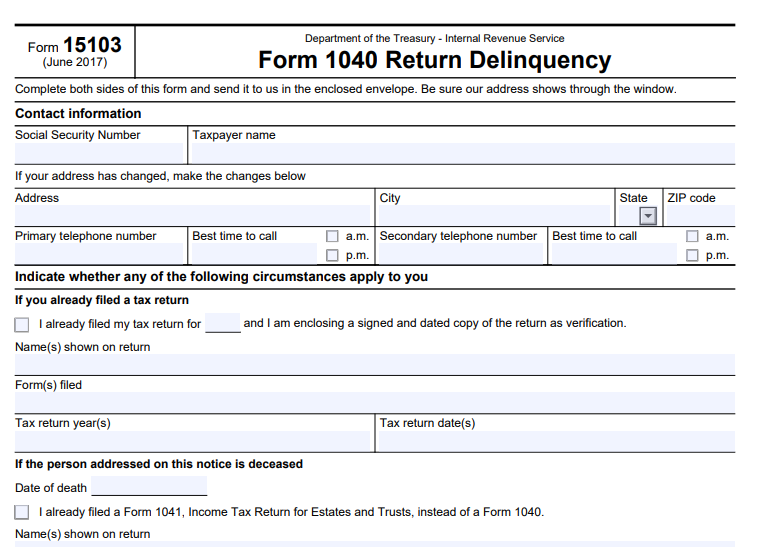

IRS Form 15103 – Form 1040 Return Delinquency – In today’s complex tax landscape, receiving a notice from the IRS about a delinquent Form 1040 can be stressful. If you’ve gotten a letter claiming you haven’t filed your personal tax return, IRS Form 15103 – officially titled Form 1040 Return Delinquency – is your key tool for responding. This form helps you explain your situation, whether you’ve already filed, don’t need to file, or have other valid reasons. In this SEO-optimized guide, we’ll break down everything you need to know about IRS Form 15103, including its purpose, how to fill it out, and submission tips, based on the latest IRS guidelines as of late 2025.

What Is IRS Form 15103?

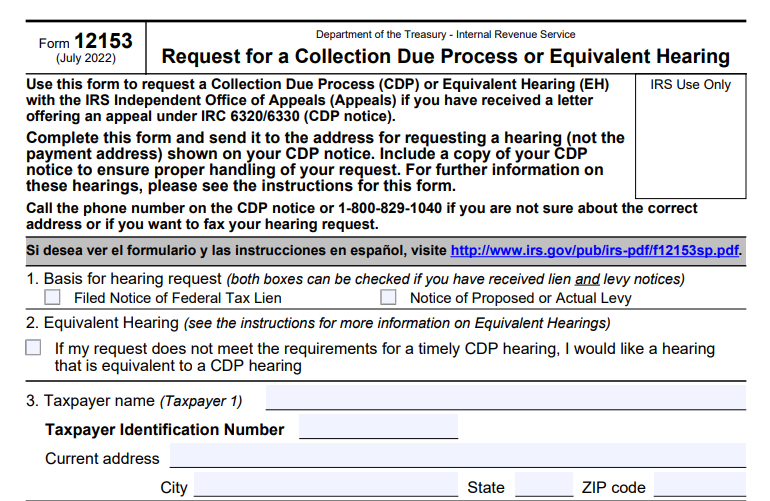

IRS Form 15103 is a delinquency response form designed for individuals who receive a notice from the IRS indicating no record of their Form 1040 tax return for a specific year. It’s a two-page document that allows taxpayers to provide details and documentation to resolve the issue without escalating to penalties or further enforcement actions.

The form, last revised in June 2017, includes sections for personal information, explanations of your filing status, and options for handling credits or refunds. It’s commonly enclosed with non-filer compliance alert notices, such as CP59, CP516, or CP518, which are part of the IRS’s efforts to ensure tax compliance, especially among high-income earners.

Key features of the form include:

- Checkboxes for common scenarios, like already filing a return or the taxpayer being deceased.

- Spaces to detail your filing status (e.g., single, married filing jointly).

- Options to explain low income or other exemptions from filing.

- Signature under penalties of perjury to confirm accuracy.

This form is available in English and Spanish (Form 15103-SP) for broader accessibility.

When Do You Need to Use Form 15103?

You should use IRS Form 15103 if you’ve received a non-filer notice like CP59, which is sent when the IRS has no record of your prior year’s personal tax return. These notices often target cases from tax years 2017-2021, particularly for high-income individuals (e.g., those earning over $400,000).

Common situations where Form 15103 applies:

- You’ve already filed: Provide a signed copy of your return as proof.

- You don’t need to file: Explain factors like low income, non-U.S. residency, or dependency on another’s return.

- Alternative filing: If you filed Form 1041 for an estate or trust instead.

- Deceased taxpayer: Include the date of death.

- Handling credits: Apply prior-year refunds to another return or request a check (note: filing is required for refunds).

If you filed recently (within eight weeks), no action may be needed, but verify details like your Social Security Number and tax year match the notice. Ignoring the notice can lead to the IRS preparing a substitute return, which may not include your deductions or credits.

How to Complete IRS Form 15103 Step by Step

Filling out Form 15103 is straightforward, but accuracy is crucial since it’s signed under penalty of perjury. Here’s a step-by-step guide:

- Provide Contact Information: Enter your Social Security Number, name, address (update if changed), phone numbers, and best times to call.

- Select Applicable Circumstances: Check boxes and fill in details for scenarios like:

- Already filed: Include name on return, form type, tax year, and filing date. Attach a signed copy.

- Deceased: Provide date of death.

- Filed Form 1041: List name, EIN, and tax year.

- Explain Non-Filing (If Applicable):

- Select filing status (e.g., head of household).

- Check boxes for conditions like age 65+, blindness, non-U.S. citizen, or work abroad.

- State total income and reason for not filing.

- Handle Credits or Payments: If you have overpayments or estimated payments, indicate if you want to apply them to another tax period or receive a refund. Remember, filing a return is required for refunds.

- Sign and Date: Affirm that all information is true and complete.

Complete both sides of the form, as it spans two pages.

How to Submit IRS Form 15103

Submission options include:

- Mail: Use the enclosed envelope from your notice, ensuring the IRS address shows through the window. Include the notice stub and any attachments like your tax return.

- Fax: Send to the number listed in your notice. Use a secure fax service and protect your data.

- Online Upload: If available, submit via your IRS Online Account for a mobile-friendly experience.

Act quickly to avoid escalation. For CP59 notices, updated in April 2025 as part of the Simple Notice Initiative, responses help prevent further actions like audits or liens.

IRS Form 15103 Ddownload and Printable

Download and Print: IRS Form 15103

Potential Consequences of Ignoring a Delinquency Notice

Failing to respond can result in:

- Accrual of penalties and interest if you owe taxes.

- Loss of refunds or credits due to time limits (generally three years for refunds).

- IRS filing a substitute return, potentially leading to higher taxes without your inputs.

- Escalation to collection actions, such as levies, liens, or even criminal prosecution in severe cases.

Filing past due returns promptly can protect Social Security benefits (for self-employed) and minimize costs.

Tips for Handling IRS Form 15103 and Avoiding Common Mistakes

- Double-Check Details: Ensure your SSN, name, and tax year match the notice to avoid delays.

- Gather Documentation: Always attach required proofs, like a copy of your filed return.

- Use IRS Resources: Download the form from the official IRS website and review publications like Publication 1 (Your Rights as a Taxpayer) or Publication 594 (The IRS Collection Process).

- Seek Professional Help: If unsure, consult a tax advisor, especially for complex situations like international work or estates.

- File Electronically if Possible: For the actual tax return, e-filing speeds up processing.

- Track Your Response: Keep copies of everything sent to the IRS.

By addressing the notice promptly with Form 15103, you can resolve the issue efficiently and avoid unnecessary stress.

Frequently Asked Questions About IRS Form 15103

What if I already filed my Form 1040?

Attach a signed copy to Form 15103 and submit it to verify.

Can I get a refund without filing?

No, you must file a return to claim refunds, even if not otherwise required.

How long do I have to respond to a CP59 notice?

Respond immediately to stop penalties; there’s no fixed deadline, but delays increase risks.

Is Form 15103 updated for 2025?

The form itself remains from 2017, but related notices like CP59 were updated in April 2025 for clarity.

Where can I download IRS Form 15103?

Access it directly from the IRS website in PDF format.

Navigating IRS notices doesn’t have to be overwhelming. By using Form 15103 correctly, you can clear up delinquencies and stay compliant. For personalized advice, visit the IRS website or contact a tax professional.