Table of Contents

IRS Form 911 – Request for Taxpayer Advocate Service Assistance (and Application for Taxpayer Assistance Order) – Are you facing IRS delays, financial hardship from a levy, or unfair treatment in your tax dealings? IRS Form 911, the Request for Taxpayer Advocate Service Assistance (and Application for Taxpayer Assistance Order), is your lifeline to the independent Taxpayer Advocate Service (TAS)—an IRS organization dedicated to resolving taxpayer issues and protecting your rights. Revised in August 2025, this form streamlines requests for help with everything from stalled refunds to imminent collection actions. In this exhaustive guide to Form 911, we’ll detail its purpose, eligibility criteria, step-by-step filing instructions, and 2025 updates—so you can secure swift TAS intervention and regain control over your tax situation.

Whether you’re an individual struggling with economic harm or a business hit by IRS inaction, knowing how to use IRS Form 911 can prevent penalties and expedite resolutions. Let’s navigate this essential tool together.

What Is IRS Form 911?

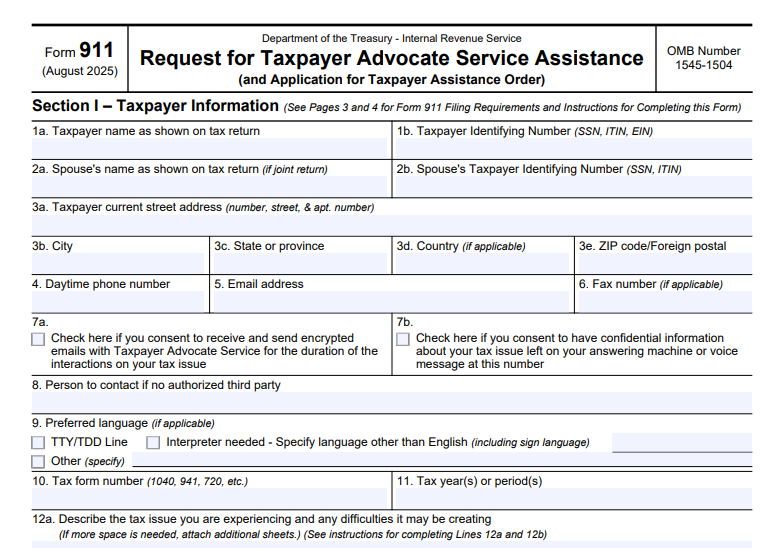

IRS Form 911 is a four-page document used to formally request assistance from the TAS, including applications for a Taxpayer Assistance Order (TAO)—a directive that can halt IRS actions causing significant hardship. Established under IRC section 7811, it empowers the National Taxpayer Advocate (NTA) to intervene when standard IRS channels fail, ensuring fair administration of tax laws.

The August 2025 revision (Catalog Number 16965S, OMB No. 1545-1504) includes minor clarifications on third-party authorizations and email consent, reflecting updates from the Paperwork Reduction Act review. Estimated completion time: 30 minutes, with attachments encouraged for faster processing. Download the fillable PDF from IRS.gov—it’s not e-fileable, but fax or mail submission is straightforward.

TAS assisted over 200,000 taxpayers in FY 2024, often resolving cases in weeks rather than months. Unlike general IRS inquiries, Form 911 targets systemic or personal hardships, not routine questions.

Who Needs to File IRS Form 911?

Any U.S. taxpayer—individuals, businesses, or authorized representatives—can file Form 911 if they’ve exhausted normal IRS remedies without success. Key qualifiers include:

- Those experiencing economic burden (e.g., inability to pay basic living expenses due to IRS levies).

- Victims of IRS systemic failure (e.g., processing delays beyond 30 days for refunds).

- Individuals facing significant hardship from IRS actions/inactions, like threats to health, safety, or property.

Use the TAS Eligibility Tool on IRS.gov first to confirm fit. Businesses file via responsible parties; non-residents submit to the Puerto Rico TAS office. Avoid frivolous claims (e.g., “taxes are unconstitutional”)—they trigger $5,000 penalties under IRC section 6702. No fee applies, and TAS prioritizes urgent cases.

Purpose and Benefits of IRS Form 911

The core purpose of Form 911 is to invoke TAS intervention under IRC section 7811, halting IRS actions that impose undue hardship and facilitating resolutions through dedicated case advocates. It also serves as a TAO application, empowering the NTA to order relief like levy releases or extended deadlines.

Benefits include:

- Rapid Resolution: TAS often bypasses backlogs, contacting you within 30 days (or sooner for emergencies).

- Hardship Protection: Prevents wage garnishment or asset seizures during investigations.

- Rights Enforcement: Ensures compliance with the Taxpayer Bill of Rights, including fair treatment and appeal access.

- No-Cost Advocacy: Free service that levels the playing field against IRS errors.

In 2025, with IRS staffing challenges amid tech upgrades, TAS assistance via Form 911 has become even more vital, reducing unclaimed relief estimated at billions annually.

Step-by-Step Guide: How to Fill Out IRS Form 911

Download the PDF from IRS.gov/pub/irs-pdf/f911.pdf. Complete only Section I (pages 1-2) unless represented; use black ink or type. Attach supporting docs like IRS notices.

- Verify Eligibility: Run the TAS tool; note failed IRS attempts (e.g., dates of calls/letters).

- Section I: Taxpayer Info (Lines 1-14): Enter name, SSN/EIN, address, phone/email. Check voicemail consent (Line 9).

- Tax Periods (Line 10): Specify years/quarters (e.g., “2024 Form 1040”).

- Problem Description (Line 12a): Detail the issue, IRS actions, and impacts (e.g., “Levy on wages causing eviction risk”).

- Requested Relief (Line 12b): Be specific (e.g., “Release levy under IRC 6343; expedite refund”).

- Authorization (Pre-Line 14): Check box for third-party contacts (waives IRC 7602(c) notices).

- Sign and Date (Line 14): Taxpayer or officer; attach Form 2848 if represented.

- Section II/III (If Applicable): For reps or IRS employees initiating.

- Review: Ensure completeness—omissions delay processing.

Pro Tip: For 2025, include email consent (Line 5) for faster digital follow-up.

Key Sections of IRS Form 911 Explained

The 2025 form emphasizes clarity with updated instructions (Rev. 8-2025):

Section I: Taxpayer Information (Lines 1-14)

- Demographics, contacts, and consent checkboxes. Lines 12a/12b: Narrative core—quantify hardship (e.g., “$X lost income”).

Section II: Third Party/Representative Info

- Attach Form 2848/8821 details; optional if on file.

Section III: Initiating Employee (IRS Use Only)

- For IRS referrals; describes identification method (e.g., “Taxpayer called TAS hotline”).

Instructions (Pages 3-4)

- Filing criteria, local TAS offices, and frivolous argument warnings.

Privacy: Protected under IRC 6109; TAS shares data only for resolution.

Submission Process for Form 911

Submit to your local TAS office—find via IRS.gov/taxpayeradvocate or call 877-777-4778. Options:

- In-Person: Nearest TAS office (at least one per state).

- Fax: Varies by office (e.g., 855-819-5024 for Hawaii).

- Mail: E.g., TAS, 7490 Kentucky Dr., Stop MS 11-G, Florence, KY 41042.

- Email: Unencrypted—use cautiously; no reply via email.

Expect contact within 30 days; follow up if not. International: Puerto Rico office (fax 855-818-5700). Track via certified mail; retain copies.

IRS Form 911 Download and Printabel

Download and Print: IRS Form 911

Privacy, Security, and Important Notes

Data is safeguarded under the Privacy Act (5 U.S.C. 552a); used solely for TAS casework. 2025 Notes:

- Email submissions unencrypted—prefer fax/mail.

- No multiple filings for one issue—delays processing.

- TAOs issued only for “significant hardship” (26 CFR § 301.7811-1).

Frequently Asked Questions (FAQs) About IRS Form 911

When should I file Form 911?

After failing normal IRS channels for hardships like delays >30 days or economic harm.

How long until TAS responds?

Typically 30 days; call 877-777-4778 if delayed.

Can TAS help with state taxes?

No—federal only; contact state taxpayer advocates.

What’s new in the 2025 Form 911?

Clarified third-party consents and email options per PRA review.

Is there a penalty for filing Form 911?

Only for frivolous arguments ($5,000); legitimate requests are penalty-free.

Conclusion: Empower Yourself with IRS Form 911 and TAS Support

IRS Form 911 is more than a request—it’s a powerful advocate for taxpayers enduring IRS hardships, backed by the August 2025 revisions for smoother access. By filing promptly, you tap into TAS’s expertise to resolve issues fairly and efficiently. Download Form 911 from IRS.gov today, confirm eligibility, and submit to your local office for the relief you deserve.

For immediate help, visit TaxpayerAdvocate.IRS.gov or call 877-777-4778. Remember: You’re not alone in tax troubles.

This article is for informational purposes only and not official IRS advice. Consult IRS.gov or a tax professional for personalized guidance.