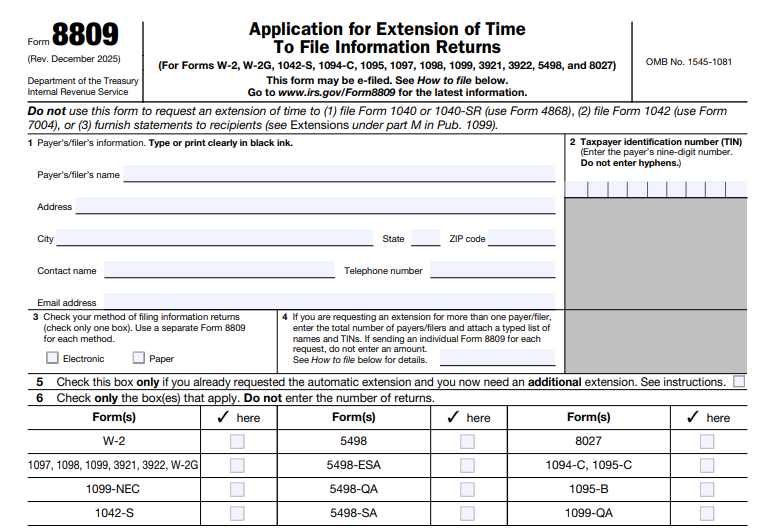

IRS Form 8809 – Application for Extension of Time to File Information Returns – If you’re a business owner, payer, or filer responsible for submitting information returns to the IRS—such as Forms 1099, W-2, or 1095—you may occasionally need extra time to meet filing deadlines. IRS Form 8809, the Application for Extension of Time to File Information Returns, allows you to request a 30-day extension for filing these forms with the IRS. This can help avoid costly penalties, but it’s important to understand the rules, eligibility, and filing process.

As of December 2025, the latest revision of Form 8809 (Rev. December 2025) is available on the IRS website, with updates including support for filing through the Information Return Intake System (IRIS) for automatic extensions.

What Is IRS Form 8809?

Form 8809 is used to request an automatic 30-day extension (and in some cases, a non-automatic additional 30-day extension) for filing certain information returns with the IRS. It does not extend the deadline for furnishing copies to recipients (e.g., sending 1099s to contractors or W-2s to employees). For recipient extensions, a separate letter or Form 15397 may be required.

Forms Eligible for Extension via Form 8809

You can use Form 8809 for extensions on:

- Form W-2 (Wage and Tax Statement)

- Form W-2G (Certain Gambling Winnings)

- Form 1042-S (Foreign Person’s U.S. Source Income)

- Forms 1094-C and 1095 (ACA reporting)

- Forms 1097, 1098 series

- Forms 1099 series (including 1099-NEC)

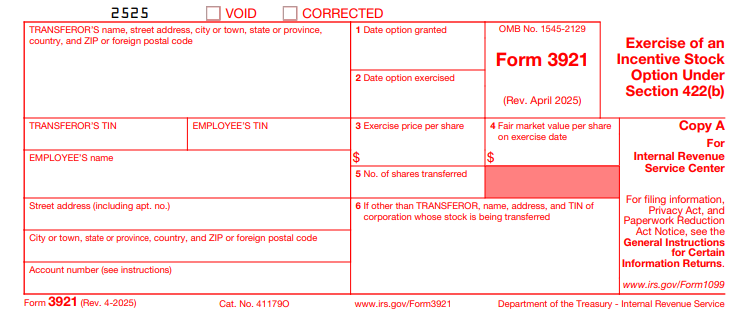

- Forms 3921, 3922

- Forms 5498 series

- Form 8027 (Tip Income)

When to File Form 8809

File Form 8809 as soon as you know you need an extension, but no earlier than January 1 of the filing year and by the original due date of the information returns. Filing after the due date will result in denial.

Common due dates for information returns (for tax year 2025, filed in 2026):

- Most 1099-NEC and W-2: January 31, 2026 (shifts to February 2, 2026, if January 31 falls on a weekend)

- Other 1099 series (paper): February 28, 2026

- Other 1099 series (electronic): March 31, 2026

- ACA Forms 1095 (furnish to individuals): March 2, 2026 (adjusted for weekends)

Thus, Form 8809 for January 31 deadlines must be filed by January 31, 2026.

IRS Form 8809 Download and Printable

Download and Print: IRS Form 8809

How to File Form 8809

The IRS encourages electronic filing for faster processing and instant acknowledgment.

Electronic Filing Options

- FIRE System (Filing Information Returns Electronically): Complete a fill-in Form 8809 online for an automatic 30-day extension (available for most forms; not for additional extensions or certain forms like W-2).

- IRIS System (Information Return Intake System): Newly supported for automatic 30-day extensions as of the latest form revision.

- Third-party IRS-authorized e-file providers can also transmit Form 8809.

Electronic requests filed by the due date receive immediate confirmation.

Paper Filing

- Download the latest Form 8809 PDF from IRS.gov.

- Mail to: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0036 (confirm on the form for accuracy).

- Required for:

- Form W-2 extensions

- Form 1099-NEC extensions

- Additional (second) 30-day extensions

- Non-automatic requests

Paper filings must be signed if requesting a non-automatic or additional extension.

Automatic vs. Non-Automatic Extensions

- Automatic 30-day extension: Granted for most forms without explanation (file timely via electronic or paper).

- Additional 30-day extension: Available for most forms (except W-2 and 1099-NEC) by filing a second Form 8809 before the first extension expires. Requires detailed justification on Line 7.

- Non-automatic for W-2 and 1099-NEC: Must provide specific reasons (e.g., catastrophic events, transmitter issues) and file on paper with a signature.

Only one extension is available for Form W-2.

Penalties for Late Filing

Failing to file information returns on time (without an approved extension) can trigger penalties starting at $60 per return (for 2025 filings), escalating to higher amounts based on how late the filing is and the size of the business. Intentional disregard can lead to even steeper fines. An approved Form 8809 extension reduces or eliminates these penalties for IRS filing (but not for recipient copies).

Key Tips for 2025-2026 Filings

- Plan ahead: Most extensions are automatic if filed timely.

- Separate requests: Use one Form 8809 per filer, but you can cover multiple form types.

- No recipient extension: Form 8809 only covers IRS filing deadlines.

- Check IRS.gov for updates: Rules can change, especially around electronic filing systems like IRIS and FIRE.

For the most current details, download Form 8809 and instructions directly from the official IRS page: About Form 8809.

By understanding and properly using Form 8809, you can avoid unnecessary penalties and ensure compliance with IRS information reporting requirements. If you’re unsure, consult a tax professional.