Table of Contents

IRS Form 8938 – Statement of Specified Foreign Financial Assets – In an increasingly globalized world, many U.S. taxpayers hold financial assets abroad, whether through investments, retirement accounts, or business interests. To ensure compliance with tax laws and combat tax evasion, the IRS requires certain individuals and entities to report these holdings using IRS Form 8938, also known as the Statement of Specified Foreign Financial Assets. This form is a key component of the Foreign Account Tax Compliance Act (FATCA), which aims to increase transparency in international financial dealings.

If you’re a U.S. citizen, resident alien, or certain domestic entities with foreign assets, understanding Form 8938 is crucial to avoid hefty penalties. In this comprehensive guide, we’ll cover everything you need to know about who needs to file Form 8938, the reporting thresholds, what assets qualify, step-by-step filing instructions, and more. Whether you’re an expat, investor, or business owner, staying informed can help you navigate tax season smoothly for the 2025 tax year.

What Is IRS Form 8938 and Its Purpose?

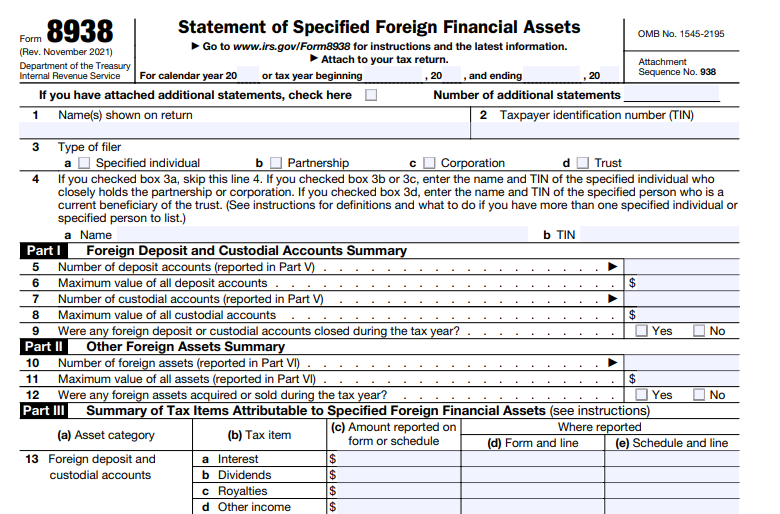

IRS Form 8938 is an information reporting form used by U.S. taxpayers to disclose specified foreign financial assets that exceed specific value thresholds during the tax year. Introduced under FATCA in 2010, it helps the IRS track offshore assets and ensure that income from these sources is properly reported on U.S. tax returns.

Unlike other forms, Form 8938 doesn’t calculate taxes owed—it’s purely for disclosure. However, failing to file it when required can lead to significant penalties, even if all taxes on the assets have been paid. The form must be attached to your annual tax return, such as Form 1040, and is due by the standard filing deadline (typically April 15, or later with an extension).

For the 2025 tax year, there are no major structural changes to Form 8938 based on current IRS guidance, but taxpayers should always check for updates on the official IRS website. It’s designed to complement other reporting requirements, like the Report of Foreign Bank and Financial Accounts (FBAR), but covers a broader range of assets.

Who Needs to File Form 8938?

Not every U.S. taxpayer with foreign assets must file Form 8938. Filing is required only if you are a “specified person” and the total value of your specified foreign financial assets exceeds the applicable reporting threshold.

Specified persons include:

- U.S. citizens and resident aliens.

- Nonresident aliens who elect to file jointly with a U.S. spouse.

- Certain bona fide residents of U.S. territories (e.g., American Samoa or Puerto Rico) in limited cases.

- Specified domestic entities, such as closely held corporations, partnerships, and trusts where at least 50% ownership is held by specified individuals.

If you meet these criteria and your assets hit the thresholds (detailed below), you must file. Note that even if you’re living abroad, you may still qualify as a specified person under U.S. tax rules.

Reporting Thresholds for Form 8938 in 2025

The Form 8938 filing thresholds depend on your filing status, marital status, and whether you live in the U.S. or abroad. These thresholds are based on the aggregate value of all specified foreign financial assets—either on the last day of the tax year or the highest value at any point during the year (whichever is greater).

Here’s a breakdown in the table below for clarity:

| Filing Status | Living in the U.S. (Last Day / Anytime During Year) | Living Abroad (Last Day / Anytime During Year) |

|---|---|---|

| Unmarried or Married Filing Separately | $50,000 / $75,000 | $200,000 / $300,000 |

| Married Filing Jointly | $100,000 / $150,000 | $400,000 / $600,000 |

These thresholds have remained consistent into 2025, with no adjustments noted in recent IRS updates. For specified domestic entities, the threshold is generally $50,000 on the last day or $75,000 anytime, regardless of location.

To determine if you’ve exceeded the threshold, sum the maximum fair market value of all qualifying assets during the year, converted to U.S. dollars using appropriate exchange rates.

What Are Specified Foreign Financial Assets?

Specified foreign financial assets include a wide range of holdings outside the U.S. that are held for investment purposes. These are divided into two main categories: financial accounts maintained by foreign financial institutions and other foreign assets not held in such accounts.

Examples include:

- Financial Accounts: Bank deposits, custodial accounts, cash-value insurance policies, or annuities issued by foreign institutions.

- Other Assets:

- Stocks or securities issued by non-U.S. companies.

- Interests in foreign partnerships, trusts, or estates.

- Bonds, notes, or other debt instruments from foreign issuers.

- Derivative contracts like swaps or options with foreign counterparties.

- Interests in foreign entities, such as corporations or hedge funds.

Exclusions apply to assets used in a trade or business, certain U.S.-based accounts (even if holding foreign securities), and assets already reported on other IRS forms like Form 3520 or 5471. Real estate is generally not reportable unless held through a foreign entity.

For valuation, use the fair market value in U.S. dollars, often based on year-end statements or exchange rates from the U.S. Treasury.

How to File IRS Form 8938: Step-by-Step Guide

Filing Form 8938 involves attaching it to your tax return. Here’s a simplified step-by-step process based on IRS instructions:

- Gather Information: Collect details on all specified foreign assets, including maximum values, account numbers, and income generated.

- Complete Identifying Info: Enter your name, TIN, and type of filer (individual or entity).

- Part I & II: Summaries: Report the number and total value of foreign deposit/custodial accounts and other assets.

- Part III: Tax Items: Summarize interest, dividends, gains, and other income from these assets.

- Part IV: Exceptions: Note if assets are reported on other forms to avoid duplication.

- Parts V & VI: Details: Provide specifics for each account or asset, including descriptions, values, and foreign currency info if applicable.

- Attach and File: Submit with your Form 1040 or equivalent by the due date, including extensions. Electronic filing is recommended.

If you have multiple assets, use continuation sheets. For joint filers, report the full value but file only one form.

Penalties for Not Filing Form 8938

Non-compliance with Form 8938 filing requirements can be costly. The initial penalty for failure to file is $10,000 per year. If the IRS notifies you and you continue to fail, additional penalties of $10,000 per 30 days can apply, up to a maximum of $50,000.

Accuracy-related penalties (up to 40% of underpaid tax) may also apply if underreporting is willful. In cases of fraud, criminal penalties could be imposed. To mitigate risks, consider the IRS’s streamlined compliance procedures if you’ve missed filings in prior years.

IRS Form 8938 Download and Printable

Download and Print: IRS Form 8938

Key Differences Between Form 8938 and FBAR

Many taxpayers confuse Form 8938 with the FBAR (FinCEN Form 114). While both involve foreign asset reporting, they differ significantly:

- Thresholds: FBAR triggers at $10,000 aggregate in foreign accounts anytime during the year; Form 8938 has higher thresholds.

- Assets Covered: FBAR focuses on financial accounts; Form 8938 includes broader assets like stocks and contracts.

- Filing: FBAR is filed separately with FinCEN by April 15 (auto-extension to October); Form 8938 attaches to your tax return.

- Penalties: FBAR penalties can reach $100,000+ for willful violations; Form 8938 starts at $10,000.

You may need to file both if thresholds are met—filing one doesn’t excuse the other.

Frequently Asked Questions About IRS Form 8938

Here are answers to common queries based on IRS FAQs:

- Do I report foreign real estate on Form 8938? No, unless held through a foreign entity like a corporation.

- What if my assets are in a U.S. brokerage? If the account is U.S.-based, even holding foreign stocks, it’s generally not reportable.

- Can I e-file Form 8938? Yes, through most tax software or IRS e-file systems.

- What about foreign pensions? Report if they qualify as specified assets; value based on your beneficial interest.

- Are there relief programs for late filings? Yes, check IRS streamlined procedures for non-willful violations.

For personalized advice, consult a tax professional, as this guide is for informational purposes only. Always refer to the latest IRS publications for the most current rules.

By understanding and complying with IRS Form 8938 requirements, you can avoid penalties and ensure your foreign assets are properly disclosed. If you suspect you need to file, start gathering your documents early for the 2025 tax season.