self-employed individuals often face high health insurance costs, but the IRS Form 7206 offers a valuable tax break through the self-employed health insurance deduction. This above-the-line deduction allows eligible taxpayers to subtract qualifying health insurance premiums directly from their adjusted gross income (AGI), potentially lowering taxable income and self-employment taxes indirectly. For the 2025 tax year, understanding Form 7206 is essential for freelancers, sole proprietors, partners, and S-corporation shareholders to maximize savings.

What Is IRS Form 7206?

Form 7206, Self-Employed Health Insurance Deduction, is an IRS form used to calculate and claim the deduction for health insurance premiums paid by self-employed individuals. The deducted amount is reported on Schedule 1 (Form 1040), line 17.

Introduced in recent years, Form 7206 replaced the previous Self-Employed Health Insurance Deduction Worksheet from Publication 535 (Business Expenses). It provides a standardized way to figure the deduction, especially in complex situations.

According to the official 2025 Instructions for Form 7206 on IRS.gov, you must use this form if certain conditions apply (detailed below). Otherwise, a simpler worksheet in the Form 1040 instructions may suffice.

Who Qualifies for the Self-Employed Health Insurance Deduction?

To claim the deduction using Form 7206, you must meet these key eligibility requirements:

- You are self-employed with a net profit reported on Schedule C, Schedule F, or Schedule K-1 (Form 1065).

- You are a partner in a partnership or a more-than-2% shareholder in an S-corporation who received wages, with health premiums paid or reimbursed by the S-corp (reported on Form W-2).

- You used an optional method to figure net earnings on Schedule SE.

- The insurance plan is established under your business (or considered established under it).

You cannot claim the deduction for any month if you (or your spouse) were eligible for subsidized employer-sponsored health coverage, including plans from your spouse’s, dependent’s, or child’s (under age 27) employer.

The deduction covers premiums for:

- Medical, dental, and vision insurance.

- Qualified long-term care insurance (subject to age-based limits).

It applies to coverage for yourself, your spouse, dependents, and children under age 27 at the end of 2025 (even if not dependents).

IRS Form 7206 Download and Printable

Download and Print: IRS Form 7206

How to Calculate the Deduction on Form 7206

The deduction is generally limited to your net profit from the business under which the insurance plan is established. Key steps from the 2025 instructions include:

- Enter premiums paid for qualifying health insurance (line 1) and long-term care (line 2).

- Calculate net profit or earned income attributable to the business.

- Apply limitations: The total deduction cannot exceed your net earnings from self-employment.

- If you have multiple businesses or plans, use a separate Form 7206 for each.

The final amount from line 14 of Form 7206 transfers to Schedule 1 (Form 1040).

Important notes:

- This deduction does not reduce net earnings for self-employment tax purposes (it only affects income tax).

- Excess premiums not deducted here may qualify as itemized medical expenses on Schedule A (but subtract the deducted amount first).

For Marketplace plans with premium tax credits (PTC), coordinate with Form 8962—only your net premiums qualify for this deduction.

When Must You Use Form 7206?

Most simple cases use the Form 1040 worksheet, but you must file Form 7206 if:

- You have more than one source of self-employment income.

- You claim qualified long-term care premiums.

- You have foreign earned income exclusion (Form 2555).

- You’re a more-than-2% S-corp shareholder with included wages.

Benefits and Limitations for 2025

- Benefit: Reduces AGI, which can lower your overall tax bracket and qualify you for other credits/deductions.

- Limitation: Cannot exceed business profit; no deduction if your business shows a loss.

- Retired public safety officers have special rules for distributions up to $3,000.

No major changes were noted for 2025 beyond standard updates (e.g., child age reference).

Tips for Claiming the Deduction

- Keep records of premiums paid and proof the plan is established under your business.

- Download the latest Form 7206 and instructions from IRS.gov/Form7206.

- Consult a tax professional for complex scenarios, like multiple businesses or PTC coordination.

By properly using Form 7206, self-employed taxpayers can significantly reduce their 2025 tax burden. Always refer to official IRS sources for the most accurate guidance.

Sources: IRS.gov (Form 7206, Instructions for 2025; Topic No. 502; Publication 974).